1 Introduction to the SADC Natural Gas Market

1.1 Gas in the World

Deep changes are occurring in natural gas markets – China is entering the global gas scene, driven by continuous economic growth and strong policy support to curb air pollution; the United States is emerging as a global LNG player (see our article on the shale gas revolution at https://epcmholdings.com/the-united-states-shale-revolution/), and the industrial sector is set to take over from power as the key driver for natural gas demand. In terms of growth, the African gas sector is no different and is looking to continue to boom in the 2020s as the region grows economically and investment increases.

Governments in West African countries are increasing their efforts to secure a stable gas supply to enhance power generation capacity and rely less on revenue generated by crude oil. Power is a key determinant and precursor to economic growth, particularly in 3rd world countries.

Other African governments are looking to set up their delivery of gas infrastructure, including pipelines, floating liquefied natural gas (FLNG) platforms and major gas field projects.

African gas discoveries are stimulating sector growth and infrastructure development in Mozambique, Kenya, and Tanzania on the east coast, while the emergence of shale gas and the strategic environmental assessment commissioned by the South African government are leading exploration on the continent.

The South African Development Community (SADC) leadership has painted a grand vision of an interconnected gas market. To better understand this vision, high-level market research on the gas market in the SADC region has been undertaken. We assess SADC’s current position and suggest a roadmap to achieve it.

1.2 Approach: The SADC Natural Gas Market

The approach we take in this article is to assess the market for natural gas via a desktop assessment of demand vs the ability of the SADC region to supply the natural gas. Available research outputs and other forms of data have been collated from the internet, using news websites, company websites, free research papers, and other online data sources, which are used to build into at least some kind of road map for natural gas demand, and equally for the supply of gas.

We begin with a brief snapshot of the SADC (South African Development Community) region and a few relevant facts, properties, and characteristics about natural gas.

Many reports, articles, and other media releases state large domestic demands in the SADC region. However, little data is provided on the demand’s source in terms of heating, electricity, and other forms. Therefore, there is little data to back up these numbers.

For the demand side assessment, we assess each of the uses of natural gas in the third world setting against an expected price for that particular use. For example, we compare an expected end-to-end cost/production price of natural gas needed for cooking purposes with the (existing) price of a substitute product (e.g. firewood). If the price of natural gas is lower than the price of firewood, then we assume natural gas can act as a substitute for that product. The outcome is that there is then a sufficient price level to warrant a purchaser switching from firewood to natural gas for heating purposes. The demand for natural gas is assumed to be fulfilled by the lower price disparity, and the demand is then (potentially) realized. Of course, for this assessment, we need a price of natural gas, so we have included a brief section on the current state of natural gas prices in the world and what an expected selling price could be in the SADC region.

For the supply portion, a high-level assessment is made through the size and location of gas reserves, and the existing infrastructure capable of delivering it to the largest populations. We have used a trigger of cities with a population of more than 1 million people by 2025. For the infrastructure, we look at transportation through transport corridors, ports and gas pipe networks. To understand how the current state of natural gas supply is developed in the SADC market, we also briefly examine the existing projects in the region, mainly in South Africa, Mozambique, Tanzania, and Angola, and their scope and size.

To conclude, we question whether the current situation in the SADC region is a precursor to the start of the SADC Integrated Natural Gas Market

2. SADC and the Need for an Integrated Natural Gas Market

2.1. The South African Development Community

Figure 1: The South African Development Community (SADC)

As it currently stands, the Southern African Development Community (SADC) is a Regional Economic Community comprising 16 Member States (Figure 1): Angola, Botswana, Comoros, Democratic Republic of Congo, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, South Africa, Swaziland, Tanzania, Zambia and Zimbabwe. SADC is committed to Regional Integration and poverty eradication within Southern Africa and has many strategic and regional plans to connect the region, reduce poverty and increase the well-being of the region’s inhabitants. SADC was formed with four principal objectives, namely:

- Reduction of Member State dependence, particularly, but not only, on apartheid South Africa;

- Forging of linkages to create genuine and equitable regional integration;

- Mobilization of Member States’ resources to promote the implementation of national, interstate and regional policies; and

- Concerted action to secure international cooperation within the framework of the strategy for economic liberation.

Follow the link below for more about SADC: https://www.sadc.int/about-sadc/overview/

2.2. Regional Gas Infrastructure and Market Development

Through a Regional Gas Infrastructure and Market Development initiative, SADC is currently looking at programs and projects aimed to facilitate the availability of sufficient, reliable, least-cost energy services in support of the ambitions of its principal objectives. The objectives are concurrent with the SADC Protocol on Energy of 1996, which promotes the harmonious development of national energy policies and matters of common interest for the balanced and equitable development of energy throughout the Region.

In 2018, South Africa Minister of Energy Jeff Radebe, in the SADC Ministerial Workshop on Regional Gas Infrastructure and Market Development, outlined a vision for the SADC community. In this, he identified key constraints to the realization of this vision:

- Do we have the policy and regulatory framework to provide an enabling environment to exploit our natural resources in the region?

- Do we have the gas infrastructure to transport the gas within the region to markets?

- Does the region have sufficient demand to pay for infrastructure development?

- Will there be funding available for the mega-regional project?

These are critical questions. Numerous authors in other developing countries have identified them as recurring issues that hinder the development of gas resources and most infrastructure projects. Therefore, the same problems seem to keep arising in most third-world countries.

3. A Brief Background of Natural Gas

3.1. Gas Facts

Here is a summary of some relevant aspects of gas as a brief introduction and for the reader’s convenience.

- Natural gas is a naturally occurring hydrocarbon gas mixture consisting primarily of methane

- Commonly includes varying amounts of other higher alkanes and sometimes a small percentage of carbon dioxide, nitrogen, hydrogen sulfide, or helium

- Generates temperatures above 1,100 °C (2,000 °F) making it a powerful domestic cooking and heating fuel.

- Used as a source of electricity generation.

- It is also used as a fuel for vehicles and as a chemical feedstock in the manufacture of plastics and other commercially important organic chemicals.

- Because of its low density, natural gas is not easy to store or transport by vehicle.

- Gas needs to be liquefied to transport because its low density means it takes up high volume, and transport in its gaseous state becomes unfeasible.

- Gas is transported in liquified overland by either pipeline or road/rail-based transport.

- Natural gas pipelines are impractical across oceans since the gas needs to be cooled down and compressed.

- Long-term contracts have traditionally been signed between gas field developers and off-takers to provide sufficient security against the risk of poor future cash flows. However, this seems to be changing.

The readers’ attention should be please be guided to the significantly more extensive articles in the EPCM catalogue if more detail is needed:

https://epcmholdings.com/liquefied-natural-gas-lng-overview/

https://epcmholdings.com/design-and-optimisation-of-micro-scale-natural-gas-liquefaction-processes/

https://epcmholdings.com/energy-outlook-oil-and-gas-dnv-report-notes/

https://epcmholdings.com/liquid-natural-gas-lng-value-chain-the-basics/

https://epcmholdings.com/where-natural-gas-is-found-and-how-it-is-obtained/

3.2. Cost of Natural Gas

In our assessment, the price of natural gas is a key determinant of the likelihood of people switching from one product to natural gas, and in our assumption, in a 3rd world country is the only reason why someone would switch, i.e. environmental impact and other aspects do not play a role in decision making.

In the medium to long term, the IEA forecasts US gas prices will increase in the short term to around $7/MMBtu by 2040. This is because the more profitable reserves are being used first, with the less profitable projects remaining. Inevitably, producers then tend to develop higher-cost projects to meet demand while still maintaining some level of profitability.

Figure 2: LNG prices

The biggest uncertainty surrounding gas demand and price projections is related to

- the costs of alternative energy solutions and

- countries’ policies in diversifying their energy sources and implementing the Paris Agreement.

In the longer term, it is also thought that the international gas market will become more flexible, which will narrow the price difference between the European and the Asian markets. The IEA projects that European and Asian market prices will settle above the US price by around $4–5/MMBtu and $5–6/MMBtu, respectively. These spreads result from the US continuing to be the lowest-cost exporting producer in the long run, with Asian prices slightly above European prices owing to the transport cost differential.

4. A Brief History of SADC Natural Gas Markets

4.1. Origins

The information available on the historical development of the SADC gas market is focused on four SADC countries: Angola, Tanzania, Mozambique, and South Africa. The other remaining SADC countries either started only recently in gas exploration or have gas markets in their absolute infancy. Madagascar is considering exploring natural gas reserves, and Namibia has already discovered two offshore fields.

4.2. Market Size Growth

Gas is currently a minor part of the Angolan hydrocarbons industry, although it is the only country in the SADC region with an LNG regasification plant. Natural gas is overshadowed by oil. BMI estimates marketable gas production for 2016 as at 3.5bcm, yet actual production will have been significantly higher, with the excess gas reinjected into oil fields or flared. Angola stands out from the rest of Southern Africa as the dominant and only oil producer. However, their gas exploration activities have only started recently. The country’s oil industry started commercial-scale production from the off-shore Cabinda fields in the 1960s. Angola has since developed a significant petro-economy with the attendant features of high reliance on oil sector revenues.

Mozambique has been producing gas since the onshore Pande and Temane fields were brought to South Africa through the Sasol Rompco pipeline in 2004. The discovery of major gas reserves in the offshore Rovuma Basin in the north of Mozambique has led to its recalibration as a major natural gas resource country and its ranking first in the SADC region.

Further north in Tanzania, gas exploration has been underway since 1952. The first discovery of natural gas was made in 1974 in the Songo Songo area, Kilwa district in the Lindi Region. Eight years later, in 1982, the second discovery took place in the Mnazi Bay area in the Mtwara region. The discovery of the natural gas reserves in these areas promoted gas research on the coastal and offshore areas, which were arguably the forerunner to the bigger, more recent discoveries. Studies were carried out by international oil companies. There have been other discoveries south of Dar es Salaam, in the areas of Mkuranga, North Kiliwani and Ntorya, between 2007 and 2012, but the extraction from these discoveries awaits infrastructure. In 1991, a natural gas purification plant was built on the island of Songo Songo along with the pipeline for exporting natural gas to Dar es Salaam. To the south of Dar es Salaam, an estimated 2.1 million cubic feet are used to generate electricity that serves the Mtwara and Lindi regions on the southern border.

4.3. Synopsis

The SADC region’s markets are rather small compared to those of the rest of Africa. Over the last 40 to 50 years, the gas market has been concentrated in the exploration sector in Tanzania, Mozambique and South Africa. Recently, Namibia and Angola have entered the exploration markets. Madagascar’s oil exploration industry is rather small, but the country has been considering gas exploration. The other SADC countries, such as Zambia, Zimbabwe, Seychelles and Reunion, have not been involved significantly in the exploration sector.

Of the countries in the SADC region, South Africa has been using the most gas over the longest period. The gas pipeline network in Johannesburg, fed from the ROMPCO pipelines, supplies areas of Johannesburg, South Africa’s largest population centre, with gas. Angola has been using gas for its 750MW Soyo gas power plant, which started producing power for the capital city’s electricity grid in 2017, using LNG from a variety of national oil blocks as well as the Angola LNG plant, its only liquefaction facility. The second phase will integrate the Soyo combined cycle power plant into the wider Angola power network. Tanzania’s small reserves south of Dar es Salaam have been producing gas for the local markets, consisting of gas for heating and cooking mainly for lower-income and poor households, as well as the production of electricity for the region just south of Dar Es Salaam.

5. Current SADC Natural Gas Market

Here, we assess the market from both a demand side (user needs and population size) and a supply side (available reserves, population size and location, existing infrastructure, and current projects).

5.1. Demand in the SADC Gas Market

As mentioned earlier, there are several reasons for the strong worldwide demand for natural gas, largely driven by the following:

- China is entering the global gas scene, driven by continuous economic growth and strong policy support to curb air pollution;

- The United States is emerging as a global LNG player, and

- The industry sector is set to take over from power as the key driver for natural gas demand.

However, in the context of the development of the SADC region, these are secondary. Third-world developing countries have different needs driven by large and poor populations. Their needs are determined by day-to-day living, i.e., heating, cooking, transport, and food production. This, in turn, drives the necessity for electricity, fuel for home fires, feedstock for livestock and fish stock, and fertilizers for agricultural produce.

Typically, the average African homestead does not have access to gas or other fuel for heating and cooking; firewood is the fuel. This is expensive in terms of time to collect. Transport is by foot or bicycle. Little livestock is kept besides several chickens, goats or cows with little to feed on. Agriculture is severely limited by rainfall, heat and soil conditions. Gas can change this, and therefore third world countries have a demand driven by the following interlinked factors:

- Uses of natural gas.

- Weather.

- Petroleum Prices.

- Populations

According to IEA, consumption in Africa is expected to rise at a rate of 3.1% per year. Angola is currently developing 400MW of gas-fired power plants, and Tanzania is aggressively pursuing a domestic gas-to-power agenda that could result in 500 bcm of gas being committed to the domestic market.

5.1.1. Uses of Natural Gas

Cooking

The majority of the population in sub-Saharan Africa depends on solid biomass for cooking and heating. The proportion is exceeding 90% for the rural population. There are a variety of different issues linked to the use of solid biomass, such as the large health burden resulting from ingesting particulates and pollutants from the combustion of solid biomass. Figure 3 shows the fuels used for cooking in Eastern Africa. In rural areas, up to 93% of the population depends on wood. In urban areas, the fuels most used for cooking are slightly different and vary between wood, charcoal and kerosene.

Figure 3: Fuel types in

To supply natural gas to residential users, a gas distribution network that connects the households to the city gate station has to be deployed. Modular gas containers can be transported via road and rail, but this quickly becomes expensive and is probably better suited to supply rural areas with sparse and small populations. Pipeline infrastructure is economically viable in urban centres due to the dense populations. The penetration of natural gas as cooking fuel in urban and rural areas depends on its price compared to the available alternatives.

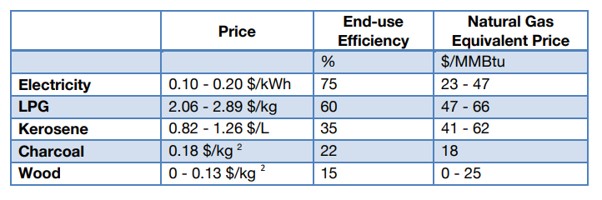

Table 1 shows a comparison of the cost of the two main clean alternatives and the three most used cooking fuels in Eastern Africa’s urban areas. The different alternatives have specific efficiencies that have been taken into account to calculate a price for the same reference heat output, which is the heat output provided by one MMBtu of natural gas used in a standard cooking appliance. The cheapest fuels are charcoal ($ 18/MMBtu) and wood ($ 25/MMBtu), which explains why they are still largely used in urban areas.

Kerosene ($41 – $62/MMBtu) is between 2 and 3 times higher than charcoal and wood, depending on the country. Concerning the clean alternatives, LPG is close to the price of kerosene, and electricity is, on average, cheaper. To allow for a large penetration of natural gas for cooking, its retail price has to be competitive with the cheapest alternatives, wood and charcoal, and electricity if its price for residential users is around $0.1/kWh or lower. Using Table 1, we can assume that a competitive retail price for natural gas would be in the range of $15 – 25/MMBtu.

Table 1: Comparison of cooking fuels in East African urban areas

Electricity

With high economic and population growth, electricity consumption in sub-Saharan countries is expected to increase drastically. There are several ways to meet this high demand.

Solar generation has great potential in Africa, with an average daily solar irradiation of 5 – 6 kWh/m2, but it is largely undeveloped due to its high cost.

Hydropower is another important means of providing electricity, with the advantage of low electricity production costs (around $0.03 -0.05/kWh). However, hydro resources are not equally distributed across the SADC region, and long-distance transmission lines are required to fully exploit the sites with the largest potential.

Diesel-driven engines are other alternatives but have high operational and maintenance costs and emissions.

When natural gas is available, gas-fired combined cycle power plants represent an interesting solution. The gas-fired combined cycle power plant is the most efficient (in terms of energy and emissions) technology to convert fossil fuel into electricity.

In sub-Saharan Africa, the production cost of electricity is highly variable (Figure 4). Outside of the borders of coal-powered (and some nuclear-powered) South Africa, power generation is essentially based on hydroelectricity and diesel generators, which are either unreliable or costly and dirty.

Figure 4: Cost of electricity in Sub-Saharan Africa

In 2015, only the most competitive renewable power plant solutions could compete with coal – and gas-powered power plants. This is partly because of the low operating costs resulting from the depressed coal and gas feedstock prices. In the coming years, it is expected that the impressive cost reductions observed in some renewable technologies (particularly wind and solar) will continue to drive down costs, making them increasingly competitive with fossil-fuel-based power plants (Figure 5), which are expected to become more expensive as a result of higher feedstock price projections increasing operating expenditures. Whether renewable energies take off in the SADC region is yet to be seen. Technologies that have already matured and where there are no expected price changes in the feedstock, such as hydropower, are not expected to see significant cost changes.

Figure 5: Energy Costs for 2015 and 2040

Several different studies indicate that for gas-to-power, a gas price below $12 /MMBtu and $48/MMBtu would allow producing electricity with a Combined Cycle Power Plant at a lower cost than from diesel.

Transportation

Compressed Natural gas (CNG) can be used as fuel for road vehicles. Natural gas vehicle growth is particularly important in the Asia-Pacific region, where natural gas represents a cheaper alternative to conventional fuels (gasoline and diesel). An important advantage of natural gas over diesel and gasoline is lower emissions (particles, CO2, NOx and SO2). The drawback of CNG is that the range is about 3.5 times shorter when compared to gasoline or diesel for the same tank volume. The CNG vehicle requires a cylindrical tank pressurized at about ~3500 psi (240 bar). There is currently limited demand for gas vehicles in the SADC region, but there is an opportunity for gas-powered vehicles to realize a large proportion of the region’s transport needs and thus facilitate the expansion of the ‘gas-powered economy’ in the region.

In most sub-Saharan countries, oil products are imported, and the retail prices of diesel and gasoline are high. Hence, domestic natural gas could offer a competitive alternative. Although LPG is only marginally used for transportation, it could be seen as an alternative to conventional fuels. Retail prices have been converted in $/MMBtu to allow the comparison with natural gas. In the US, the CNG price at a refuelling station is, on average, 25% higher than the price at the city gate. Assuming a similar ratio for Eastern African countries, the natural gas price at the city gate should not exceed $25/MMBtu to $52/MMBtu, depending on the country (see Figure 8), to represent a competitive alternative to conventional transportation fuels.

The use of motor vehicles in SADC countries is relatively low compared to other third-world countries like China and first-world countries. A significant step up in terms of vehicle availability and fuel is needed before a decent market is established in this.

Fertilizer production

Sub-Saharan Africa’s agricultural productivity is low compared to other developing countries. The same is true in the SADC region. In Sub-Saharan Africa in 2010, the average fertilizer use was 8 kg/ha, compared to 303 kg/ha in East Asia and 107 g/ha in North America. This low use of fertilizers is essentially due to the relatively high retail prices for the farmers. The supply of fertilizers relies on imports, and the transportation costs (including ocean freight, port costs and truck transport) significantly impact the retail prices.

Fertilizers provide nitrogen (N), phosphorus (P), and potassium (K) as the main nutrients. They are most often produced using natural gas. On average, the cost of natural gas represents around 50% of the price of ammonia, the main feedstock for producing nitrogenous fertilizers such as urea.

If affordable natural gas is available in sub-Saharan Africa, domestic production of nitrogenous fertilizer could be developed. The distribution costs for this fertilizer can be estimated at around $115/ton. It appears that domestic production with a natural gas price as high as $15/MMBtu could supply urea at a very competitive cost ($570/ton) compared to importing urea.

Figure 6 shows a large variation in the yearly average price for urea between 2010 and 2012. In 2010 – the most favourable year – the average price of urea was between $549/ton and $808/ton, depending on the country.

Figure 6: Nitrogenous Fertilizer retail price in Eastern Africa

Considering these values for domestic production and distribution, the price of natural gas should be $14 – 24/MMBtu or lower to produce locally competitive fertilizer.

Animal and fish feed

Natural gas can be used to produce animal and fish feed. The pellets are made using methane-eating bacteria—methanotrophs—found naturally in soil and lakes. These are fed methane gas, which causes them to grow and multiply into protein-rich biomass that can be dried and turned into animal feed.

The process is essentially the fermentation of sugar into acids, gases, or alcohol, mainly by yeast and bacteria. With most fermentation, the carbon source is sugar, whereas here, the carbon source is methane in natural gas. The produce could be more environmentally sustainable and supply the growing demand for feed in the aquaculture and agriculture markets, such as farmed fish, crustaceans, and livestock.

The process uses somewhere between 60 and 80% less water than alternative ingredients, including soy and wheat proteins. In the SADC market, animal and fish feed can be used to supplement either traditional or commercial animal farming activities, thereby substituting more expensive types of feed with a gas produced. Unfortunately, due to the infancy of the development of the research into the commercialization of the process, there is little information available on production costs, but the research suggests that when gas prices are above 20-30% of the current price, the technology is not commercially feasible and will not provide a product that can be substituted for other forms of feed used in the SADC region.

5.1.2. Populations in the SADC Region

Market size is a key determinant of the demand for natural gas. All else being equal, more people equates to higher demand. The SADC region has several population centres of over 1 million people (Figure 7). By 2025, these spread to several inland locations: Harare, Lusaka, Mbuji-Mayi, Lubumbashi, and an ever-growing Gauteng area in South Africa.

Figure 7: SADC major population centres – 2025 estimates

The largest population centres (14-16m) are concentrated in Dar es Salaam, Johannesburg, and Kinshasha, with Dar es Salaam being the only coastal city with port access for shipping. Luanda, Cape Town, Ethekweni (Durban), Antananarivo, and Maputo are all significant centres (5-8m), with Antananarivo being the only non-coastal city with a significant population.

Short-sea shipping is an option for coastal centres, while a mixture of piping and road/rail transport is necessary for smaller towns. River barging may be appropriate for a location like Kinshasa, but it is likely to be cheaper via pipeline.

5.2. SADC’s Ability to Supply Natural Gas to the Market

5.2.1. GAS Reserves

According to EIA, at the end of 2019, the world had proven natural gas reserves of some 200,000 cm, and Africa had 15,700 cm, around 8% of the world’s total. Exploration on the continent has yielded an increase of around 1% in total African gas reserves since 2018.

Even though 90% of gas production continues to come from Algeria, Nigeria, Egypt, and Libya, the SADC countries are currently planning to utilize their gas reserves as effectively as possible to grow their economies and improve their people’s livelihoods.

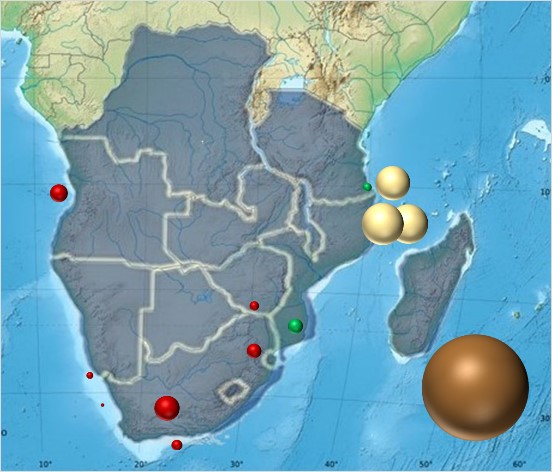

The region has reserves currently estimated at approximately 1,500 cm, around 0.7% of the world’s total, the majority of which are in Mozambique and Tanzania. South Africa, Angola, Zimbabwe, and Namibia all have discovered gas, some more so than others.

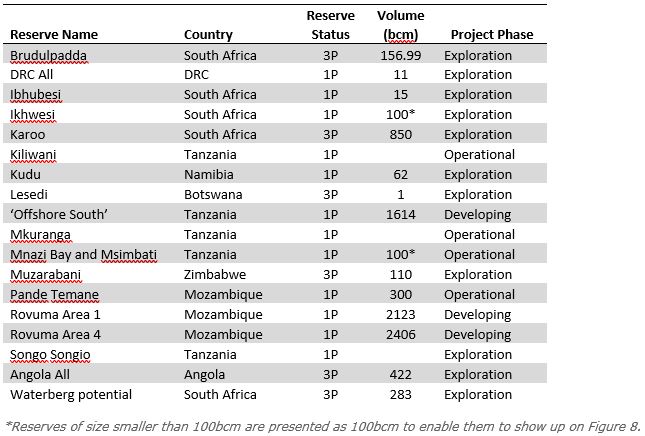

Table 2 provides details of the region’s most promising reserves. They are split by country, reserve status (1P = proven reserves at 90% likelihood), and project phase (3P reserves are considered estimates and probable).

Table 2: SADC Gas Reserves

Most of the reserves are still being investigated further. What stands out is the size of the Rovuma gas fields and the offshore gas field in south Tanzania, the three in total amounting to 7,000 cm. South Africa Karoo shale gas as a P3 reserve features prominently, but with several varying estimates, the exact amount is quite uncertain. For more information on South Africa’s Brulpadda reserves, see our article at https://epcmholdings.com/brulpadda-totals-offshore-discovery/.

Concerning Angola, Mozambique, and Tanzania, the volume of gas resources is not a constraint to the wider utilization of natural gas as it is with the smaller gas fields. Each of these countries is attempting to transition to a significant gas producer and consumer from a low base, which, most notably in the case of Mozambique, requires bringing on-stream gas reserves that are orders of magnitude larger than the already producing fields.

Several common themes are present:

- There are significant gas reserves in the SADC region;

- There are large distances between reserves and major market centres;

- Gas production and transportation by pipeline or gasification are capital-intensive investments for which scale economies are critical, and

- Many other countries and regions are also expanding their gas production capacity, which is reflected in softer world markets and greater difficulties in securing the off-take contracts necessary to commit to investment decisions.

Therefore, a coordinated approach is necessary to avoid competition diluting the benefits of low transport costs. However, in a world of competition and free markets, this may be difficult.

With the sheer size of the Tanzanian and Mozambican gas fields, SADC countries close to the reserve have a double advantage: economies of scale and lower transport costs. Within SADC, South Africa, Zambia, and Malawi can all access this gas at relatively cheaper prices through proximity. South Africa already has a gas pipeline from Mozambique that runs over a distance of about half that from the Tanzanian and Mozambican fields.

Figure 8: Gas Reserves: Approximate location and size (Green = Operational, Yellow = P1 reserves, Red = Probable Estimates P3 Reserves. Brown sphere = total African reserves at 15,000 bcm)

5.2.2. Legal and Regulatory Aspects

Gas is different from oil. The lower energy content per unit, dependency on local infrastructure, asset specificity, capital expenditure and the need to secure a market at the early stages of a project make the exploration and production projects for natural gas different from those of oil. As such, a typical contract would treat natural gas somewhat differently from oil, and from the producer’s perspective, the contract between the producer and the gas purchaser becomes crucial for the project.

Long-term supply contracts are an essential part of the financing of large-scale natural resource projects by providing security as to off-take and prices, from exploration and production to pipelines and/or natural gas liquefaction facilities.

Long-term natural gas commodity contracts have been the backbone of the EU’s security of supply for decades. Since the 1970s, these contracts have been used to import more than 250 Bcm/year of natural gas to the EU area. Accepted as the modus operandi among both producers and the EU purchasers, the traditional view is that long-term take-or-pay contracts provide for the security of demand for the producer and the security of steady supply for the purchaser. The producer has the certainty of demand and can plan for the necessary investments with a long-term rationale. The purchaser has the certainty of supplies and can, therefore, adopt a long-term strategy in downstream markets.

In the SADC context, the long-term contract needs project developers to trust that governments will uphold their end of the contract. Perhaps traditionally, Africa has a legacy of poor contractual performance, an unsophisticated, if any, regulatory environment, and a poor justice system. These are precursors to a lack of trust in contracts. Regulations are essential, and indeed, this seems to be changing, perhaps off the back of the success of other African hydrocarbon industries, such as Libya’s, Nigeria’s and Angola’s. In Mozambique and Tanzania, for example, long-term contracts are largely in place for a large proportion of the reserves in the ground, a highly promising position. To top it off, South Africa has, of course, been importing gas from Mozambique since 2003, and it has a 16-year history of trust.

5.2.3. Transport Corridors

The SADC region has an extensive network of freight transport corridors. These corridors were first established in the 1980s because of the many landlocked countries in the region. A particular motivation was to bypass South Africa in rejection of the apartheid government there at the time. The corridors were mostly identified starting from a port and developed, protruding inwards towards the landlocked countries (Figure 9).

Figure 9: Transport Corridors and ports in the SADC region

Today, the SADC transport corridors are regarded as some of the most successful corridors in the world. Some features that made them successful include common political objectives, adopting a common language (English), similar road and rail design and operational standards, cooperation among member states, and the establishment of corridor-specific secretariats. The SADC corridor approach to regional development is based on well-maintained and operated infrastructure and the provision of seamless transport services.

However, although the corridors have been successful to date, there are several challenges relating to providing adequate regional infrastructure and related transport services, a setting that urgently requires strategies to improve and expand the freight transport system to meet emerging demand. Freight transport in the SADC region is furthermore characterized by extreme polarization in favour of road transport. The setup translates into a situation in which there are numerous negative aspects, including a high rate of transport-related accidents, road congestion, high infrastructure expenditure, and environmental damage. This inevitably results in high transport costs.

5.2.4 Ports

South African ports dominate the extensive port system in the SADC region, both in terms of sheer numbers and capacity and volumes handled. South African ports also serve the majority of landlocked countries in the SADC region (Figure 9). Most ports in the SADC region were primarily designed to serve the needs of the individual countries and their natural hinterlands, and thus, there is an apparent fragmentation in the general transport networks that connect the ports. Many of the SADC ports are also general ports focused on a variety of imports and mineral exports and, hence, are not adapted to SSS.

Additionally, Africa’s high average growth rate over the last few years has had a marked effect on the utilisation and efficiency of these ports, and many are operating around their design capacity. Opportunities for new operations are emerging slowly, such as the specialization of ports for container handling or dry bulk handling, especially in high-potential markets such as Namibia and Tanzania.

Short sea shipping has the theoretical potential to work in the SADC, given the large geographic region, projected freight volumes, and customs and trade policies the SADC region is pursuing. Such a system would have three main roles: to offer unimodal freight transport between port cities, to offer the main leg of an intermodal route, and to offer feeder services to deep-sea shipping in a hub-and-spoke cycle. However, freight transport in the SADC region has several shortfalls that need to be addressed—of note, port competitiveness, customs provisions, and policies for intra-regional trade require impetus. However, the uploading and discharge of the gas from the vessel through liquefaction and regasification via FSRU offshore can be challenging, especially in environmentally sensitive and harsh offshore ocean conditions.

5.2.5. Gas Pipe Network

The SADC pipe network is in an early stage of development. Sasol pipes gas from the Pande Temane reserve in Mozambique to Sasolburg, from where it is distributed to the greater Johannesburg area.

Several other projects are currently being studied to increase the available pipe network in the SADC region, and these are mostly focused on the Eastern SADC countries. These studies are still in their infancy, but SASOL has indeed shown that long-distance gas pipelines can work in Africa.

Figure 10: SADC Gas Pipe Network

5.2.6. Status of Major SADC New Gas Infrastructure Projects

Mozambique

Mozambique’s current natural gas production is operated by Sasol (South Africa) in Inhambane Province, which holds proven reserves of 300 bcm. The natural gas is produced and processed at a central facility in Temane and then transported via an 865 km pipeline to South Africa, with a link to southern Mozambique for domestic use. Additionally, Sasol will develop an integrated oil and liquefied petroleum gas project adjacent to its existing petroleum facility. The project includes 13 wells and an LPG production facility at an estimated cost of USD 1.4 billion.

Due to the discovery of over 4500bcm of natural gas reserves in the Rovuma basin by Texas-based Anadarko (Area 1) and Italian firm ENI (Area 4), Mozambique is expected to become a major exporter by 2023. Anadarko will build an LNG plant to process the gas they discovered in Area 1, off the northern coast of Mozambique near the border with Tanzania. It selected a joint venture of developers that includes McDermott (USA), Saipem (Italy), and Chiyoda (Japan) to construct the Afungi LNG Park, which is valued at USD 25-30 billion. Anadarko expects to conclude several sales and purchase agreements (SPA) by year-end for liquefied natural gas (LNG), and they announced their final investment decision in June 2019 for USD 25 billion during the recent US-Africa Doing Business Summit Conference. This is a major investment for Mozambique and the first of such value in the entire African continent.

On June 1, 2017, ENI announced the final investment decision amounting to USD 8 billion for the construction of six subsea wells connected to a Floating Liquified Natural Gas (FLNG) production facility in Area 4, which is due for completion in mid-2022. The Engineering Procurement and Construction (EPC) contract was officially awarded to a TechnipFMC, JGC, and Samsung Heavy Industries consortium. Furthermore, in 2018, ExxonMobil acquired a 25% indirect interest in the Area 4 block from ENI. As part of this agreement, ENI will lead all upstream operations, and ExxonMobil will lead the construction and operation of liquefaction facilities onshore to be located in the Afungi LNG Park.

Tanzania

The international gas outlook indicates that the overseas natural gas markets are large and lucrative enough in the medium to long term to make the development of Tanzanian offshore gas deposits economically viable. Therefore, it is understandable why proposals from international oil companies (IOCs) in Tanzania have focused on liquefying the gas for export.

As recognized by the Government of Tanzania, however, natural gas can be a powerful tool to facilitate the country’s broader economic development and diversification. Compared with coal, liquid fuels, and biomass, it provides a readily available and relatively clean source of energy for power generation, industrial use, and residential consumption.

Thus, all countries that develop their gas primarily for export must answer the complex and important questions related to domestic use. The Government of Tanzania, through Article 8 of its production-sharing agreements, has the right to require IOCs to make up to an extra 10% of the exported gas available to be sold within Tanzania.

Before its final approval of the offshore development and LNG proposals, the Government must agree with upstream companies on the arrangements as to how much gas will be reserved for domestic use, how it will be delivered, how costs will be shared, and the price for the gas that will be paid to the developers. Each of these upstream arrangements must be considered in conjunction with decisions on how onward usage, transmission and pricing of that gas to final consumers will work. This section outlines some of the key considerations that must be considered in domestic gas allocation.

South Africa

Most of the dry natural gas is exported to South Africa via the ROMPCO international gas pipeline, which currently exports some 3.65 cm. Those fields are estimated to end their life around 2027, and Sasol is, therefore, actively exploring adjacent blocks.

Sasol and its partners’ development of the Temane fields in the Inhambane province has moved onto engineering design to handle wet and dry gas as well as LPG. Most of the gas will go to a 400-megawatt (MW) power plant in Maputo, with the rest destined for third-party customers using the ROMPCO pipeline.

VGN and NGV Gas receive natural gas at a distribution station in Langlaagte via the Sasol Gas pipeline, which runs from Temane to Secunda and then to Johannesburg. The company then distributes gas to customers anywhere within a 300 km radius of this distribution station, managing the entire delivery process on a pay-as-you-use basis according to customers’ energy requirements.

6. A Roadmap for SADC: The Future

Getting the gas to the markets

The large reserves found in Tanzania and Mozambique, totalling some 3% of the world’s reserves, will undoubtedly assist in taking the SADC region’s vision of an integrated gas market to fruition. Piping natural gas from Mozambique to South Africa has shown that this can technically work over some 1000km. Connecting this existing pipeline to the gas fields in northern Mozambique and southern Tanzania, as well as to Dar es Salaam, will significantly open up the entire eastern seaboard of Africa, south of Kenya, to the gas market. Relatively short tap-in lines can then feed the internal landlocked markets of Harare, Lusaka, Mbuji-Mayi and Lubumbashi and open up Zimbabwe, Malawi and Zambia to gas markets. The existing road and rail network can assist in getting the gas to the smaller markets, i.e. villages and other types of informal settlements, in a small modular form suitable for cooking and heating.

For the western seaboard of SADC, Cape Town and Windhoek, as the largest population centres, can be served via short sea shipping from the gas export facilities in Mozambique and Tanzania. The markets of Kinshasha and Luanda can be served from Angola’s 3P reserves and perhaps even the Mozambique and Tanzania reserves.

The industry can be reassessed in the large capital cities for manufacturing plants for gas-assisted fertilizer and animal feedstock plants, especially where these cities are close to the larger agriculture and livestock farming economies.

Re-alignment of the long-term contract

Due to the increased flexibility of LNG, spot markets and potentially unconventional natural gas providers, the significance of long-term take-or-pay contracts from the purchaser’s point of view has started to change in the EU. Alternative sources of supply, together with the storage of natural gas where possible, provide flexibility in the incumbent’s purchasing portfolio that downplays the need to rely on long-term contracts. It requires a well-developed gas market in the SADC region before this approach can be emulated between the major SADC gas producers (arguably Tanzania, Mozambique, Angola and South Africa) and the potential major SADC purchasers (Democratic Republic of Congo, South Africa and Madagascar).

Achieving SADC Developmental Goals

Natural gas is already a reality for industrial and transport sectors within a 300 km radius of Johannesburg thanks to NERSA-approved gas traders Virtual Gas Network (VGN) and NGV Gas’ development of a compressed natural gas distribution infrastructure, including delivery networks, filling stations and conversion systems. These companies have already converted state hospitals, canneries and manufacturing and assembly plants across a range of industries, in addition to commercial fleets, busses and around 1,000 taxis, to natural gas.

In so doing, the end-users have been able to:

- Reduce energy/fuel costs

Natural gas has a high energy content and excellent price/kilojoule ratio. Its consistent energy output improves efficiency, and it delivers 20% to 40% cost savings over petrol and diesel. - Enhance site and vehicle safety

Lighter than air, natural gas dissipates quickly into the atmosphere, reducing the risk of fire pools. It’s also more difficult to ignite, with a combustion temperature of 600° C (150° C higher than petrol and LPG). - Lower operational and maintenance costs

This cleaner-burning fuel reduces residue, stench, and carbon build-up, lowering maintenance requirements, extending service intervals, and prolonging overall equipment life, both in plants and vehicles. This reduces downtime and loss of production time. - Go green

Natural gas emits less CO2 and other harmful greenhouse gases than other fossil fuels. The inevitable introduction of carbon credits in South Africa will increasingly emphasize natural gas’s economic and environmental importance. - Enjoy stable pricing schedules

Natural gas isn’t prone to the constant price fluctuations seen in crude oil products, which allows for greater budgeting accuracy while increasing customer cash flow. - Enhancing access to natural gas

Natural gas can be distributed in various ways: through pipelines, compressed in high-pressure cylinders, or liquefied by freezing to -163° C in cryogenic tanks.

The increased availability of this superior, alternative energy source in Gauteng is enhancing the long-term profitability of assets in the industrial and transport sectors. As South Africa’s gas economy develops, the country will be able to increase production efficiencies, economic growth, and job creation while reducing reliance on a less efficient, polluting fuel used in ageing energy infrastructure.

An early start?

South Africa, Angola, and Tanzania are far more advanced in terms of using gas for domestic use and electricity generation than the remainder of SADC. This is important because it means there is an example for SADC to learn from, a backbone of exploration activities (most of the SADC countries), moderate levels of extraction from the relatively small fields in Mozambique, Tanzania and Angola, liquefication facilities and supply network feeding the cities (Johannesburg) and the power plants (Angola and Tanzania), which all provide a very positive indication that SADC has (at least, pre-emptively) started to move forward in its grand ambition to connect the member countries with natural gas.

Gas has a huge role to play in the social and economic development of the region, from heating, cooking, transport, fertilizer, feedstock and bunker fuel; the direct and indirect benefits to the population are immense, and perhaps it has already begun.

7. References

Demierre, Jonathan & Bazilian, Morgan & Carbajal, Jonathan & Sherpa, Shaky & Modi, Vijay. (2014). Potential for regional use of East Africa’s natural gas. Applied Energy. 143.

http://wiki.openoil.net/History _of_Tanzania’s_Oil_and_Gas_Industries

https://www.chathamhouse.org/sites/default/files/public/Research/Africa/260213presentation.pdf

https://energypolicy.columbia.edu/sites/default/files/Potential-for-Regional-Use-of-East-Africas-Natural-Gas-SEL-SDSN.pdf

https://macauhub.com.mo/2017/08/14/pt-central-de-ciclo-combinado-do-soyo-angola-comeca-a-produzir-energia-electrica/

https://www.allaboutfeed.net/New-Proteins/Articles/2018/7/The-future-of-feed-might-be-microbial-protein-312228E/

https://www.alliedmarketresearch.com/press-release/bunker-fuel-market.html

https://www.dbsa.org/EN/DBSA-in-the-News/NEWS/Pages/20191113-DBSA-Mozambique.aspx

https://www.dmr.gov.za/mineral-policy-promotion/shale-gas

https://www.eia.gov

https://www.export.gov/article?id=Mozambique-Oil-Gas

https://www.mdpi.com/2071-1050/11/6/1532/htm

https://www.psmarketresearch.com/market-analysis/bunker-fuel-market

https://www.rystadenergy.com/newsevents/news/press-releases/the-australian-lng-market/

Obadia KB, Lingling Z, Witness GM, Shaldon LS, Grace GM, An overview of the natural gas sector in Tanzania – Achievements and challenges, Journal of Applied and Advanced Research, 2018: 3(4) 108−118

Wanzala, Maria, and Rob Groot. “Fertiliser Market Development in Sub-Saharan Africa.” International Fertiliser Society. Windsor, UK, 2013.

To all knowledge

To all knowledge