What Are Petrochemicals?

Petrochemicals, a specific type of industrial chemicals, are derived from petroleum resources like ethane, naphtha, and natural gas. These substances are crucial in producing a wide range of chemicals and materials (like plastics).

The consumption of plastics, synthetic fibers, rubber, fertilizers, and other industrial chemicals heavily influences petrochemical demand. Interestingly, petrochemical production is responsible for about two-thirds of the energy demand in the chemical sector. These versatile substances find their way into various consumer products, including plastics, fabrics, detergents, carpeting, pesticides, and food containers.

What are the Manufacturing Stages of Petrochemicals?

Feedstock

The Feedstock sector typically employs resources sourced from the petroleum sector, which encompass natural gas, condensates (a by-product of gas distillation), and naphtha (obtained through the distillation of crude oil). Naphtha, serving as a prevalent feedstock, is utilized in around half of the petrochemical production capacity, particularly in Asian and European facilities. On the other hand, gas takes precedence as the favored feedstock in North America and the Middle East due to the abundance of natural gas reserves in these regions. Furthermore, recent advancements in technology have paved the way for the utilization of organic materials like sugarcane, cassava, and palm as primary resources in the production of bioplastics. As a result, investments in these sectors are projected to increase in the future.

Upstream Petrochemical

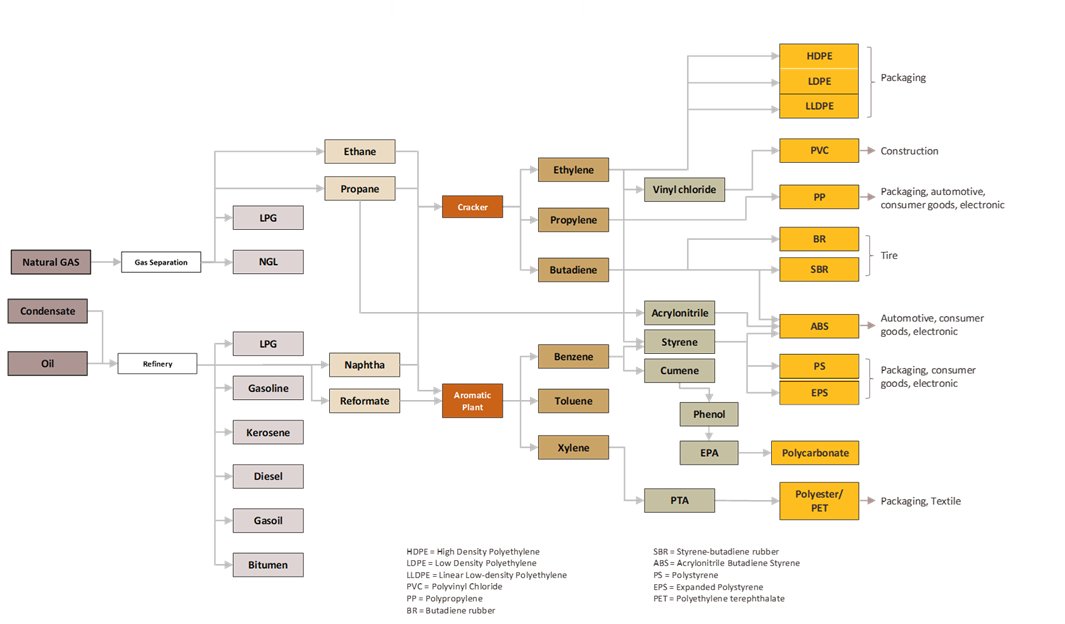

In the initial stages of the petrochemical industry, the feedstock is harnessed to generate initial petrochemical products, commonly referred to as precursors. These precursors can be categorized into two groups based on their molecular composition. Firstly, there are the olefins, encompassing methane, ethylene, propylene, and similar chemicals that possess a fundamental structure comprised of four carbon atoms, also known as “mixed C4” chemicals. Secondly, we have the aromatics, such as benzene, toluene, and xylene, which serve as inputs in the production of various other petrochemical products.

Intermediate Petrochemical

The intermediate phase of the petrochemical industry involves the utilization of upstream olefins and aromatics products, which are further processed or combined with other chemicals to different products/chemicals. Notable examples of such intermediate products include vinyl chloride and styrene. These intermediate products are then supplied to downstream industries for further utilization.

Downstream Petrochemical

The downstream petrochemical industries play a vital role in taking the upstream and intermediate goods and transforming them into finished products that find applications in related sectors. The products utilized by these downstream industries can be categorized into four distinct groups.

Plastic resin has emerged as a widely employed material across various downstream sectors, including packaging, construction materials, automotive parts, and consumer goods. Key plastic resins of significant importance encompass polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polystyrene (PS), and acrylonitrile butadiene styrene (ABS).

Secondly, synthetic fibers such as polyester and polyamide (nylon) predominantly cater to the needs of the packaging and textiles industries.

Thirdly, synthetic rubber or elastomers find their application in producing automotive components, consumer goods, and tires. Common examples include butadiene (BR) and styrene butadiene (SBR).

Lastly, synthetic coatings and adhesive materials which serve multiple industries, particularly the construction sector.

Overall, these downstream petrochemical industries transform raw materials into finished products that fulfill the diverse requirements of packaging, textiles, automotive manufacturing, construction, and other related industries.

Figure 1: Synthesis route of petrochemicals.

How Is Only Petrochemical Feedstocks Production Not Profitable for Refineries?

Petrochemical-integrated refineries go through different commercial and economic conditions. The decrease in feedstock transportation costs is an obvious benefit. As a result, although ownership differs, steam cracker locations are frequently found in the same industrial area as refinery sites. While allowing for possible integration in utility supply and logistical infrastructure, the integration of these assets into the portfolio of a single organization results in cost reductions for company expenses. Aligning energy supply and demand needs will maximize their complementary nature by balancing them.

Notably, low-value refinery output like naphtha holds immense value as a feedstock in petrochemical processes, particularly in steam cracking. Further, hydrogen, a steam cracking by-product, is essential to a refinery’s desulphurization units. The need for hydrogen to fulfill more strict regulations on the sulfur content of transportation fuels increases as the sulfur level of processed crude oil rises. Although refineries recover some hydrogen by naphtha reforming, it is frequently inadequate. Such situations need the purchase of hydrogen to fill the gap.

Refineries can further process other by-products of steam cracking, like pyrolysis gasoline, for use as gasoline additives. The range of economically feasible crude oil grades is further increased by integrating refinery-petrochemical processing, which allows more flexibility in choosing crude oil feedstock.

Figure 2: Current challenges for the petrochemical industry.

Petrochemicals Market Insights

The worldwide petrochemicals market had a value of USD 584.50 billion in 2022, and it is projected to grow at a compound annual growth rate (CAGR) of 7% from 2023 to 2030 [1].

The growth of the petrochemical market is driven by the increasing downstream product demand in industries like automotive, construction, and pharmaceuticals. Petrochemicals play a vital role in industrial processes and serve as the foundation of industrial economies. They are used to produce various products, including plastics, industrial oil, tires, detergents, etc. Petrochemicals based plastics are the fundamental component in consumer goods manufacturing.

Ethylene holds the largest market share, accounting for 40.7% of revenue in 2022 [1]. The construction, packaging, and transportation industries drive the demand for ethylene. Emerging economies like India, Brazil, Vietnam, and Thailand are experiencing ongoing industrialization and a flourishing automotive and packaging sector, leading to increased consumption of ethylene in these countries. The use of polyethylene is also expected to contribute to the overall growth of the petrochemical market.

The methanol segment growth is projected to a CAGR of 8.8% [1]. Methanol serves as a feedstock for producing acetic acid and formaldehyde, both of which are utilized in foams, adhesives, plywood subfloors, and windshield washer fluids. The extensive use of methanol in end-use industries such as construction, paints and adhesives, pharmaceuticals, polymers, and automotive is anticipated to increase methanol’s demand.

Butadiene is the second-largest product segment. It is primarily used as a monomer in the production of rubbers such as Polybutadiene Rubber (PBR), Styrene-Butadiene Rubber (SBR), Nitrile Rubber (NR) and Polychloroprene (PCR). The market for butadiene derivatives has significantly increased, especially in China, India, and other Asian countries.

Figure 3: Stages in the production of petrochemicals and associated end-users.

What are the Regional Insights of the Petrochemicals Market?

The consumption trends of significant petrochemicals and fertilizers vary across regions based on their wealth, as measured by GDP per capita. As income per capita increases, the consumption of these products generally rises. However, the demand for certain products can reach saturation in regions with a high per capita income.

Regarding plastic usage, clear indications of saturation are less evident, and consumption levels are even broader compared to fertilizers. Based on the limited available data, developing regions currently have relatively low consumption levels of key plastic resins, as little as 4 kg per capita. Nevertheless, these regions are experiencing high growth rates, reaching double digits. The average consumption in developed countries is between 55 and 80 kg per capita, with many developed economies reaching an endpoint at approximately 60 kg per capita.

Asia Pacific

The Asia Pacific region emerged as the dominant player in the market, capturing a market share of 49.1% in 2022 [1]. This share can be attributed to the thriving chemicals industry and the increasing consumption of polymers. Companies in the region are actively shifting their focus towards natural gas liquids and other non-oil feedstocks to meet the growing demand for petrochemical products. Moreover, they are devising cost-effective strategies to enhance product sales.

The rapid economic growth observed in emerging economies like China, India, and other Asian countries has led to a surge in demand for various petrochemical products, including plastics, fertilizers, electronic devices, clothing, medical equipment, tires, detergents, etc. As a major player in the region, China has been making significant investments in transitioning to alternative feedstocks like naphtha and natural gas for petrochemical production, moving away from coal-to-chemical manufacturing methods used to supply raw materials to its extensive domestic industrial base. The demand for consumer products is anticipated to increase as the purchasing power of the population rises.

North American

The petrochemical industry in North America is anticipated to grow, fueled by the increasing exploration activities in shale gas in the United States and Canada. The escalating shale gas production in these countries presents an opportunity to substitute traditional feedstocks with shale gas in manufacturing various petrochemical products.

The past ten years have witnessed remarkable technological progress, especially in hydraulic fracturing, which has greatly boosted the upstream petroleum industry in the region. This has led to a substantial increase in oil and gas production, surpassing the local demand for fuel. As a result, investors are expected to focus on endeavors that create additional value and establish new production facilities.

Europe

Europe is expected to experience a CAGR of 6.4% during the forecast period [1]. This growth can be attributed to the ongoing recovery of the overall manufacturing sector in Europe following the global pandemic and the expansion of oil and gas capacity in the region, which is anticipated to drive the industry’s progress. However, Western Europe is projected to witness limited growth due to market saturation. Nevertheless, countries like Germany, France, and the U.K. are witnessing increased ethylene production, leading to a surge in demand for petrochemicals from manufacturers to produce various industrial chemicals.

In recent years, there have been enormous structural shifts in and threats to the European market. The rising cost of energy and feedstock and increased international competitiveness are two major challenges. Health safety and environmental rules, climate change rules, and energy policies all apply in the petrochemical industry in the EU. With fewer investments in new facilities, the EU has seen a drop in its share of worldwide petrochemical output. However, many EU member countries are investing in shifting to environmentally friendly chemical processes.

African Markets

African markets are likely to grow slowly due to underdeveloped sectors.

Middle East

The Middle East market is expected to grow in the predicted period as a result of increased investments in the development of local petrochemical facilities. Middle East countries rich in crude oil recognize this opportunity and are making substantial investments to expand their domestic petrochemical capabilities, taking advantage of the abundant and economical oil and gas resources. This proactive approach will likely positively impact and stimulate market growth.

What are the Driving Factors behind Petrochemicals Growth?

Petrochemicals play a crucial role in producing various plastics. The demand for these plastics has significantly increased in recent decades, particularly in key industries and commercial products. This upward trend is expected to continue in developing regions like Asia and Africa. Finding cost-effective and environmentally favorable alternatives to petrochemical-based plastics to meet the rising global demand remains difficult despite ongoing efforts to encourage recycling and reduce single-use plastics utilization.

International Energy Agency (IEA) said that established economies like the U.S. and Europe consume around 20 times more plastic per capita compared to developing, presenting a vast potential for market expansion. Plastics contribute to extending the food shelf life, reducing food waste, and optimizing fuel consumption during transportation due to their lightweight nature. They provide immediate economic advantages and help optimize resources, which is crucial for the growth of emerging economies. With the increasing purchasing power of a significant population segment in developing nations, the demand for consumer products is expected to rise, leading to higher consumption of plastics and driving market growth.

What Factors are Hindering Petrochemicals Market Growth and Pushing to Seek Alternatives?

The market growth may be restricted due to increasing concerns about health and the environmental hazards of petrochemicals. With the availability of information, there is a growing number of environmentally conscious consumers worldwide, which is driving industries to offer more environmentally friendly products. For instance, petrochemicals like benzene threaten the environment and have also been identified as carcinogenic to humans by the International Agency for Research on Cancer (IARC). Short-term contact with these substances can cause eye and skin irritation, while long-term exposure can cause significant health problems such as anemia, impaired immunity, and cancer.

Plastic waste is currently a major global crisis, with its accumulation in the oceans at an alarming rate, affecting nearly every corner of the planet. The breakdown of plastics into microplastics has substantial environmental issues. Microplastics cause ocean contamination and are ingested by marine organisms, hence entering the food chain. Governments, international organizations, and the commercial sector are working together to define standards and methods for measuring these materials’ impact on the environment throughout their life cycles. This will lead to strict regulations focused on health and the environment, restricting the use of hazardous products and consequently hindering the market growth.

While petroleum-based plastics like PET and HDPE are non-biodegradable, they can be widely recycled. However, plastics with complex compositions, multiple layers, or additives pose effective separation and recycling challenges. As a result, recycling rates are lower, and there is a higher likelihood of these plastics ending up in landfills or incineration facilities.

These challenges have prompted countries, authorities, and industries to actively seek suitable alternatives and develop sustainable and environmentally friendly processes and products.

Where are Petrochemicals being used Majorly?

Petrochemicals are used in a wide range of applications. Here are some of the major areas where petrochemicals are extensively utilized:

Plastics and Packaging

Petrochemicals, particularly plastics, are extensively used in packaging materials due to their versatility, durability, and cost-effectiveness. Polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) are commonly used to produce various packaging items, including plastic films, bottles, containers, bags, and wraps. These materials provide excellent barrier properties, protecting goods from moisture, air, and contaminants. Plastic packaging also offers lightweight and shatter-resistant alternatives to traditional packaging materials like glass and metal.

Textiles and Clothing

Petrochemical-based synthetic fibers revolutionized the textile industry. Polyester, made from petroleum-derived ethylene glycol and terephthalic acid polymerization, is widely used in clothing, home textiles, and upholstery. It is highly versatile, offering strength, wrinkle resistance, quick drying, and easy care. Nylon, another synthetic fiber derived from petrochemicals, is known for its durability and elasticity and finds applications in activewear, hosiery, and other performance-oriented textiles. Acrylic fibers are used for their softness, warmth, and color-fastness in products like blankets, sweaters, etc.

Agriculture and Farming

Petrochemicals are utilized in the agricultural sector to improve agricultural productivity. Fertilizers, such as nitrogen-based urea and phosphate-based compounds, are derived from petrochemicals. These fertilizers provide essential nutrients to plants, enhancing their growth and yield. Petrochemical-based pesticides and herbicides help control pests, diseases, and weed growth, ensuring healthier crops and higher agricultural productivity.

Building and Construction

Petrochemicals find widespread use in the building and construction industry. Plastics, resins, adhesives, and coatings derived from petrochemicals are used to produce pipes, insulation materials, paints, sealants, flooring, roofing, and other construction components. These materials offer durability, weather resistance, thermal insulation, and ease of installation. Petrochemical-based products also contribute to energy efficiency in buildings by providing insulation and reducing heat transfer.

Automotive and Transportation

Petrochemicals are essential in the automotive and transportation sectors. Plastics, synthetic rubber, adhesives, lubricants, and fuel additives derived from petrochemicals are used to manufacture and maintain vehicle components. They contribute to automotive components’ lightweight, fuel efficiency, durability, and performance. Petrochemical-based materials also find applications in tires, hoses, gaskets, paints, coatings, and adhesives, enhancing safety and performance.

Consumer Goods

Petrochemicals are integral to the production of a wide range of consumer goods. Plastics, resins, and coatings derived from petrochemicals are used to manufacture toys, kitchenware, household appliances, electronics, furniture, sports equipment, and other consumer products. These materials provide desirable properties such as strength, lightweight, impact resistance, and aesthetic appeal.

Personal Care and Cosmetics

Petrochemicals play a crucial role in the personal care and cosmetics industry. They are used to produce various ingredients and formulations for skincare products, hair care products, makeup, toiletries, and fragrances. Petrochemical-derived compounds such as mineral oil, petroleum jelly, fatty acids, and alcohol serve as moisturizers, solvents, and active ingredients in these products.

Healthcare and Pharmaceuticals

Petrochemicals are utilized to manufacture medical equipment and devices essential for diagnostics, treatment, and patient care. Plastics derived from petrochemicals are widely employed in medical equipment due to their favorable properties, including biocompatibility, stabilizability, durability, and ease of molding.

Further, petrochemicals play a crucial role in the pharmaceutical industry, serving as the foundation for many life-saving medications. Petrochemical derivatives produce a wide range of active pharmaceutical ingredients (APIs).

How to be Petrochemicals Used More Effectively?

Several strategies have been proposed to use petrochemicals more effectively. Here are some ways to enhance the efficient use of petrochemicals:

Process Optimization

Petrochemical manufacturing processes can be optimized to minimize waste and maximize yield. This involves improving reaction efficiency, reducing energy consumption, and optimizing the use of catalysts and raw materials. Process integration and advanced control systems can also help enhance efficiency.

Energy Efficiency

Reducing energy consumption in petrochemical production processes can significantly improve overall efficiency. Implementing energy-efficient technologies, such as heat recovery systems, optimizing equipment performance, and utilizing renewable energy sources, can help minimize energy consumption and greenhouse gas emissions.

Product Design and Innovation

Rethinking product design to promote durability and recyclability and using renewable or biodegradable materials can help reduce the reliance on petrochemical-based products. Encouraging research and development of alternative materials and technologies can drive innovation and the development of more sustainable options.

Reduce, Re-Use and Recycling

By-products and waste materials from petrochemicals have the potential to be re-used or recycled in different ways. Implementing efficient recycling initiatives can decrease the demand for new petrochemical resources and mitigate the environmental consequences. This involves recycling plastic materials and utilizing waste heat or by-product gases for energy generation or other beneficial uses.

Collaboration and Knowledge Sharing

Encouraging collaboration between industry stakeholders, governments, and research institutions can facilitate sharing of best practices, technological advancements, and research findings. This collaborative approach can lead to the development and adoption more efficient and sustainable petrochemical production and utilization methods.

Regulatory Measures and Incentives

Governments can play a crucial role in promoting the effective use of petrochemicals by implementing regulations, standards, and incentives. These can include carbon pricing, emissions regulations, and tax incentives for companies that invest in sustainable practices and technologies.

By implementing these strategies and adopting a holistic approach, the effective use of petrochemicals can be enhanced, leading to improved resource efficiency, reduced environmental impact, and the development of a more sustainable petrochemical industry.

Plastic Recycling and Associate Challenges

Plastic recycling is the process of converting used or waste plastic materials into new products or chemicals. It involves collecting, sorting, cleaning, and processing plastic waste to create recycled materials/chemicals that can be used as feedstock to produce new products. Plastic recycling can be divided into mechanical and chemical recycling based on the processing and feedstock involved.

Plastic Mechanical Recycling

Most thermoplastic materials that have reached the end of their useful life can undergo mechanical recycling with minimal deterioration in quality, depending on the chosen approach. To enable recycling, plastics need to be separated based on their specific material composition. This separation can be carried out manually, requiring significant labor, or through automated methods such as float-sink, near-infrared, or marking systems. Many plastic products are conveniently labeled with recyclable codes, simplifying the sorting process.

Figure 4: Stages in plastics mechanical recycling.

The quality of recycled materials is dependent on the quality of the plastic waste stream. Plastics undergo physical and chemical transformations throughout their lifespan and during the processing and recycling stages. Oxidative reactions occur in polymers, leading to thermal and photo-degradation of the recycled material. The formation of oxidative components depletes polymer stabilizers, reducing long-term stability and mechanical properties. Assessing the degree of degradation in waste plastics is crucial as it impacts the performance, stability, and mechanical properties of recycled products.

Regarding waste stream composition, a clean stream consisting of single-type thermoplastics is ideal for mechanical recycling. However, mixed plastic waste streams with contamination pose challenges as they require additional steps for washing and separation to remove impurities. Mechanical recycling is generally cost-effective but has its limitations. Profitability and economic viability depend on the material being recycled and the level of contamination in the waste stream.

Other factors influencing overall costs include collection and transportation fees, process efficiency, and material type. While cost efficiency is achievable, the quality of the obtained material may have limitations if additional techniques are not employed. Purity and material type play a significant role in cost efficiency.

The other key challenges are:

- Mixed and contaminated plastic waste streams make sorting and recycling problematic.

- The burden of contamination in recovered material increases with different grades of the same plastic.

- Sorting and separating items with several layers is challenging

- Lack of consistent availability of feedstock.

Plastic Chemical Recycling

Chemical recycling processes may disassemble polymers into their component and turn them into useful secondary raw resources. The production of new chemicals and polymers is then possible with these components. Several chemical recycling methods process plastic waste using one of three recycling pathways:

- Dissolution: recovering plastic

- Depolymerization: reducing it to its constituent parts

- Conversion: transforming it into raw materials

Figure 5: Life cycle analysis of plastic incorporating recycling approaches.

Chemical recycling can process a broader range of plastic waste compared to traditional mechanical recycling. It can handle mixed plastics, multi-layered packaging, and even contaminated or difficult-to-recycle plastics that would otherwise be sent to landfills or incinerated.

Chemical recycling enables the recycling of low-value plastics that may not be economically viable for mechanical recycling. These include certain types of flexible packaging, plastic films, and lower-grade plastics that have limited end-market demand.

Chemical recycling allows to divert significant amounts of plastic waste from landfills and incineration facilities. It offers an alternative solution for plastics that are difficult to recycle through traditional methods, thus contributing to waste reduction and landfill space preservation.

While chemical recycling holds promise, it is still a developing technology with certain major challenges mentioned here:

- Chemical plastic recycling processes are often more complex and resource-intensive than mechanical recycling. The process can result in higher operational costs, making chemical recycling less economically viable in some cases.

- Chemical recycling processes generally require significant energy inputs to convert plastic waste into useful products.

- Certain chemical recycling processes have limitations regarding the types of plastic waste they can effectively handle. Some processes may be more suitable for specific types of plastics, while others may not be able to process certain plastic compositions or additives.

- Establishing consistent regulatory frameworks and quality standards for chemical recycling technologies is still developing.

What are the General Challenges of Plastic Recycling?

One of the primary challenges is ensuring a consistent and sufficient supply of plastic waste for recycling. The availability and quality of plastic waste can vary depending on factors such as collection systems, consumer behavior, and waste management practices. An inadequate feedstock supply can limit the viability and scalability of recycling operations.

With each recycling cycle, the quality of the plastic can degrade. Mechanically recycled plastics may undergo a loss of physical and mechanical properties, limiting their re-use in high-value applications. The downcycling of plastic can result in lower-value products, reducing the economic viability of recycling.

The economic viability of plastic recycling is critical for its widespread adoption. The costs associated with collecting, sorting, cleaning, and processing plastic waste can be substantial. Fluctuating market prices for recycled plastics and competition from low-cost virgin plastics can make recycling financially challenging.

What is the difference between Bio-Based, Biodegradable, and Compostable Plastics?

The terms “biodegradable” plastics and “bio-based” plastics are often considered interchangeable due to their shared “bio” prefix. However, it’s important to note that they have distinct characteristics. Bio-based plastics are derived from biomass sources, whereas biodegradable plastics are not necessarily derived from biomass feedstock but they are degradable in the environment in a specified time.

Biodegradability refers to the ability of a material to naturally break down into the water, carbon dioxide, and other unharmful substances in a specified time. This decomposition process is facilitated by microorganisms, which become active under specific light, temperature, and humidity conditions. Many biodegradable plastics are still derived from conventional petrochemicals, although some additives may be incorporated to enhance their biodegradable properties.

Figure 6: Plastics based on the origin and biodegradability.

Biodegradable plastics should not be confused with compostable plastics, as they possess different characteristics. While biodegradability is just one aspect, compostability requires additional properties. For a material to be considered compostable, its degradation rate should align with that of recognized compostable materials like cellulose, and the process must not generate any harmful residues. In the EU, a material is deemed compostable only if more than 90% of the original substance can undergo biological breakdown within six months.

The environmental benefits of biodegradable plastics are still under debate due to inadequate environmental conditions as needed. Even under favorable circumstances, it can take years for these materials to break down. Since biodegradable plastics are not recyclable, their inclusion in recycling bins can compromise the quality of collected recyclables, thus impeding the recycling processes’ efficiency.

Moreover, these plastics can give a false perception that discarding them is not harmful. It could be argued that the biodegradable nature accelerates the release of carbon contained in the material. However, the biodegradation process does not offset the harm caused by insufficient plastic waste management.

284

Figure 7: An approach for circular and bio economy [2].

Possible Alternative Feedstock of Petrochemicals to Produce Similar End Products?

Biomass, agricultural waste, or plant-based materials are renewable resources that may be used as feedstocks. Plastics from petrochemicals might be replaced by bio-based polymers made from sugarcane, maize, or cellulose.

Currently, three different types of generating feedstocks are used in manufacturing bioplastics.

First Generation Bio Feedstocks

The first generation of feedstocks primarily relies on food plants with high carbohydrate content, such as sugarcane, sugar beet, corn, potato, and oily seeds. The sourcing of raw materials for these feedstocks has garnered attention and controversy due to the utilization of edible food crops and the need for land cultivation. Concerns regarding these practices’ environmental impact and sustainability have been raised, including land requirements, water usage, fertilizers, and pesticides in crop production. However, multiple studies have indicated that bioplastic production’s overall environmental and energy impacts are considerably lower than petrochemical plastics production [3].

Second-Generation Bio Feedstocks

The lignocellulose-rich raw materials used to make the second-generation feedstocks include wood as well as non-edible agricultural waste and crop by-products including wheat straw, maize stover, bagasse, and other organic waste [4].

Third-Generation Bio Feedstocks

Algae and commercial and municipal waste are used as feedstocks for third-generation bioplastics [5]. Although studies have shown that converting lignocellulose to building block monomers requires more energy and longer steps than first-generation feedstocks, the second and third generations of biomass are thought to be more environmentally friendly than the first.

Bioplastics have various qualities depending on the biomass sources utilized for polymerization [6]. For instance, bio-based succinic acid is utilized in sportswear, automotive, agricultural, and textile applications, whereas bio-based PLA, bio-PET, bio-PE, and starch blends are mostly employed for packaging applications [7].

Algae, as well as municipal and industrial waste, serve as the feedstock for third-generation bioplastics. Compared to the components used in first-generation feedstocks, these materials are considered more environmentally friendly. However, according to some research, the lignocellulose to building block monomer conversion methods for second and third-generation feedstocks require a lot more energy and stages than the processes utilized for first-generation feedstocks [8].

What are the Production Routes of Bioplastics?

The three primary groups that make up the production processes for bioplastics are as follows:

- A thermochemical and catalytic process in which the first stage involves converting biomass feedstocks into monomers and the second phase involves polymerization.

- A fermentation procedure in which the biomass feedstocks are first fermented into monomers and then into polymers in a subsequent phase.

- Altering naturally existing polymers without altering their fundamental properties.

Insights of Sustainable Feedstocks and Bioplastics

In order to transition to a circular and bio-economy system for plastic production, it is necessary to rethink the entire value chain of plastics, moving away from the current linear economy approach. Bio-based plastics have the potential to play a significant role in decoupling from fossil fuel feedstocks. Biomass serves as a sustainable feedstock not only for plastics but also for biofuels and chemicals. Bioplastics currently holds a small market share (1%), providing substantial opportunities for innovation and developing bioplastic building blocks from complex biomass sources [9].

The source of biomass feedstocks and the lack of a well-developed recycling and end-of-life management infrastructure are two additional difficulties in producing bioplastics. Focusing on recyclability and resource recovery from end-of-life goods is essential for a sustainable bioplastic system. Approximately 2.05 million tons of bioplastics were produced globally in 201; 54% were biodegradable and the remaining 26% were not [10].

Biodegradable plastics primarily consist of starch and various aliphatic polyesters, with polylactic acid (PLA) being the most widely used and commercially developed polymer. Biodegradable plastics like PLA do not possess thermal, mechanical, and rheological properties like fossil-based plastics. Copolymerization or blending with additives is often necessary to achieve the desired properties, considering the limited compatibility and current recycling systems [11].

In recent years, bio-based polymers have gained attention as renewable alternatives to fossil-based feedstocks for conventional plastics. These bio-based monomers can produce final products that exhibit similar performance and applications to conventional plastics. Efforts are being made to improve other bio-based monomers’ quality, such as propylene, acrylic acid, styrene, terephthalic acid, etc. which are widely used in plastics.

The scope of bio-based plastics extends beyond fossil-based alternatives, encompassing novel structures derived from renewable sources. Examples include furan-based monomers, isosorbide, and 2,5-furan dicarboxylic acid (FDCA). In contrast to traditional polyethylene terephthalate (PET), which uses purified terephthalic acid (PTA) as a building block, polyethylene furanoate (PEF), a fully bio-based plastic, utilizes FDCA, which is obtained from the dehydration of C6-sugar oxidized by 5-hydroxymethylfurfural (5-HMF). PEF has excellent thermal and superior barrier properties. PEF is thought to be the best replacement for present day packaging polymers [12]. Additionally, value-added sectors like medicine and cosmetics use bioplastics.

Life cycle analysis studies have demonstrated the advantages of bio-based plastics in terms of energy savings and reduction of greenhouse gas (GHG) emissions compared to fossil-based plastics. For instance, a comparable LCA study between PEF and PET reported approximately 40-50% savings in nonrenewable energy use and a 50% reduction in GHG emissions [13]. Furthermore, research on the GHG emissions from bio-based products, such as biofuels and bioplastics, shows that overall emissions can be reduced in comparison to those from petrochemical products by utilizing the atmospheric CO2 sequestration during photosynthesis during plant growth [14].

Conclusion

As the world moves towards a more sustainable and environmentally friendly future, there is growing concern about the role of petrochemicals in our economy. Petrochemicals are widely used to produce various products, including plastics, rubber, and chemicals. However, their production and use significantly negatively affect the environment and society, such as air pollution, greenhouse gas emissions, and plastic waste.

The demand for petrochemicals is projected to continue rising in the coming years due to population growth, urbanization, and improved living standards in developing nations. According to the International Energy Agency (IEA), petrochemical demand is expected to increase by 40% by 2030 and nearly double by 2050. This growth poses a significant challenge in transitioning towards a more sustainable future, as petrochemicals contribute significantly to greenhouse gas emissions and environmental pollution.

Several potential solutions can help mitigate the environmental impact of petrochemicals in a green future. One approach is to enhance the efficiency of petrochemical production, reducing energy consumption and associated emissions. Advanced technologies like process optimization, waste heat recovery, and carbon capture and storage can contribute to achieving this goal.

Another solution lies in developing alternative and more sustainable feedstocks for petrochemical production. Bio-based feedstocks, such as plant-derived sugars and waste biomass, offer renewable chemical and plastics manufacturing sources. By utilizing these feedstocks, the environmental impact of petrochemicals can be reduced by decreasing greenhouse gas emissions and reliance on fossil fuels.

Furthermore, improving end-of-life management for petrochemical products presents significant opportunities to reduce environmental impact. This involves increasing recycling and re-using of plastic products and developing biodegradable and compostable plastics that readily break down in the environment.

An effective strategy to enhance the sustainability of petrochemicals is the implementation of a circular economy for plastics. This approach aims to keep materials in use for as long as possible through recycling and repurposing rather than disposing of them. Additionally, designing products with easy disassembly and recyclability in mind contributes to the circular economy concept. Moreover, it brings economic benefits such as job creation, reduced dependence on fossil fuels, and increased competitiveness in the global market.

In conclusion, the future of petrochemicals in a green and sustainable domain is a complex and multifaceted issue. While the demand for petrochemicals is expected to grow, there are several potential solutions to mitigate their environmental impact throughout the production and usage cycle. Improving efficiency, exploring alternative feedstocks, and embracing a circular economy approach can pave the way for a greener and more sustainable petrochemical industry.

Endnotes

[1] Petrochemicals Market Size, Share & Trends Analysis Report. (2023). G. V. Research. https://www.grandviewresearch.com/industry-analysis/petrochemical-market

[2] Carus, M. (2017). Biobased economy and climate change—important links, pitfalls, and opportunities. Industrial Biotechnology, 13(2), 41-51.

[3] Singh, N., Ogunseitan, O. A., Wong, M. H., and Tang, Y. (2022). Sustainable materials alternative to petrochemical plastics pollution: A review analysis. Sustainable horizons, 2, 100016.

[4] Brodin, M., Vallejos, M., Opedal, M. T., Area, M. C., and Chinga-Carrasco, G. (2017). Lignocellulosics as sustainable resources for production of bioplastics–A review. Journal of Cleaner Production, 162, 646-664.

[5] Rahman, A., and Miller, C. (2017). Microalgae as a source of bioplastics. In Algal green chemistry (pp. 121-138). Elsevier.

[6] Nandakumar, A., Chuah, J.-A., and Sudesh, K. (2021). Bioplastics: a boon or bane? Renewable and Sustainable Energy Reviews, 147, 111237.

[7] Dietrich, K., Dumont, M.-J., Del Rio, L. F., and Orsat, V. (2017). Producing PHAs in the bioeconomy—Towards a sustainable bioplastic. Sustainable production and consumption, 9, 58-70.

[8] Singhvi, M. S., and Gokhale, D. V. (2019). Lignocellulosic biomass: hurdles and challenges in its valorization. Applied microbiology and biotechnology, 103, 9305-9320.

[9] Singh, R. (2020). The new normal for bioplastics amid the COVID-19 pandemic. Industrial Biotechnology, 16(4), 215-217.

[10] Facts and Statistics – IfBB – Institute for bioplastics and biocomposites. (2023). IfBB. https://www.ifbb-hannover.de/en/facts-and-statistics.html

[11] Hatti-Kaul, R., Nilsson, L. J., Zhang, B., Rehnberg, N., and Lundmark, S. (2020). Designing biobased recyclable polymers for plastics. Trends in biotechnology, 38(1), 50-67.

[12] Hwang, K.-R., Jeon, W., Lee, S. Y., Kim, M.-S., and Park, Y.-K. (2020). Sustainable bioplastics: Recent progress in the production of bio-building blocks for the bio-based next-generation polymer PEF. Chemical engineering journal, 390, 124636.

[13] Eerhart, A., Faaij, A., and Patel, M. (2012). Replacing fossil based PET with biobased PEF; process analysis, energy and GHG balance. Energy & environmental science, 5(4), 6407-6422.

[14] Escobar, N., and Laibach, N. (2021). Sustainability check for bio-based technologies: A review of process-based and life cycle approaches. Renewable and Sustainable Energy Reviews, 135, 110213.

To all knowledge

To all knowledge