1 Introduction

1.1 LPG Background

Liquefied Petroleum Gas (LPG) is a valuable energy source used worldwide for numerous business applications in transportation and industry. Its market growth will result in the need for additional facilities to produce and transport these fuels in the foreseeable future. As a result, new technologies will emerge to address the cost, safety, and reliability issues this expansion may create.

Propane (C3H8) is a hydrocarbon and is sometimes referred to as liquefied petroleum gas, LP gas or LPG. Liquefied petroleum gas or liquid petroleum gas (LPG or LP gas), also referred to as simply propane or butane, are flammable mixtures of hydrocarbon gases used as fuel in heating appliances, cooking equipment, and vehicles. Propane is obtained from both natural gas processing and crude oil refining. It is non-toxic, colourless, and virtually odourless. As with natural gas, an identifying odour is added so the gas can be readily detected.

The term Liquefied Petroleum Gas comprises basically the two gases, propane and butane, and their mixtures because of their properties and characteristics. Both gases exist in the liquid state at room temperature under relatively low pressure, of less than 9 bar. That is why they are also called liquefied petroleum gases. Liquefaction diminishes the volume of LP gases by a factor of approximately 250 [1].

Propane and butane are both alkanes, i.e. short-chain saturated hydrocarbons. The former is a molecule with three carbon and eight hydrogen atoms. The latter consists of four carbon and ten hydrogen atoms and has two isomers, normal butane and isobutane; n-butane and isobutane share the same chemical formula (C4H10) but display different spatial arrangements of their atoms and also have other properties, for example, a boiling point at –0.5°C for n-butane vs. –12.8°C for isobutane. Due to their material and combustion properties, both liquefied petroleum gases suit many possible applications. When used as fuel in vehicles with an internal combustion engine, LPG is also called autogas.

Liquefied Petroleum Gas (LPG) should not be confused with Liquefied Natural Gas (LNG) or Compressed Natural Gas (CNG), both of which consist mainly of the natural gas methane (CH4). LNG is stored as a cryogenic liquid cooled at –161°C; CNG is kept under high pressure of at least 200 bar.

Figure 1. LPG gas mix. Source: https://www.shell.com/business-customers/shell-liquefied-petroleum-gas-lpg.html

1.2 Facts and Figures

Sometimes known as propane, LPG is a flammable hydrocarbon gas used commonly as a non-toxic, sulphur-free fuel. It is chosen over several other energy fuels since it burns with lower sulphur and carbon emissions and thus is more environment-friendly. Easy storage makes it a highly portable fuel and functional source of energy for industries located in areas where pipe gas supply is not available.

- Varieties of LPG bought and sold include mixes that are primarily propane (C3H8), butane (C4H10), and, most commonly, mixes, including both propane and butane.

- The maximum pipeline transport pressure is approximately 250 psi.

- As its boiling point is below room temperature, LPG will evaporate quickly at average temperatures and pressures and is usually supplied in pressurised steel vessels.

- The ratio between the volumes of the vaporised gas and the liquefied gas varies depending on composition, pressure, and temperature but is typically around 250:1.

- The pressure at which LPG becomes liquid, called its vapour pressure, likewise varies depending on composition and temperature; for example, it is approximately220 kPa (32 psi) for pure butane at 20∘C (68∘F) and approximately 2200 kPa (320 psi) for pure propane at 55∘C (131∘F)

- In 2020, propane was the world’s 80th most traded product, with a total trade of 27.4 billion USD. Between 2019 and 2020, the exports of LPG decreased by 13%, and trade in LPG represented 0.16% of total world trade.

- In 2020 the top exporters were the United States ($11.7B), Qatar ($2.46B), United Arab Emirates ($2.26B), Canada ($1.38B), and Saudi Arabia ($1.02B).

- In the same year, the top importers were China ($5.27B), Japan ($3.81B), India ($3.04B), Mexico ($1.6B), and South Korea ($1.51B).

- The countries with the highest import tariffs for LPG are Bermuda (25%), Jordan (23.3%), Cayman Islands (22%), and Bhutan (19.6%). The countries with the lowest tariffs are located in Central and Eastern Africa: Kenya, Madagascar, Mauritius, Rwanda, and Tanzania, all with 0% charge [2].

2 Key Market Insights

2.1 General

The petrochemical industry will continue to lead demand growth, with ethane, LPG and naphtha together accounting for 70% of the forecast increase in oil product demand to 2026. The LPG market is projected to grow from $129 billion in 2021 to $212 billion in 2028 at a CAGR of 7.3% in the forecast period 2021-2028. The global impact of COVID-19 has been unmatched and staggering, with LPG witnessing a negative demand amid the pandemic across all regions. The global market outlook [3] exhibited a drop of -2.22% in 2020 as compared to the average annual growth during the previous three-year period. The rise in CAGR during the market forecasts is attributable to this demand and growth rate, returning to pre-pandemic levels once most prevention measures are over.

LP gas, first and foremost, serves as a feedstock for ethylene production through the cracking process and syngas production through steam conversion. The critical factor that positively impacts is the sustained growth in the automotive industry and the increasing requirement for lower carbon footprints and energy-efficient fuels. Furthermore, rampant LPG adoption by domestic end-users is providing a boost to market growth. In line with this, shifting consumer predilection from high-cost conventional fuels such as petrol and diesel to low-cost LP gas is also a contributing factor. Additionally, the increasing utilisation of LPG by the industrial and commercial sectors is another growth-inducing factor.

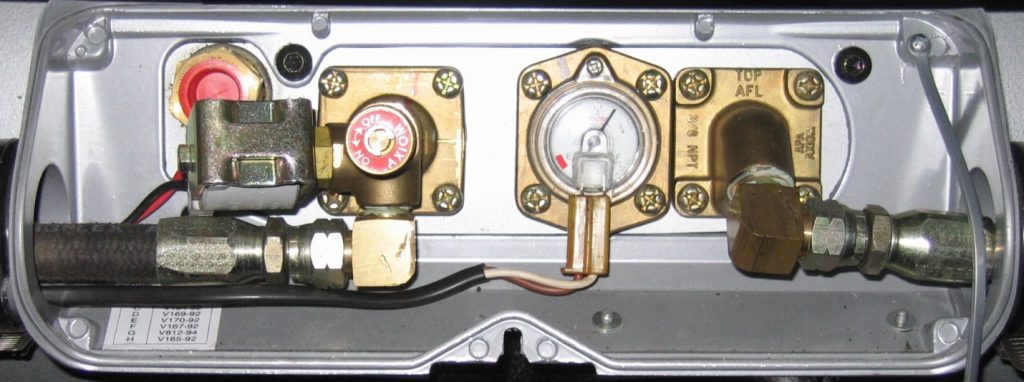

Figure 2. Autogas (LPG) tank valves. Source: “File:AutogasAPATankValves.JPG” by Athol Mullen is marked with CC BY-SA 3.0.

Global consumption of autogas has increased overwhelmingly over the last two decades and hit a new level of 27.1 million tonnes in 2019. Then, the upheaval derived from the COVID-19 emergency resulted in a significant fall in the consumption of autogas with other transport fuels in 2020. The autogas fleet continues to grow steadily, with almost 27.8 million autogas vehicles used actively worldwide. The share of LPG in total consumption of automotive fuels varies widely among countries, ranging from 0.03% in the U.S. to over 22% in Turkey. The great disparity in the progress of autogas in competing against gasoline, diesel, and other conventional fuels is explained mainly by distinctions in government incentive policies.

2.2 The Global LPG Trade

Similar to liquefied natural gas (LNG), the trade in LPG accounts for a large proportion of the global clean energy consumer market. Moreover, the LPG trade volume has grown over recent years, and it is forecasted to maintain growth in the near future (Sieminski, 2015). However, because of the heterogeneous geospatial distribution of both the source and the market, the supply and demand sides of this trade require transportation between ports via LPG vessels. Therefore, investigating the long-term global LPG maritime transport network based on the port scale will help improve the understanding of global LPG trade patterns and their evolution. Moreover, such research will provide scientific support for the adjustment and optimisation of the energy policies of countries involved in this trade’s supply and demand sides, helping to guarantee energy supply security.

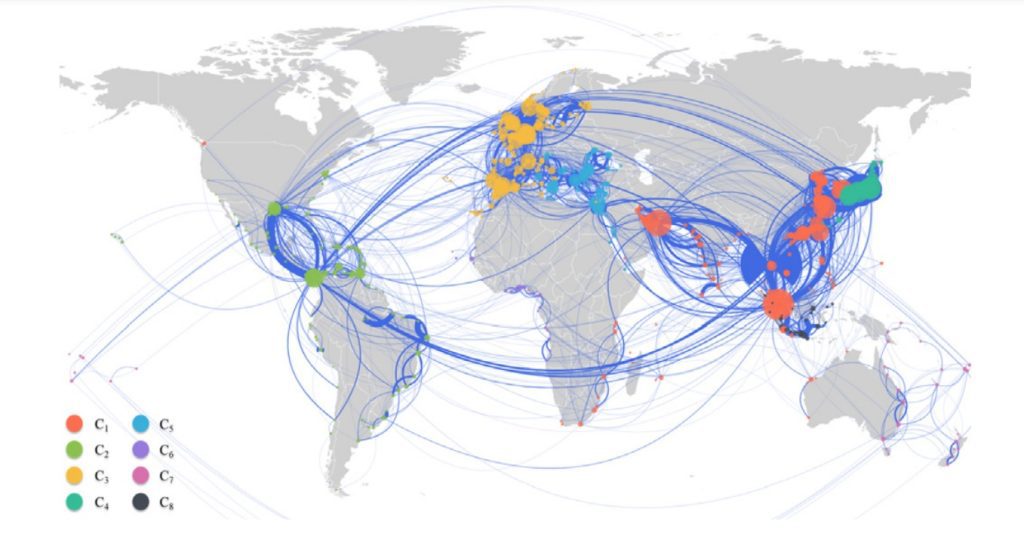

The specific characteristics of maritime transportation transshipments, certain differences in the functional capacity of different ports, and transshipments via cargo vessels around hub ports have led to the formation of a series of closely linked trading communities. However, the study of LPG trade at the national scale cannot reflect the fine-grained details of global LPG trade patterns. Fortunately, mass trajectory data on cargo vessels collected by the automatic identification system (AIS) can reflect the real-time operational status of maritime transportation and provide data with great potential to support the study of global LPG trade patterns at the detailed port scale [4].

The large-scale production of natural gas exploitation projects since 2014, especially the rise of the North American shale gas industry and the continuous expansion of the oil refining industry in Iran and Qatar in the Middle East, have simultaneously led to the rapid growth of LPG production. During 2013-2015, the number of ports, routes, and journeys involved in LPG transportation all showed a trend of rapid growth with annual growth rates of 10.0%, 21.3%, and 34.3%, respectively. In the same period, because of stimulation attributable to lower oil and gas prices, the civil consumption of LPG in Asia and Africa increased considerably. Furthermore, the increase in propane dehydrogenation capacity in China has further supported the rapid growth of LPG demand.

Moreover, according to statistics compiled by the International Energy Agency [5], global LPG consumption exhibited a trend of increase from 2016to 2017, in stark contrast to the reduction in the scale of maritime LPG transportation that occurred during the same period. The main reason is that with further expansion of the Panama Canal, the proportion of LPG exported directly from the world’s largest LPG exporter (i.e., the United States) to the Asia-Pacific region using very large gas carriers was increased. Consequently, LPG is transported by large vessels to the ports of the Panama Canal and then transshipped by smaller vessels to destination ports in the Asia-Pacific region.

Figure 3. Spatial distribution of the ports involved in LPG trade by 2017. Source: https://doi.org/10.1016/j.jclepro.2019.119883

2.3 Rising Asian Demand

Asia’s liquefied petroleum gas markets are proving a magnet for suppliers as demand continues to grow across the region [6]. Several sectors are driven by demand growth, from households to petrochemicals. In the Indian sub-continent, automotive use is rising. Future growth markets include power generation and marine bunkers.

Asia is a net importer of LPG and, as such, is a target for countries with surplus production. The Persian Gulf is the region’s traditional external supplier. New gas developments in Iran have made increasing volumes available for export, while Iraq has recently become a net exporter after years of having to import LPG. The US, which has more LPG available both from gas plants and refinery production, has emerged as an aggressive seller in the region since early 2016. Booming US exports helped to create a glut in markets east of Suez, causing stock levels to rise. However, rising demand is likely to return as the dominant factor in determining market direction in the longer term. The two main Asian markets for LPG are China and India.

China has a significant petrochemical demand, both for steam crackers and propane dehydrogenation (PDH) plants (see section Propane Dehydrogenation). The principal feedstock for the steam crackers is naphtha. LPG is sometimes substituted, however, when a lighter yield is required and when the price of LPG is sufficiently below that of naphtha. China has also been opening and envisaging new PDH plants; more than 30 new plants with a capacity of more than 30 million tons per year are currently under construction in the red dragon nation or planned for the coming years [7].

There are many other large industrial users of LPG, including several units producing gasoline components, such as alkylate, isomerate and methyl tertiary butyl ether (MTBE). LPG is also used as an industrial fuel, where its use as a substitute for heavy fuel oil and coal is being encouraged by new legislation on air quality. It is used in addition as a refinery fuel, as well as being processed in downstream units. Household use is also large, at 40% of the total, the same proportion as petrochemical use, leaving the remaining 20% for general industrial use. Total demand is about 1.7 mn bpd, of which 0.7 is imported.

Asia’s other large area of LPG use in the Indian sub-continent. In India itself, the government is heavily promoting the use of LPG by households instead of kerosene and biomass. In pursuit of this, it is significantly extending the distribution network for LPG and encouraging the establishment of dealerships to supply the retail market. India imports about half its domestic LPG needs and is increasing its import capacity in anticipation of a rising volume of imports. Most of its imports come from the Persian Gulf, but India will probably need to increase the number of suppliers shortly: and the US looks like a likely candidate.

Pakistan’s consumption and imports are also rising rapidly. As in India, the government is encouraging the greater use of LPG by households. It is also vigorously promoting it as an automotive fuel in order to improve air quality in large urban areas, telling LPG sellers to reduce their prices in order to make it cheaper than gasoline. In Bangladesh as well, its use is increasing, partly as a result of a shortage of natural gas; and in many other parts of Asia, demand is also rising.

3 Main Applications and Latest Technology Trends

3.1 Transportation

Liquefied petroleum gas (LPG) is a viable alternative gaseous fuel not only as a replacement for both petrol and diesel fuel used in SI and CI engines but also as a basis for reducing NOx, soot and PM emissions. LPG has a high calorific value compared to other petroleum fuels (petrol and diesel). Therefore, greater engine power is possible for lower fuel consumption. The heat of vaporisation of LPG is lower than that of diesel, bringing beneficial effects of the mixture formation, especially by direct injection process, because vaporising LPG consumes less heat. LPG is inexpensive, clean burning and has a relatively low carbon content [8].

While waiting for eco-friendly vehicles to become adequately entrenched in the market, governments have extended recent support to the use of LPG vehicles, which are expected to play an intermediary role between gasoline and diesel vehicles and electric vehicles (EVs) and hydrogen fuel-cell vehicles (HFCVs). LPG is a mature alternative fuel source that can be used as an auxiliary fuel in dual fuel compression ignition engines together with diesel oil or in special spark ignition engines. The use of LPG in transportation is concentrated in a few countries (Russia, Poland, Korea, and Turkey), and it is mainly used in bi-fuel light-duty vehicles.

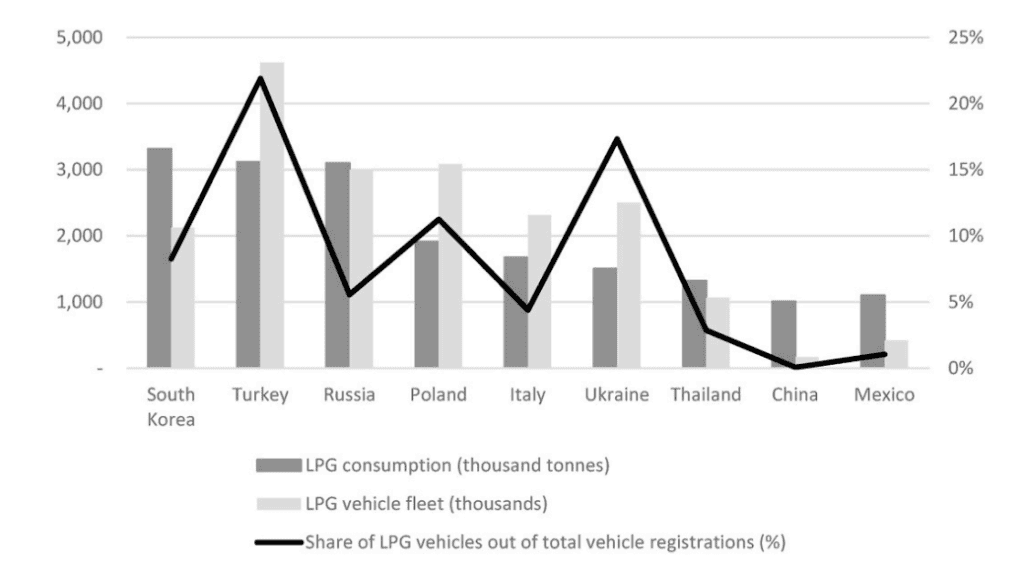

Globally, gasoline and diesel account for approximately 80% of the total energy consumption by the transportation sector, followed by biofuels, liquified natural gas, compressed natural gas, and LPG. With the rise in environmental awareness, LPG vehicles have been recognised as an alternative to internal combustion engine vehicles (ICEVs) since the 2000s, and LPG consumption has steadily increased. Figure 4 shows LPG consumption and the number of LPG vehicles in countries with high autogas consumption. The share of LPG vehicles in the total number of registered vehicles was the highest in Turkey (22%) in 2017, followed by Ukraine (17%), Poland (11%), and Korea (8%).

Figure 4. LPG consumption and vehicle fleets in 2017. Source: https://www.wlpga.org/publication/2018-autogas-incentive-policies-report/

Notably, the LPG consumption level in the transportation sector is the highest in South Korea, followed by Turkey, Russia, and Poland. This is because taxis account for a large share of LPG consumption in South Korea, while Europe, a major LPG market, has a large proportion of private cars. Most taxis in South Korea use LPG, as the oil tax is the cheapest for this fuel. South Korea is also better equipped with LPG charging stations compared to other developed countries. In fact, as of 2016, the proportion of LPG stations in Japan, the United States, and France was only 5%, 2%, and 1%, respectively, while that in Korea was approximately 20% (Korea LPG Association, 2017).

3.2 Propane Dehydrogenation

Propane dehydrogenation (PDH) is a process that converts propane into propylene, which is a chemical intermediate used to produce polypropylene (PP). PP is widely used to make a variety of plastics and fibres. The PDH process also produces hydrogen as a by-product. The traditional source of propylene was petrochemical (steam) crackers, many of which in Asia were run on naphtha. This heavy feedstock produces large amounts of propylene as a co-product.

Global demand for propylene has been growing rapidly. However, many new steam crackers use ethane as a feedstock, which is lighter than naphtha and produces a lot less propylene, leading to an increasingly tight market in propylene and PP. Asian and other petrochemical producers have responded by investing in purpose-built propylene plants in the form of PDH units, and more are likely to be added.

Propylene is a vital intermediate petrochemical whose derivatives include:

Cumene – used to make epoxy resins and polycarbonate

- Acrylic acid – used in coatings

Propylene oxide

- Acrylonitrile – used in acrylic fabric

- Phenol – used in the manufacturing of nylon and other synthetic fabrics

- Isopropyl alcohol – used as a solvent

Although its demand has been unwaveringly increasing, the supply has been constrained — steam crackers focused more on producing ethane than propylene, and that may be the main reason. Likewise, there is the shale revolution in the US. The North American country produces more of the lighter crude which does not produce as much propane as heavy crude.

The majority of the global capacity was co-production, which could not keep up with the increasing demand for PP. This was further deranged by massive investments in US LPG and LNG transportation terminals. Shipping refrigerated ethane and LPG to the booming economies of India and China further lessened the co-product co-production of propylene.

This situation has been solved by the “on-purpose” production of propylene. Several other factors make “on-purpose” production of propylene represent economic sense, e.g., demand for propylene has outpaced the demand for ethylene in recent years and is forecasted to do so soon.

Most of the “on-purpose” production of PP is attributed to propane dehydrogenation because recent advancements and technical maturity in the process have made the PDH competitive with the co-production technologies in the market.

3.3 LPG and Hydrogen Fuel

Hydrogen is an environmentally friendly fuel since its combustion only generates water. It can also be produced by renewable feedstocks such as biomass, which can be shown to be carbon-neutral. However, renewable resources may not be enough to guarantee a steady supply of hydrogen. Hence, it is still necessary to use fossil fuels such as natural gas, liquefied petroleum gas, naphtha, and others to fulfil its demand, even though it is unsustainable in the long term.

The hydrogen economy has raised interest in studying the steam reforming of light hydrocarbons, such as the ones found in LPG (propane, butane, propene, and butene). LPG has considerable advantages over other fuels since it can be easily handled, transported, and stored. Many cities already have an existing infrastructure for LPG, e.g., for cooking, which makes LPG a promising fuel to generate hydrogen onshore.

Hydrogen production by steam reforming of LPG using supported perovskite type precursors. Literature reports several paths of LPG conversion into Hydrogen, such as partial oxidation (POX), dry (DR), and autothermal (ATR) reforming processes. Another commonly reported route for hydrogen production is the steam reforming of LPG [9].

Steam reforming reactions of propane and butane can be described through equations 1 and 2, respectively, as well as the water-gas shift reaction (equation 3):

(1) C3H8 + 3 H2O → 3 CO + 7 H2 ᐃH0 (298 K) = +497 kJ/mol;

(2) C4H10 + 4 H2O → 4 CO + 9 H2 ᐃH0 (298 K) = +649.9 kJ/mol;

(3) CO + H2O ↔ CO2 + H2 ᐃH0 (298 K) = +41.2 kJ/mol

Liquefaction plays an essential part in the storage and transport of hydrogen as an energy source. In the liquid state at the boiling point, at –253°C (20.3 K) and 1.013 bar, hydrogen has a density of 70.79 g/l. At the melting point, at –259.2°C (13.9 K) and 1.013 bar, its density is 76.3 g/l. Liquefaction increases the density of hydrogen by a factor of around 800, and the storage volume falls correspondingly.

For the purposes of comparison, when Liquefied Petroleum Gas (LPG) is liquefied, the density or volume factor, depending on the proportion of butane/propane, is around 250; when methane is liquefied to form Liquefied Natural Gas (LNG), the factor is around 600 [10].

3.4 Dimethyl Ether

DME (Dimethyl ether = CH3-O-CH3) is a versatile, chemically stable aerosol propellant with a special solvency power for both polar and non-polar ingredients. DME is an isomer of ethyl alcohol and has a low boiling point. It is colourless, virtually odourless, has a low surface tension and a low viscosity. Due to its high solubility coefficient, the propellant DME also acts as a solvent in aerosol formulations. This property makes DME a precious component in aerosol formulations which contain substances that are difficult to dissolve.

| Chemical formula | Temperature | CH3 – O – CH3 | Measurement |

| Mol. Mass | NA | 46.07 | g/mol |

| Boiling point | NA | -24.9 | °C |

| Vapour Pressure | 20° C | 5.1 | bar (abs) |

| NA | 50° C | 11.5 | bar (abs) |

| Density liquid | 20° C | 668.3 | kg/m³ |

| NA | 50° C | 615 | kg/m³ |

| Relative vapour density | 20° C | 1.59 | (air = 1) |

| Solubility | NA | NA | NA |

| DME in water | 20° C/1 bar | 5.7 | % (m/m) |

| NA | 20° C/4.8 bar | 36 | % (m/m) |

| Water in DME | 20° C/4.8 bar | 5.5 | % (m/m) |

| Net calorific value, liquid | NA | 28.43 | kJ/kg |

| Ignition Point | DIN 51794 | 235 | °C |

| Kauri Butanol Number | NA | 91 | NA |

| Solubility coefficient | NA | 7.3 | NA |

| Surface tension (liquid) | 20° C | 0.0125 | N/m |

| Viscosity gaseous | 20° C | 0.0091 | mPas |

| Viscosity liquid | 20° C | 0.11 | mPas |

DME has attracted increasing attention as a clean and environmentally friendly energy; it can be used for power generation, automotive fuel, domestic cooking fuel, hydrogen source for fuel cells, and as feedstock for various chemicals. Besides, other properties that make DME so attractive are: (a) the high oxygen content of 35% by weight, which provides smokeless combustion; (b) a cetane number of 55-60 and a boiling point of 225 C, which can reduce ignition delay time and lead to fast mixture formation, excellent cold-temperature ignition. Considering the similar physical and chemical properties to LPG, DME can replace LNG, coal gas and LPG as civil fuel, LPG and DME. However, as a newly-developing fuel, its relevant production, distribution, transportation, storage and burning devices have not matured enough.

Related studies have shown that with the blending of low content DME, DME/LPG blended multi-fuel combustion efficiency is significantly improved. The original LPG distribution, loading and burning devices need only minor modifications. This promotes the rapid development of DME clean fuel while maximising cost savings. In recent decades, DME/LPG blended multi-fuel has been preferred by more and more countries, predominantly Asian countries such as Japan, South Korea, Indonesia, and China. For instance, it has been investigated that LPG/DME blended fuel with DME content of 30% or less has been widely used in domestic cooking and heating in China [11]

Shell and other petrochemical firms offer high purity Dimethyl ether (DME) for all cosmetical and technical uses. From their German production in the Rhineland Refinery Wesseling, the oil & gas giant delivers to production facilities all over Europe.

3.5 Subsea Loading Lines

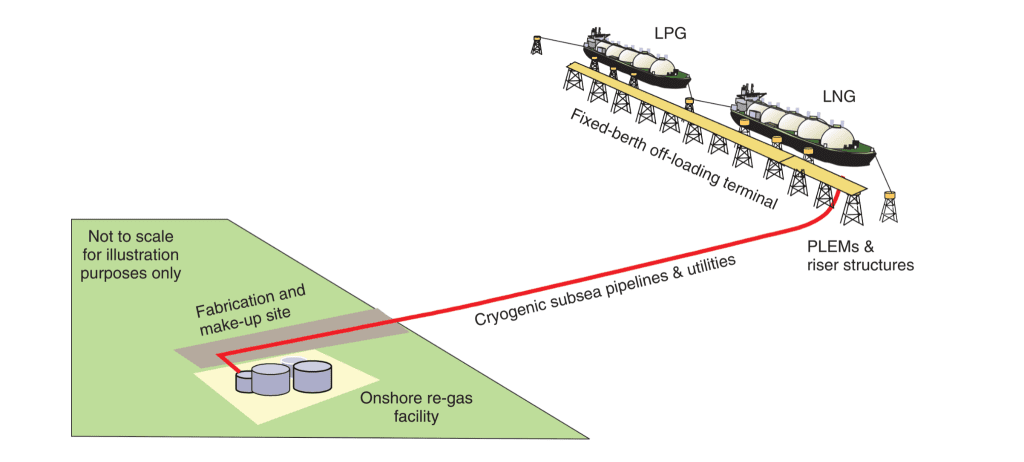

Offshore terminals are required to load and offload LPG into tankers. For locations with sufficiently deep water access, terminals may consist of jetty structures and breakwaters where tankers can be moored, and offloading can take place via standard loading arms. As terminal location concerns build over pressures from environmental and public safety issues, there is a trend to reconsider moving terminal locations offshore. Given that both production and import of LPG will move more and more offshore, it is recognised that there is a need for a safe, efficient, and reliable transfer system.

As an alternative to trestle-supported piping, subsea pipelines may be considered. A subsea pipeline can be used to transport the LNG/LPG from/to an offshore terminal, thereby eliminating the need and cost for a connecting trestle. With current subsea cryogenic pipeline designs, these fuels can be efficiently transferred over distances of up to 20 miles (Figure 5).

The most dominant advantages of LNG/LPG offshore terminals are the lower costs for construction and operation and the possibility of locating the terminal in deeper water, thereby eliminating the need for dredging [12]. In addition, the increased availability, safety, and reduced voyage time, as LNG carriers need not enter and maneuver in congested waters. LNG/LPG carrier berths can be located away from confined waterways, thereby increasing safety and security while at the same time preventing costly civil works. Furthermore, the impairment of new and existing shipping traffic will be minimised.

Figure 5. Typical subsea pipelines layout with loading jetty. Source: https://doi.org/10.1002/9781118476406.emoe468

Subsea cryogenic pipelines are emerging technologies that are essential for the new generation of offshore LNG loading and receiving terminals. The major challenges for these systems include the managing of pipeline contraction due to the low temperature of the LNG, the thermal efficiency of the insulation system chosen, the reliability of the system, the ease of construction, and the ability to monitor, inspect, and, if necessary, repair in a timely manner.

Of the many types of subsea pipeline configurations now being considered for use in subsea applications [13], the most common compact systems being developed are as follows based on thermal efficiency and cost:

- 1Aerogel-filled annular space pipe-in-pipe (PiP) with 9% Ni–Fe alloy product pipe and carbon steel casing pipe.

- Aerogel-filled annular space PiP with 36% Ni–Fe alloy (Invar M93) product pipe and steel casing pipe.

- Fumed silica insulated pipe-in-pipe-in-pipe (PiPiP) with partial vacuum and 36% Ni–Fe alloy (Invar M93) product pipe, 304 stainless steel intermediate pipe, and carbon steel casing pipe.

The first major project involving a subsea LPG pipeline occurred in Peru and is referred to as the Camisea Offshore Loading System.

- The gas is exported from a marine terminal facility that is located on the Pacific coast near Pisco and is designed to deliver gas products to marine tankers for exporting with a pipeline loading rate of 30,000 barrels per hour (4770 m3/h).

- The loading lines connect the Pisco Facility to a marine berthing facility approximately 3 km offshore in 15 m of water.

- The loading system consists of the following elements: Two 20′′ low temperature insulated LPG pipe-in-pipe systems (24′′ carrier) with a riser. Each LPG pipe-in-pipe bundle consisted of 4 km of a 508OD by 2.7WT API X65 inner pipe with a 609 mm by 20.4 Wt API X70 outer pipe with 20 Thk Izoflex insulation layer.

- The insulation requirement for the complete 4 km LPG system was a U value of 0.35 W/m2/K.

- The parallel 4-km-long pipelines have continuous annulus sealed at the end with bulkheads. These pieces offer stress distribution between the two pipes so that the loads remain low and decrease the need for large spool pieces.

4 References

[1] https://epub.sub.uni-hamburg.de/epub/volltexte/2017/68119/pdf/shell_lpg_studie.pdf

[2] Propane, liquefied. Trade Data..

[3] https://www.fortunebusinessinsights.com/lpg-liquefied-petroleum-gas-market-106373

[4] Peng, P., Cheng, S., & Lu, F. (2020). Characterising the international liquefied petroleum gas trading community using mass vessel trajectory data. Journal of Cleaner Production, 252, 119883.

[5] https://www.iea.org/reports/energy-access-outlook-2017

[6] LOOKING AHEAD: Rising Asian LPG demand looks set to soak up last year’s oversupply. (2017). Oil and Energy Trends, 42(7), 14–15. doi:10.1111/oet.12489

[7] China Market Insider. Why Is There a PDH Plant Construction Boom in China?’.

[8] Karimi, M., Wang, X., Hamilton, J., Negnevitsky, M., & Lyden, S. (2021). Status, challenges and opportunities of dual fuel hybrid approaches-a review. International Journal of Hydrogen Energy, 46(70), 34924-34957.

[9] Borges, R. P., Moura, L. G., Spivey, J. J., Noronha, F. B., & Hori, C. E. (2020). International Journal of Hydrogen Energy, 45(41), 21166-21177.

[10] Adolf, J., Balzer, C. H., Louis, J., Schabla, U., Fischedick, M., Arnold, K., … & Schüwer, D. (2017). Energy of the future?: Sustainable mobility through fuel cells and H2; Shell hydrogen study.

[11] Zhang, Q., Qian, X., Chen, Y., Li, M., Wu, D., Yuan, M., & Wang, D. (2020). Effect of DME addition on flame dynamics of LPG/DME blended fuel in tail space of closed pipeline. Energy, 202, 117746.

[12] Prescott, C. N. (2017). LNG/LPG Subsea Loading Lines. Encyclopedia of Maritime and Offshore Engineering, 1-14.

[13] https://onepetro.org/OTCONF/proceedings-abstract/09OTC/All-09OTC/OTC-19824-MS/35857?redirectedFrom=PDF

To all knowledge

To all knowledge