1 LNG Fundamentals

1.1 What is LNG?

The Liquid Natural Gas (LNG) industry started as a way to make use of natural gas in isolated areas and of natural gas associated with oil production that was being flared or reinjected into the earth. As such, LNG was redefined from merely a wasteful byproduct of oil production into a valuable raw material [1].

There are large quantities of natural gas in countries like Russia, Qatar, Iran, Algeria, Australia, and several other countries, where local demand or market prices are low. There are other regions and countries where there is a strong need for imported gas at an attractive market price, like Western Europe, Japan, Korea, or, until the development of unconventional gas, the U.S. In most cases, this need is driven by the rising demand for electricity.

The distance between these two types of countries is substantial, which makes delivery by pipelines too expensive. The alternative is to cool the product to -162°C (-259°F), the temperature at which methane becomes a liquid; in the process, the fluid reduces its volume by a factor of about 625 (Figure 1). The resulting LNG can then be transported in specially designed and insulated ships to a special-purpose receiving terminal in the market country. The charge is offloaded to insulated storage tanks and then transported by special tanker trucks to regional storage tanks or re-vaporised to methane gas and delivered into regional pipelines.

Figure 1. The natural gas to LNG volume ratio. Source: https://www.ihrdc.com/els/po-demo/module15/mod_015_02.htm

1.2 A question of scale

Liquefied natural gas is the transition fuel of choice for several sectors as the world moves towards net-zero emissions. Then, it is more than likely that smaller countries with isolated consumption centres or islands will adopt small-scale LNG (SSLNG) to cover their energy requirements.

So, what is the basic concept of small-scale LNG? LNG plants can be grouped into three types: base-load, peak-shaving, and small-scale plants [2].

- Base-load — These are large plants directly linked to a particular gas field development and serve to transport gas from the field. A base-load plant typically has a production capacity greater than 3 million tonnes per year (MTPA) of LNG. This type accounts for the bulk of global LNG capacity.

- Peak-shaving — Smaller plants connected to a gas network. Natural gas is liquefied and stored as a gas buffer throughout times of low gas. LNG is vaporised during short periods when gas demand is high. These plants have a limited liquefaction capacity (e.g., 300 tons/day) but a massive storage and vaporization capacity (e.g., 5,000-6,000 tons/day). Several peak-shaving plants exist in the U.S.

- Small-scale — Small-scale plants are connected to a gas network for steady LNG production on a smaller scale. It is delivered to different customers — with a minimum-to-moderate energy or fuel requirement — by trucks or small carriers. This type of plant typically has a production capacity greater than 500,000 tons per annum. There are several plants of this kind in operation in Norway and China.

Then, the small-scale LNG industry began to make use of natural gas resources in socially remote regions. Targeted deliveries by smaller, regasification-capable tankers could be combined with the economies of scale of large-volume LNG transportation over long distances (as in the Middle East to the United States). Their hybrid concept could be called a transfer platform, transhipment facility, or just a hub [3]. The concept has been ideal for smaller markets, especially on islands where pipeline networks from a central facility to a bunch of islands would be economically infeasible.

Large bulk carriers would unload liquid to storage tanks mounted on a far-offshore platform, then smaller “taxi tankers,” small-scale LNG tankers with onboard regasification, would load up at the platform for the relatively short run to multiple points of entry to consuming markets. This method would allow the smaller ships to drive around the “pipeline bottlenecks,” focusing their deliveries where those deliveries were needed physically, with minimal new onshore facilities being necessary.

1.3 The LNG value chain

Natural gas extraction and use was historically a very localised industry. The global LNG industry begins from a redefinition of nature and creating a new global commodity chain. Unlike oil, natural gas cannot be transported via tanker trucks or railroad cars. Natural gas transportation requires pipelines. Pipeline construction is, however, extremely costly and time-consuming.

The development of the global small-scale LNG industry has offered an opportunity to turn into a usable resource to justify the massive investment. A shorter pipeline to a coastal location where a liquefaction plant could be built to compress and load gas onto specialised LNG carriers would turn this waste product into a socially beneficial, saleable product [1].

Figure 2. The LNG value chain. Source: https://www.ihrdc.com/els/po-demo/module15/mod_015_02.htm

The range of activities involved in the liquified natural gas business is collectively referred to as the LNG Value Chain [4]. From production to market, the LNG value chain is a substantial integrated venture. All of its components must be aligned both legally and commercially for a viable project. Those components are shown in Figure 2.

LNG export facilities take natural gas by pipeline and liquefy the product for transport on specialised LNG ships or tankers. So-called LNG carriers transport most LNGs in large, onboard, super-cooled (cryogenic) tanks. LNG is also transported in smaller ISO-compliant containers placed on ships and trucks.

LNG is offloaded from ships at import terminals and may be stored in cryogenic storage tanks before it is regasified. The natural gas is then moved through pipelines to natural gas-fired power plants, industrial facilities, and residential and commercial customers.

The upstream segment of the chain involves gas exploration and production (E&P). The midstream segment comprises transportation via pipeline from the gas production facilities to the LNG plant for liquefaction. The “gas merchant” purchases gas from the E&P Company for supply to the plant. LNG produced is sent to storage tanks before being loaded onto LNG tankers for shipment to the marketplace. In the downstream segment, the “LNG marketer” purchases the LNG and ships it to an import terminal that regasifies the LNG into natural gas before sending it into the pipeline networks where it is ultimately marketed to downstream customers.

Figure 3. SSLNG Value Chain Integration with Standard LNG. Source: https://www.ufmgasplatform.org/wp-content/uploads/2020/07/UfM-SSLNG-Report-final-version_vsk.pdf

The SSLNG chain is identical to the standard LNG chain at a high level, with the main difference being at the distribution levels. SSLNG transportation is possible using small marine barges storing small quantities of fuel or with ferries carrying LNG trucks on land or trucks on the ground to carry the volumes instead of large LNG carriers in the case of standard LNG.

Liquefied natural gas, its associated infrastructure, and natural gas pipelines, in general, require very little labour after the construction phase is completed. Liquefaction plants, exporting-and-importing ports, and regasification facilities also require little labour once they are in operation [5].

The largest facilities usually liquefy natural gas drawn from the interstate pipeline grid, but many smaller facilities without liquefaction capabilities receive LNG by truck. Figure 4 shows an example of a “satellite” LNG storage tank and a photo of an LNG delivery truck serving these tanks. LNG trucks are of more robust construction than typical fuel trucks. LNG is notably extensively transported by trucks and barges in China, where pipeline networks are not well developed.

Figure 4. Example of a satellite LNG storage and LNG truck. Source: https://docplayer.net/docs-images/66/56234888/images/150-0.jpg

2 What is Behind the Surge in SSLNG?

2.1 The energy transition

Global emission cap stimulates the use of SSLNG. Liquefied natural gas (LNG) is a comparatively clean energy source that is cost-competitive with other fuels in distant markets. In recent years, LNG has emerged as a critical component in meeting the world’s expanding energy demands. It can be seen as the mechanism that can share the abundance of the cleanest, lowest carbon fossil fuel to the entire globe.

For instance, LNG is the transition fuel of choice for several big players in the marine industry as regulators and value chain stakeholders incentivise the move towards net-zero emissions. Global demand for marine LNG has led to generous disbursements in production, infrastructure, and distribution networks’ logistics, boosting LNG shipping demand.

Small-scale LNG tanks are essential in adding “peak-shaving” flexibility to natural gas pipeline grids. According to Shell, global LNG demand increased by 12.5% in 2019 and is projected to double by 2040, led by India, China, and Africa [6].

These areas are seeing a substantial change from conventional to renewable energy sources, as well as increased demand from the power generation, residential, commercial, and industrial sectors. In fact, China has adopted policies that will accelerate LNG imports into the country, enabling it to move away from coal and achieve its goal of being carbon neutral by 2060.

Small-scale LNG plants, as opposed to capital-intensive large-scale LNG plants, require less investment and provide immediate returns as production would start much sooner.

2.2 Small-scale LNG increases markets for natural gas

Where pipelines are not feasible or are absent, liquefying natural gas is a way to deliver natural gas from producing sites to markets, such as to and from the U.S and other countries — Asian countries combined account for the largest share of global LNG imports.

Besides, a traditional LNG plant costs around $1.5 billion per 1 million metric tons per annum capacity [7]; this is sometimes unaffordable for users due to LNG terminal charges coupled with transportation vessels’ cost. Small-scale tankers have a capacity in the range of 12,000-15,000 cubic meters and are ideal for waterways, ports, inter-islands, loading and receiving terminals. Furthermore, small-scale LNG allows for greater versatility in terms of plant size and operating capability, allowing plants to meet seasonal variations in demand.

In the U.S., some power plants make and store LNG onsite to generate electricity when its demand is high, such as during cold and hot weather or when pipeline delivery capacity is constrained or insufficient to meet increased demand for natural gas by other consumers. This process is called peak shaving. The power plants take natural gas from natural gas pipelines, liquefy it in small-scale liquefaction facilities, and store it in cryogenic tanks. The LNG is regasified and burned by the power plants when needed. Some ships, trucks, and buses have specially designed LNG tanks to use LNG as fuel.

A small, targeted LNG supply has a significant advantage compared with the large bulk LNG operations: it can focus deliveries to exactly match what a market needs when it needs it and allows the receiving market to avoid the cost and impact of an onshore regasification facility.

2.3 Emission reduction needs in the marine sector

The increasing international concerns over energy and environmental security have led to the emergence of policies from both gas importing and exporting nations, increasing the LNG trade in the coming years [8]. SSLNG finds niches primarily in road transportation, marine fuel, and off-grid power applications.

Due to the sharp increase in marine trade, a rise in air pollution from shipping has been witnessed. New environmental emission policies have led many regions to begin building up small-scale infrastructures. In October 2016, the International Maritime Organization (IMO) adopted stricter regulations on emissions, most prominently restrictions on sulfur oxide (SOx) emissions, which came into prominence in January 2020 [9]. The earlier limit of allowed sulfur content was no more than 3.50% m/m (mass of sulfur/total mass), and with the new 2020 regulations, ships must use the fuel oil with a sulfur content of no more than 0.50% m/m. This is one of the reasons that will lead to an increase in the business of SSLNG in the maritime industry. It provides a low cost and efficient solution to meet these emission cap targets.

IMO identified four emission control areas – the Baltic Sea area, the North Sea area, the North American area, and the U.S. Caribbean Sea area. Ship manufacturers around the world now need to adopt solutions to lower exhaust emissions and improve fuel efficiency. Marine vessels plying in emission control areas (ECA) are expected to adopt LNG as fuel in the coming years. As marine gas oil (MGO) prices are likely to increase when the demand rises after COVID-19 pandemics, LNG’s operational cost can be as much as 35% lower than MGO, making LNG a preferred solution to meet the sulfur emission norms.

Figure 5. Marine emission control areas. Source: https://upload.wikimedia.org/wikipedia/commons/3/35/Carte_des_zones_ECA_dans_le_monde.gif

3 The Current SSLNG Market

3.1 Market overview

The International Gas Union (IGU) defines small-scale projects as anything less than 0.5 MTPA for liquefaction, 1.0 MTPA for regasification, and 60,000 m3 for LNG vessels [10]. However, the typical range of SSLNG storage capacity is between 500 m³ and 5,000 m³. Other elements of SSLNG include LNG bunkering facilities for LNG-fueled vessels, LNG satellite stations, and infrastructure to supply LNG as fuel for road vehicles.

As stated before, SSLNG has gained attractiveness over the last few years due to the new environmental emission policies and the arbitrage in oil and gas prices. One of the challenges related to the SSLNG business is an expensive supply chain due to the diseconomy of the small-scale and the small size of the market.

The SSLNG industry continues to grow, primarily to serve end-users in remote areas or not connected to the main pipeline infrastructure and as a transportation fuel. The factors that drive the SSLNG market differ for every region. For example, in Scandinavia, the primary driver is environmental concerns. At the same time, for the United States, it is primarily economic concerns, and in the case of China, it is both economic and environmental concerns. In Latin America, the drivers include monetising stranded gas supplies and reaching remote consumers. Geopolitical tensions between countries also drive the governments to enter the SSLNG space, mainly to help customers become independent of pipeline gas suppliers.

The small-scale LNG market could register a compound annual growth rate (CAGR) greater than 21% over the forecast period 2020-2025 [11]. With multiplying pressure on large-scale plants to showcase returns to investors, operating companies are increasingly backing small-scale LNG projects. Compared to larger plants, which can take up to ten years to construct, a small-scale LNG plant with a size of less than one MTPA can be built in three years.

Factors, such as the early enjoy of profits, combined with rising LNG consumption as a primary energy fuel, are expected to push the SSLNG market in the coming years. Yet, factors such as lack of supporting infrastructure in some regions (e.g., Africa and the Middle-East) and high CAPEX requirement, along with a long payback period of more than 12 years, are expected to hinder the market

‘s growth.

Because of the enormous capital spending needed for a small-scale LNG infrastructure, the construction of cost-effective small-scale LNG networks is projected to create substantial opportunities in the future for technology suppliers and transporters. Europe dominates the global market, with most of the demand coming from countries such as Norway, Spain, and the United Kingdom.

3.2 Key market trends

Rising number of LNG-fueled fleet

LNG-based propulsion increases the ship’s operational efficiency and reduces carbon footprint significantly [12]. In 2018, the number of operating LNG-fuelled ships climbed to 121, while 51 ships were ordered. The number on request is expected to reach 126 by 2024, representing an increase of almost 147% compared to 2018’s level.

Additionally, to promote LNG fueled vehicles, various nations are providing grants and other financial aids. For instance, the Norwegian government’s NOx fund provides government financial support for the high maintenance costs incurred by businesses when investing in LNG-fueled ships. Other nations, including France, have pledged to explore similar economic benefits expected to rise LNG-fueled ships.

Therefore, the increasing demand from the maritime industry for LNG as a fuel source and different government initiatives worldwide to promote LNG fueled ships are expected to drive the small-scale LNG market over the next decade.

Europe and North America to Dominate the Market

Europe has long been a global leader in the development of small-scale LNG programs. The bulk of the world’s LNG supply locations are located in Europe. As of 2017, approximately three-quarters of the operational small-scale LNG infrastructures were in countries with large-scale regasification terminals, mainly in Western Europe [13].

Despite persistent low oil prices and market uncertainty, there has been a noticeable rise in small-scale LNG projects in the region. Stricter controls for the marine sector and huge subsidies on LNG use are propping the use of small-scale LNG as a bunker fuel across Europe. Spain, France, Italy, and the United Kingdom have been driving the growth in small-scale LNG infrastructure, increasing their operational facilities by 133% over 2016-2017.

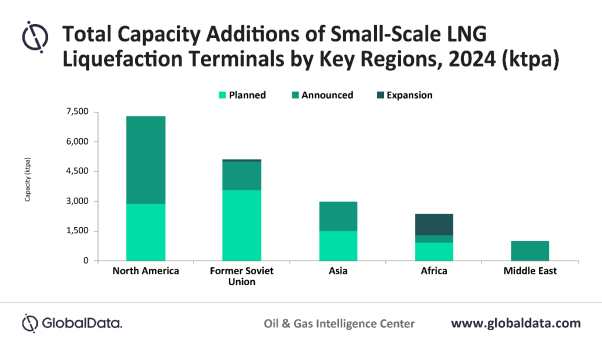

In terms of growth, North America is expected to witness the highest global capital expenditure and small-scale liquefaction capacity additions globally, expected to contribute around 37% of the global additions by 2024 [14].

Figure 6. Total small-scale LNG liquefaction capacity additions of kilo-tonnes per annum (ktpa) by 2024. Source: North America to lead global small-scale LNG liquefaction capacity additions through 2024, says GlobalData

Competitive Landscape

The small-scale LNG market is moderately concentrated. Some of the most influential small-scale LNG technology providers include the Linde Group, Baker Hughes Company, Wartsila Oyj Abp; small-scale LNG marine transporters include Evergas A/S, Anthony Veder Group NV, IM Skaugen SE; and small-scale LNG operators include Royal Dutch Shell PLC, Engie SA, Gazprom PAO, and Gasum Oy.

Suppliers of oilfield services, products, technology, and systems used in the oil and gas industry are entering (and often monopolising) the market. Other stakeholders provide products and services for other businesses, like downstream chemicals and processes and pipeline services. SSLNG companies offer products and services in the upstream, midstream, downstream, industrial, and digital sectors.

Their SSLNG segment provides equipment and related services for compression, mechanical drive, and power-generation applications across the oil and gas industry, as well as products and services to serve the downstream sector for the same. Their digital solutions often complement this offer, including the measurement and controls business for hardware technologies and software that leverage cloud services. This segment consists of condition monitoring, inspection technologies, measurement, sensing, and pipeline solutions.

Companies offer skid-mounted small-scale solutions, from design to engineering and manufacturing, to provide a cleaner, abundant fuel source. By delivering standardised plug-and-play designs and simplified plant control systems, they ensure faster plant commissioning times and reduced installation costs. Typical fully integrated, plug-and-play natural gas liquefaction plants produce between 25 and 1,200 k/gallons of LNG per day [15]. Such plants are designed for a variety of remote power, utility, and transportation applications.

3.3 Small-scale LNG in the world

The sheer scale of the LNG industry in material and investment terms is striking. The International Gas Union 2019 report [16] lists 89 LNG liquefaction plants, 125 regasification plants in importing countries, and 525 specialised and expensive LNG tankers (average newbuild prices for LNG carriers was approximately $183 million).

Specialists have identified three key trends that have cumulatively built the global LNG industry and the emerging global gas market: the growth of LNG trade, the shale boom, and the buildup of inter-connective gas infrastructure. Stakeholders in the energy sector transformed natural gas from a side product into LNG that could be transported thousands of miles to market, redefining the pipeline concept.

China’s rapid economic ascent in terms of sustained economic growth rates over the last three decades is well known. Coal was central to China’s rapid growth; its decrease came only after extensive efforts by the Chinese government to promote a wide range of other energy sources. For example, China’s natural gas extraction rose from 12.4 million metric tons of oil equivalent (MTOE) in 1980 to 138.9 million MTOE in 2018 [17]. However, consumption rose more rapidly than supply, from 12.4 million MTOE in 1980 to 243.3 million MTOE in 2018.

China’s rapid economic ascent has made imported fuels critical to its sustained growth. As a result, the Chinese state is supporting efforts to import LNG. Small-scale liquefaction plants have also emerged in Sichuan because of shale gas’s rapid development in the province [18]. Natural gas supplies via pipelines and LNG carriers are an equally important part of the Russia-China raw materials relationship.

3.4 LNG in the United States

As the latest large-scale LNG exporter, the United States joined the industry based on another redefinition of nature: natural gas extraction is now economically and technologically accessible in shale formations [1]. New drilling technologies and advancements in hydraulic fracturing have created natural gas reserves driving down prices with surplus production and provoking a quest at new opportunities via LNG exports. LNG is reshaping economies, communities, industries, and ecosystems in the U.S. and other parts of the world.

Hydraulic fracturing, also known as “fracking,” and new drilling technologies transformed shale into immense reserves of natural gas and oil that drove down prices with excess production and generated a search for new markets around the world via LNG processing. In short, the global LNG industry and particularly its emerging U.S. component are based on redefining nature via technology and investment in LNG and fracking.

Moreover, natural gas is still being wasted via flaring in areas where gas is associated with petroleum, particularly in North Dakota and West Texas, despite billions of dollars of investment in pipelines to carry the gas to market and LNG export facilities. The wasted gas could be valuable if there were adequate pipeline capacity to move it to processing plants or SSLNG export facilities.

The contribution of LNG exports to the U.S. trade balance rose from zero in 2013 to $212.8 million in 2014 and 5.63 billion dollars in 2018. Figure 7 shows the rapid growth of LNG exports since 2015.

Figure 7. Monthly liquified U.S. natural gas exports. Source: U.S. Energy Information Administration.

American natural gas production is expected to provide 50 per cent of the new global gas supply between 2019 and 2035, an estimated 380 billion cubic meters out of 635 billion cubic meters of projected new production per year; LNG demand is projected to increase 3.6 per cent per year over this same period [19]. The impact of fracked natural gas on the United States and the global economy is significant; the United States is now the world’s largest natural gas producer [20].

4 Market Segmentation

The small-scale LNG market can be segmented by mode of supply (truck, transhipment and bunkering, and pipeline and rail), by type (regasification terminal and liquefaction terminal), by application (transportation, industrial feedstock, power generation, and other applications), and by geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa.

The statements expressed herein are those relative to the mode of supply segmentation. Further detail about other segments should appear in future articles.

4.1 By mode of supply

Transhipment and bunkering

Transhipment and bunkering are expected to provide a significant impetus to the demand in the small-scale LNG market globally. It gains increased traction as a viable marine fuel ahead of tighter environmental rules for the shipping sector. Furthermore, as a sustainable alternative fuel for ships and long-haulage trucks, LNG has also emerged as an attractive fuel source for industries in areas not connected to the natural gas grid.

Strict norms to restrict the sulfur content produced by conventional fuels drive the demand for LNG bunkering infrastructure. The ships across various regions are gradually starting to adopt LNG as bunker fuel for propulsion.

Between 2015 and 2018, eight projects came online to supply LNG bunkering loading for vessels. However, most of the demand in the coming years for SSLNG-based transhipment and bunkering facilities is expected to come from China, where efforts point to getting clean fuels to fight the high air pollution levels in cities.

A shift to LNG for propulsion is considered more advantageous than the traditional method of fueling ships with marine gas oil, heavy fuel oil, and others. Similarly, LNG-based propulsion reduces the carbon footprint significantly and increases the ship’s operational efficiency.

LNG bunkering infrastructure is already being developed along major trade routes in ports, such as Zeebrugge, Rotterdam, and Singapore. These LNG bunkering ports are serviced with small-scale LNG bunker ships, like the 5,000 cm ENGIE Zeebrugge.

In a positive move for expanding LNG bunkering, the French shipping group, CMA CGM, ordered nine large-scale LNG-powered containerships in 2017, which will be the world’s largest, once built.

Figure 8. LNG bunkering operation in Szczecin, Poland. Source: https://www.offshore-energy.biz/pgnig-lotos-complete-first-lng-bunkering-in-szczecin/

Truck transport

Trucks can transport LNG to remote areas or areas not served by pipelines. Not only that, advances in technology that the boil-off gases are utilised to power the trucks along the journey has made this segment open to using LNG.

The SSLNG for transport solutions could be either truck trailers designed for cryogenic temperatures or trucks carrying ISO containers. Truck trailers used for LNG transportation are double-walled with internal containment in either stainless steel or aluminium and external walls of either carbon or stainless steel with vacuum isolation in between with multilayer super insulation. This system reduces the volume losses from heat transfer and usually may include pressure release valves in case of pressure buildup from boil-off gas. Modern trailers can store LNG for up to 45 days without having to resort to venting for pressure management.

Many examples of this transport system have been deployed in India, which has a robust LNG regasification infrastructure but had its gas usage constrained by lack of pipeline connectivity to industrial users in the hinterlands. Several local businesses have started delivering LNG to remote diesel-fired power plants and other industries on LNG trucks.

Pipeline and rail

LNG transportation by rail constitutes a challenging option to transport LNG. The fuel is transported in ISO containers by rail transportation combined with a truck option that allows rail, loading, unloading, and transport to end-users. Since LNG containers can be unloaded from trucks and placed on freight trains, assuming the railway infrastructure is already in place, the investments are minimal. On the other hand, trains are more efficient and cost-effective than trucks if the distance is more than 200-250 km since larger quantities can be transferred at once.

This is the case in Hokkaido, Japan, where Japex moves LNG from Tomakomai to Kushiro, approximately 280 km away. One freight train can accommodate up to 40 containers. Firstly, about 10 tons of LNG are transported to a railway station, where the charge is shifted to a train. Secondly, at a railroad station close to the destination, a satellite facility run by a local gas company, the containers are transferred back to trucks for the final leg of the journey.

5 What Challenges are There to Tackle?

5.1 Reduced energy economies

Stakeholders argue the world LNG market is shaky, with all of the disincentives created for expanded commerce in LNG. For a long time, it was thought that widely dispersed points of use, such as the Caribbean islands, would be fertile markets for floating regasification [3]. There was a great deal of oil-fired power generation, there was little ability to build pipelines between the islands, and the islands were close to the United States’ points of export and long-time exporters such as Trinidad.

There is indeed growth going on there, but a lot of the enthusiasm waned for simply replacing oil with LNG in existing power plants when the oil-gas price differential contracted. Similarly, the widespread islands of Indonesia have looked very attractive for floating regasification. In both cases, though, gas is best deployed using higher-efficiency technologies than simply burning it in existing boilers.

In other words, there is an increasing awareness that nothing should be assumed to be the way it used to be in today’s world. Importing fuel to supply an existing power generators’ infrastructure makes less sense than developing a complete answer of clean fuel supply. New power generation optimised to use that clean fuel supply and integrate the whole thing with growth in renewable sources. This challenge is especially true in emerging markets, where there are plenty of opportunities to build new generation capacity to supply the growing demand while fuel decisions are being implemented.

5.2 Safety

Liquified natural gas is natural gas cooled down to liquid form for ease of transport and storage under non-pressurised conditions. This is done because of the numerous hazards that could occur if kept under pressure in the gaseous state. The whole process from gas to liquid conversion and then transfer to storage areas is a complex process requiring close supervision [22].

The equipment used in such processes is complex and requires expert skill for seamless operation.

Standard LNG carriers can measure up to 300 meters, making structural condition and fatigue analysis key safety concerns for operators. Cargo containment, reliquification, and propulsion systems must meet high safety and reliability standards to transport LNG.

Safety and design experts have been working with manufacturers on the concept approval and certification of many innovative solutions, providing the sector with a thorough understanding of the critical issues to be addressed. Some advanced proprietary software help owners specifically manage to slosh risk by calculating the exact motion of liquid within tanks, improving safety and avoiding spillage.

Satellite LNG tanks are generally surrounded by containment impoundments that limit the spread of an LNG spill and the potential size of a vapour cloud [23]. The risk in land transport systems is highway collisions, truck rollover, spills upon loading the storage tanks, and storage tank leaks. The scale is smaller, but the event frequency is higher than for LNG import terminals and regasification systems.

6 Conclusion

Natural gas is a primary feedstock for industrial production and a flourishing energy source for power generation and residential heating. LNG offers a flexible means of transporting this energy source without the need for inter-regional pipeline infrastructure. Its impact on security and diversification of supply, flexibility, liquidity, prices, and competition and market integration can be significant.

Attention should be paid to the development of small-scale LNG that is flexible, has lower capital costs, and can service smaller markets. Transportation application is expected to boost the SSLNG market significantly because of the skyrocketing demand for LNG as a fuel source for heavy-duty trucks and ships. Despite the small-scale technology being a new concept in the market, several big companies have started to tap the market.

With LNG becoming increasingly cost-competitive, the push for cleaner fuel gathering pace, and energy companies’ desire to expand and diversify their businesses, global investors are becoming aware of small-scale LNG projects’ potential.

Therefore, some factors are expected to drive the small-scale LNG market over this decade: namely the increasing demand for LNG as a maritime fuel source, the IMO efforts to reduce the sulphur emissions, and more investments in gas infrastructure across the region. The small-scale LNG facilities should benefit from consuming considerably less time for construction than large-scale LNG facilities.

7 References

[1] Ciccantell, P. S. (2020). Liquefied Natural Gas: Redefining Nature, Restructuring Geopolitics, Returning to the Periphery?. American Journal of Economics and Sociology, 79(1), 265-300.

[2] Bahadori, A. (2014). Chapter 13–Liquefied Natural Gas (LNG). Natural Gas Processing, Gulf Professional Publishing, Boston, 591-632.

[3] Smead, R. G. (2016). Could Hub‐and‐Spoke Be the Future of LNG?. Natural Gas & Electricity, 33(2), 30-32.

[4] https://ntnuopen.ntnu.no/ntnu-xmlui/handle/11250/2593065

[5] Mokhatab, S., Mak, J. Y., Valappil, J. V., & Wood, D. A. (2013). Handbook of liquefied natural gas. Gulf Professional Publishing.

[6] https://www.gep.com/blog/mind/the-future-of-energy-transition

[8] https://unece.org/DAM/energy/se/pdfs/Booklet_Dec2015/Booklet_Gas_Dec.2015.pdf

[9] IMO 2020 – cutting sulphur oxide emissions.

[11] https://www.mordorintelligence.com/industry-reports/small-scale-lng-market

[12] Lindstad, E., Eskeland, G. S., Rialland, A., & Valland, A. (2020). Decarbonizing Maritime Transport: The Importance of Engine Technology and Regulations for LNG to Serve as a Transition Fuel. Sustainability, 12(21), 8793.

[13] GIE releases new small-scale LNG database

[15] Small- and medium-scale LNG terminals

[17] Full report – B.P. Statistical Review of World Energy 2019.

[18] https://www.apec.org/Publications/2019/09/Small-scale-LNG-in-Asia-Pacific

[19] Global gas & LNG outlook to 2035

[20] Kleinhenz and Associates. (2019). Natural Gas Savings to End-Users: 2008–2018 A Technical Briefing Paper. Allentown, PA: Kleinhenz and Associates.

[22] LNG Risk Based Safety: Modeling and Consequence Analysis, by John L. Woodward and Robin M. Pitblado. 2010, John Wiley & Sons, Inc.

[23] Gaul, D., & Young, L. W. (2003). US LNG markets and uses. U.S. Energy Information Administration, U.S. Department of Energy.

To all knowledge

To all knowledge