1 Background

1.1 Energy Sector in the Caribbean

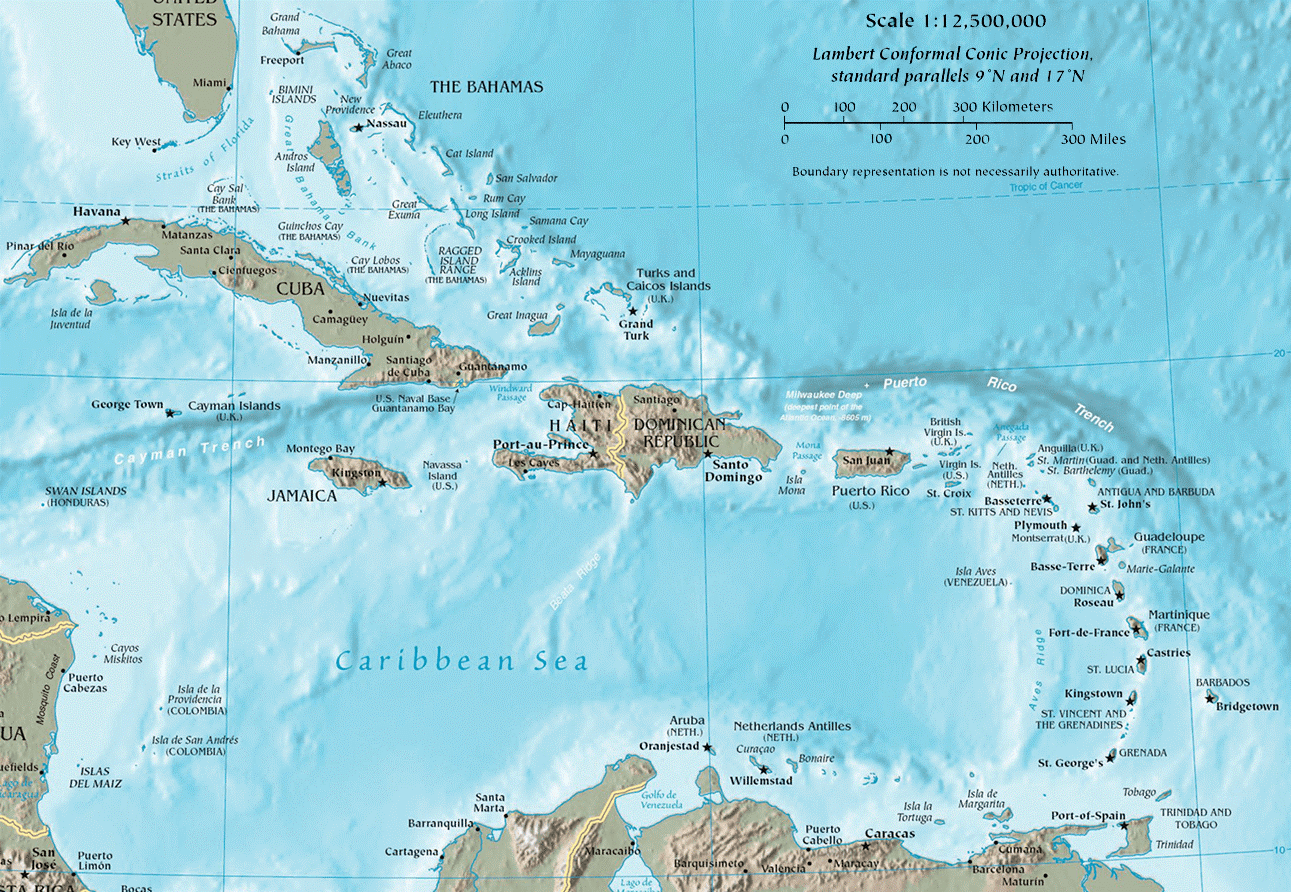

The Caribbean is a vast region ranging from the southern coast of the United States to the northern coast of South America, bounded to the west by Mexico and the Central American States and facing the Atlantic to the east. From this article’s point of view, we define the concept of “the Caribbean”, setting the boundary around the islands and thus, excluding the surrounding coasts.

Therefore, the selected countries and islands for this article include Aruba, The Bahamas, Barbados, Cayman Islands (U.K.), Cuba, Curaçao (Netherlands), Dominican Republic, Haiti, Jamaica, the Organisation of Eastern Caribbean States—OECS (Antigua and Barbuda, Dominica, Grenada, Saint Lucia, Saint Kitts and Nevis, Saint Vincent and the Grenadines), Sint Maarten, Trinidad and Tobago, and Turks and Caicos. Gross Domestic Product (GDP) per capita varies from around US$1,200 to over USD 30,000; some countries rely on commodity exports, while others on tourism [1].

Figure 1. The Caribbean islands. Source: https://upload.wikimedia.org/wikipedia/commons/8/85/CIA_map_of_the_Caribbean.png

Most Caribbean countries depend on heavy fuel oil and diesel as the primary power generation sources and face typically high electricity prices. It is well known that countries that are heavily dependent on foreign oil to power a significant portion of their power generation are especially vulnerable to volatile oil prices. Two situations occur: electricity prices are three or four times higher in net energy importer countries, such as Dominica, and lower in net exporters like Trinidad and Tobago.

In oil-importing countries worldwide, high and volatile oil prices ripple through the power sector to numerous economy segments. As prices fluctuate, so does the cost of electricity production, which has far-reaching effects on fiscal and trade balances, businesses, and household living standards [2].

Natural gas imports could alleviate pressures in some of the larger countries. The Dominican Republic has already moved that way, and Barbados and Jamaica are likely to follow. For instance, Dominica and St. Kitts and Nevis have substantial geothermal reserves, which, if broadly developed, could transform their power supply mix. However, in most islands, the scope for substitution of oil-fired capacity appears quite limited, and renewable-resource estimates are still incomplete.

Natural gas can provide a practical alternative to reduce fuel oil dependency in the Caribbean and moderate electricity prices by introducing an additional energy source. Natural gas may enhance energy diversification in other fields of relevance, such as transportation and distribution facilities. Small-scale LNG, floating regasification ships, and satellite LNG stations using containerised storage units provide acceptable transport options for small markets. LNG delivery innovations in this sense make it possible to deliver natural gas to the Caribbean countries without incurring economic trouble.

Table 1. EPCM’s elaboration based on the United Nations Population Division [3], World Bank national accounts data [4] and World Bank data based on IEA Statistics [5].

1.2 Countries with Natural Gas Reserves

Many island nations are grappling with many challenges, such as fuel import addiction, exposure to oil price volatility and uncertain energy supplies that inhibit economic development. Although the Caribbean economy is diverse, it still relies on imported fossil fuels for nearly all its energy needs. Hence, natural gas reserves in the region become fundamental to minimise the reliance on external resources.

Trinidad and Tobago and Barbados are the only countries in the region with natural gas reserves. The former is the most industrialised nation and the largest natural gas producer in the islands—its proven natural gas reserves have remained stable over the past few years. For Central and South America combined, Trinidad & Tobago is the third biggest gas producer, only behind Argentina and Venezuela.

Hydrocarbons have long been the primary driver of Trinidad and Tobago’s economy, even developing an upstream petrochemicals industry. Indeed, the country has been supplying LNG to the U.S. and Europe through consistent exports since 1999, in addition to ammonia and methanol. On the other hand, Barbados’ natural gas reserves are scarce compared to the existing reserves in its resource-plentiful neighbour: only 0.03% [6].

Otherwise, there are promising gas exploration opportunities in the rest of the Caribbean. Numerous hydrocarbon plays are plausible from the complex tectonic history of this relatively underexplored region. An Upper Aptian to Lower Albian-age bituminous limestone has oil-generating potential. At the same time, recent onshore seep discoveries from other Cretaceous sources confirm the presence of an active petroleum system in Jamaica [7].

Active license rounds are taking place in Cuba and the Dominican Republic, plus extensive open acreage available for direct negotiation across Jamaica, and farm-in opportunities are available in The Bahamas [8]. Finally, The Ministry of Energy and Energy Industries of T&T was supposed to offer blocks in the Deep Water acreage via a round of competitive bidding by the fourth Quarter of 2020 [9]. Several prominent companies have been awarded exploration licences for the nearby Canje Block, offshore Suriname & Guyana.

Figure 2. Participating interests in the Canje Block. Source: https://www.stabroeknews.com/2019/06/02/news/guyana/companies-say-award-of-canje-oil-block-licence-was-above-board/

2 Implications of Global Trends for The Caribbean

Changes in the global markets for natural gas generate an incentive to bring natural gas to the Caribbean. These include an expected global oversupply of LNG in the medium term, a competitive gas pricing regime in the U.S. resulting in low gas prices and technological advances lowering the scale of cost-efficient regasification, transport and storage. These trends and their implications in the Caribbean natural gas supply chain are described below.

2.1 Supply

With global proven natural gas reserves having more than doubled in the past 30 years [6], large natural gas reserves worldwide will enable continued production growth in the coming years. The vast majority of it comes from conventional resources, although unconventional resources, such as shale gas, represent the fastest growing resource. The leading natural gas producers are the United States and Russia, accounting for 38 per cent of total global production with 24.2 trillion cubic feet (Tcf) and 21.3 Tcf, respectively. Other producers are much smaller, with Iran, Qatar, and Canada producing less than 6 Tcf.

Shale gas has undergone a boom in production growth, especially in the U.S. It could eventually remake global supply as many today minor oil-producing countries also have significant shale resources; however, the pace and ultimate volume of gas that can be economically produced remain uncertain. Shale gas has transformed the U.S. from an LNG importer to a potentially massive exporter. This country is thus the most likely supplier to the Caribbean among the emerging suppliers in the market.

As per natural gas prices, future trends will be driven by shale gas developments in North America. Given this market’s price flexibility, a note of caution shall be made: if alternative sources of natural gas or cheaper alternative fuels become available, investments could be stranded, causing both price and supply volatility in LNG markets. Even for Caribbean countries with experience as oil-importing countries, it may be challenging to manage these risks. This is because of the much smaller number of potential supply sources and the relative difficulty of securing spot cargoes. Flexibility on the demand side can help mitigate price volatility.

2.2 Demand

Today, natural gas plays a prominent role in global energy demand. Its importance is expected to increase as climate policies and continued technological innovation reinforce strong growth in natural gas demand for decades to come. The share of natural gas in global energy demand has risen dramatically over the last two decades, namely driven by the growing use of this energy source in power generation and the economic and emissions cut benefits compared to other fossil fuels.

Natural gas is expected to continue to play a significant role in future energy demand as continued economic growth, environmental pressures, and technological innovation support strong growth in natural gas demand for decades to come. The EIA’s Reference Case projection in the International Energy Outlook 2019 forecasts natural gas consumption to increase by 40 per cent by 2040, compared to 2018 [10].

Natural gas demand comes mainly from the industry sector—including power generation— which accounts for 37 per cent of the global total. The residential and commercial sector (space heating) consumed a further one-third in 2018; the transport sector, including vehicles and more recent marine uses, was just 7 per cent of global demand. Although North America and Europe/Eurasia remain the largest gas-consuming regions, the Asia Pacific and the Middle East are proliferating.

Figure 3. Bahamian “Pacific Eurus” LNG carrier. Source: https://www.vesselfinder.com/

2.3 Trade

LNG markets have been divided into two main regional markets for most of the industry’s history: Asia-Pacific and the Atlantic basin, which focused itself on supplying Europe and, to a lesser extent, the U.S. These spots have become less distinct over the past years as a surge of new liquefaction, shipping, and regasification capacity has dramatically expanded the volume of globally traded LNG. Analysts also expect trade and competition to multiply as new LNG facilities and pipelines are built. Patterns of global trade are expected to shift mainly in response to growing production in the Americas.

Trinidad and Tobago is the only country in the Caribbean that exports LNG. Since 2000, Trinidad and Tobago’s LNG exports have increased dramatically, so did the number of countries it sells. Initially, Trinidad and Tobago’s exports were dominated by the U.S.—up to 77 per cent of LNG exports. In contrast, Trinidad and Tobago currently trades with about 17 countries, with Argentina, Chile, Brazil, Spain, and the United States on the list.

On the other hand, Barbados neither imports nor exports natural gas despite having small, proven natural gas reserves. Not long ago, the Dominican Republic and Puerto Rico were the only jurisdictions in the Caribbean that imported LNG. Haiti then imports from the Dominican Republic by truck. In 2017, for example, Jamaica and Barbados also imported natural gas, gathering 7,015,000 MMBTU and 250,000 MMBTU, respectively.

3 Potential Demand for Natural Gas

3.1 Transportation

The transportation sector has a considerable share of total oil consumption in most Caribbean islands, accounting for 32 per cent of the total on average, according to a 2015 thorough feasibility study [11]. Replacing oil with natural gas would increase the latter’s demand by roughly 90 Bcf per year, not counting the construction of suitable distribution and retail fueling infrastructure, as well as converting all road vehicles to run on natural gas.

In the different scenarios simulated, the shift to natural gas is assumed to materialise in 20 years. Vehicular natural gas consumption would then begin three years after natural gas first introduction into each country and will reach maximum penetration about two decades after. The final natural gas penetration will be affected by each island’s size: those with smaller territory have a higher concentration of filling stations and present fewer logistical challenges. Thus, countries such as Barbados and the Bahamas are projected to have a higher penetration rate under all possible scenarios.

3.2 Natural Gas for Industry

Except for Haiti, industrial oil consumption is relatively low in the Caribbean, averaging 5 per cent of total oil consumption overall. Replacing this utilisation with natural gas is technically possible, and industries will likely be the first customers to be appealed to once the natural gas supply chain is established. Along with replacing oil, converting these industrial consumers to natural gas might help to endorse investment in distribution infrastructure, subsequently being used for other sectors.

The conversion to natural gas is assumed to occur in 15 years for this sector, with industrial natural gas consumption beginning two years after launch and reaching maximum penetration 15 years later. Given that individual consumers are large, the pace of penetration is quicker for the industrial sector.

3.3 Residential, commercial and other uses

The remaining sectors account for approximately 25 per cent of total oil demand in the region. However, introducing natural gas in the residential, commercial and other sectors might be too ambitious. Within the residential sector, water heating and cooking would be the only domestic uses for natural gas and consumption per user is thus negligible. Building underground gas pipelines to connect each household or business to the supply would likely be expensive; the distribution networks could only be developed within major urban areas given the greater density of final users.

Barbados might be the exception; there is a natural gas distribution grid in place, serving commercial and residential customers. The National Oil Company (BNOCL) has produced indigenous oil and gas for over 30 years, part of which has been used to establish a thriving gas distribution and sales service to 16,000 customers [12].

3.4 Electricity Generation

Despite the deterrent of high prices (Figure 4), Caribbean energy consumption has been growing, putting further pressure on total energy bills. Electricity generation consumes more energy than any other use in the Caribbean. This, along with the electricity sector structure, usually with a single utility in each country, makes it the most promising natural gas market in the region.

Figure 4. Example of national electricity tariffs by 2012. Source: https://www.elibrary.imf.org/

The projected demand for natural gas from power generation is based on (i) the expected demand for electricity; (ii) the total installed capacity per country to meet the anticipated demand; and (iii) the electricity generation and installed capacity using natural gas.

It is necessary to estimate electricity consumption and add system losses to forecast the electricity generation by country. Each country’s historical electricity consumption has served as a reference to predict the electricity consumption growth each year at an average annual growth rate. The system losses can be calculated as a function of projected electricity consumption of each year and the latest data on the percentage of system losses. Haiti has the highest losses accounting for 77% of total electricity generation, followed by the Dominican Republic (41%), Jamaica (33%), Bahamas GBPC (18%), Bahamas BEC (16%), (9%) and Barbados (7%) [11].

The Dominican Republic is by far the largest electricity market in the region. By 2030, the final electricity demand will increase to 25-30 TWh by 2030 [13]. Beyond natural gas, bioenergy has considerable potential to account for roughly half the total final energy mix because it can substitute fossil fuels in different applications across the energy system.

A renewable energy roadmap has shown that the Dominican Republic can raise its renewables share to 27% by 2030 [14]. In grids with a high-penetration of variable renewable energy sources, the uncertainty and risks taking place with these technologies must be mitigated through operational reserves or other means within the timeframe of the dispatch intervals. Backup would compensate for potential differences between planned output generation and actual power demand. This is important because natural gas can provide backup for intermittent wind and solar input into major electricity networks.

Figure 5. The Dominican Republic final energy mix by 2014. Minor changes have occurred since then: a mild decrease in oil was compensated with slight growth in solar, hydro, and coal. Source: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2016/IRENA_REmap_Dominican_Republic_report_2016.pdf

Most of the islands have relatively small electricity generation sectors, with only a limited number of power plants meeting each country’s needs, making it easier to convert a vast part of a country’s capacity to natural gas-fired capacity. There are fewer locations that should connect to the natural gas supply, and many plants are located close to each other.

4 Introducing LNG in the Region

4.1 Market Alternatives

Pipelines, CNG, and LNG are conceivable market technologies for delivering natural gas in the Caribbean. CNG is an already proven technology, and there are economic and environmental reasons to develop this market in different countries. It is a cost-effective solution to supply gas to areas that are not reached by the grid and do not reach the minimum required volume to invest in a traditional infrastructure. In general, onshore CNG can be economically viable for volumes up to around 5 MMscf/d and distances up to approximately 500 miles (800 km). Marine CNG is not commercially proven yet but could be economically viable for large volumes and distances up to around 2000 nautical miles. Regarding the environmental aspect, CNG technology is an alternative to reduce CO2 emissions from transport and small power plants [15].

However, LNG is the most likely alternative for introducing natural gas in the region. The LNG market is mature and uses proven technology. This alternative is more flexible than either CNG or pipelines and is likely the most competitive option for the selected countries. When compared with CNG, technological development of suitably worldwide scaled LNG is far more widespread and is developing more rapidly (particularly in shipping). Using CNG could pose technology risk as the project would be one of the first commercially deployed in the world. In addition, a CNG supply chain would require dedicated ships explicitly built for serving small clients in the Caribbean. This implies less flexibility in adding or redirecting individual cargoes or in negotiating shipping rates and supply costs.

Compared with pipelines, LNG imports can provide greater protection against counterparty risk because they can be shipped from multiple suppliers. Pipelines connect a limited number of supply and demand points and so have much less flexibility. Also, pipelines that connect multiple markets rely on each participant’s ongoing cooperation to ensure natural gas supplies continue to flow. LNG is a well-established technology that has been used on a global scale for decades, and so is best able to take advantage of this flexibility.

Increasing portfolio trading levels represents an opportunity for Caribbean countries, as annual flexible volumes with low take-or-pay levels are more adapted to their LNG needs. Nevertheless, competing in this market also poses challenges for the region. In the spot or short-term market, volumes are sold to the highest bidder, and Caribbean countries would have to compete with buyers in more established and larger markets.

The availability of low-priced gas in the United States encourages greater competition and price flexibility. Growing supply competition creates opportunities for the Caribbean region, indicating natural gas price decreases and significant commercial gains from oil substitution. Also, growing trade could contribute to increasing contract flexibility and easing credit conditions. Nevertheless, Caribbean countries may have difficulty securing Henry Hub-linked prices since they are small individual markets, many of which do not have LNG import facilities and have weak investment-grade credit ratings.

The commercial arrangements should allocate risks to those entities that are best able to manage them. In each case, the shifting of risk from one entity to another will likely impact the final price. A critical threat facing Caribbean countries is the limited size of each market. Countries with the smallest potential natural gas demand also suffer the highest costs in delivering the gas. The cost to build many components along the supply chain is relatively insensitive to the project’s size. The challenges with these smaller volumes of demand are securing long-term gas supply agreements and coordinating infrastructure and services across multiple countries.

4.2 Financial and Technical Aspects

Financial Planning

Planning and investment in generation depend on the market structures. Most of the Caribbean countries have state-owned and vertically integrated electricity utilities. In these cases, the utility makes generation asset planning and financing decisions. The utility—or the government—sometimes finances and operates new generation assets directly. Otherwise, the government or the utility issue tenders to buy electricity from an IPP. Planning and financing differ across Caribbean countries. Particularly market size and degree of competition might influence investment decisions and pricing dynamics. These disparities must be considered when developing options for a regional energy market.

Caribbean countries are utterly vulnerable to climate change and natural disasters. Extreme weather events are common—the region experienced three Category 5 hurricanes between 2017-2019. When a tropical storm strikes, it can wipe out more than the entire annual GDP of a small island nation. Major hurricanes, including Irma in 2017 and Dorian in 2019, were stark reminders.

The Caribbean has been badly impacted by the near halt in tourism following the onset of the COVID-19 pandemic. The Caribbean economy is expected to show harsh figures in 2020 and 2021 [1]. Building financial resilience and investing in preparedness—be it physical or health-related—are critical to reducing the immense human and economic costs caused by climate change, natural disasters, and other shocks, including pandemics.

Technology Improvements

The expected supply surge from shale gas and pressure from the demand side for more environmentally friendly energy sources drive innovation across the natural gas value chain. Key relevant areas include transportation—such as small-scale LNG and sea-borne CNG; regasification and storage—such as floating regasification and storage ships or satellite LNG stations using container-sized storage units; and LNG uses—such as directly using LNG in fleet vehicles and vessels.

LNG delivery innovations in small-scale shipping and floating regasification units make it possible to deliver economically natural gas to the Caribbean countries. Further cost reductions are expected as R&D mature smaller-scale technologies currently under development.

In general, market changes point to natural gas being available at competitive prices in the Caribbean. Many other competing importing countries can also offer far larger markets for gas exporters. Natural gas projects, especially LNG projects, benefit from economies of scale, suggesting the potential for greater returns from larger markets than from smaller ones. Some developers may charge a premium for the intermittent, spot cargoes that may be all that smaller Caribbean markets require. Larger markets such as Japan also have more flexibility in diversifying their sources of natural gas imports, providing greater security of supply and reducing their dependence on any one project. In 2012 this country received LNG from suppliers located in different countries.

Finally, investment across the many stages in the natural gas value chain—from upstream supply through liquefaction, shipping, and regasification—is often mistimed, creating shifting bottlenecks and rapidly changing costs as different parts of the chain face shortages or oversupply. As a small participant in a huge global market, Caribbean countries will have little ability to influence these trends.

4.3 Transport and Storage

The challenge has been how to move gas to the other islands, which are located far from each other and whose market size is small. Of the two available approaches, pipelines and an LNG terminal, only the latter has been tried to date, first in Puerto Rico in 2000 and the Dominican Republic two years later. In both cases, the LNG terminal was developed jointly with a power plant (540 MW in Puerto Rico and 320 MW in the Dominican Republic). Both projects have succeeded both technically and economically [2].

After those transoceanic LNG vessels arrive at the receiving port, either unload to the onshore storage tank or another smaller LNG vessel for regional delivery services—the term “bunkering” is used. Usually, those transoceanic LNG vessels can load liquefied gas as much as 50 thousand tons or more, while the smaller regional delivery vessels will carry 1 to 10 thousand tons of LNG. This bunkering approach has perfectly matched the demand from those countries or areas with small scattered islands, such as the Philippines, with more than two thousand inhabited islands nationwide. In contrast, Indonesia even has a much larger number of islands. The Caribbean region has a similar situation, but with less number of inhabited islands. LNG delivery will be made by those smaller LNG ships calling different regional ports on an as-needed basis. Those isolated islands need electricity and natural gas supplies to improve their living conditions [16].

To mitigate risks to on-site employees of facilities that transport and use LNG, personnel must be trained in handling equipment operating at very low temperatures. This includes training managers and workers on protocols for safe storage and handling of hazardous materials, worker safety procedures, and appropriate actions and their assigned responsibilities for implementing response plans for natural hazards and spills. Suitable protective clothing and training can mitigate risks during normal operations. On the other hand, installing appropriate navigational aids for ships and operational protocols (such as speed limits in channels) can help avoid accidents at sea, in accordance with national and international regulations and standards. Finally, monitoring groundwater, seawater, freshwater, air, and soil quality is essential for early spilling detection.

The Panama Canal

Panama Canal hit a new record for the transit of LNG in January 2021. The Panama Canal Authority reported 58 vessels transited the Neopanamax locks, totalling 6.74 million tons. This compares to 54 LNG tankers that crossed the canal in January 2020 and 6.23 million tons reported in November last year [17]. The record came from the site response to the growing demand stemming from a recent boom in the energy market.

The Panama Canal Authority further implemented several adjustments to its operations, enabling it more flexibility and the possibility to respond to changing trading conditions. The increase in LNG tankers’ transit responds to winter conditions boosting the demand for liquefied natural gas for power generation in Asia.

Figure 6. An LNG vessel in the Panama Canal. Source: https://www.offshore-energy.biz/panama-canal-hits-lng-transit-record/

A bottleneck at the Panama Canal could delay LNG shipments through the peak-demand winter months. The Panama Canal congestion has recently pushed LNG prices and shipping rates to record highs, combined with supply constraints and strong demand from Asia. Ships carrying LNG from the U.S. with Asia as the destination waited for as long as two weeks to transit the canal.

The canal’s authority explained that congestion had prompted charterers seeking to deliver American LNG to northeast Asia to explore alternative routes. The Suez Canal in Egypt emerged as a preference. About 15 ships carrying December-loaded LNG from the U.S. are expected to cross the Suez Canal in February and March 2021, up from just two in the same period a year earlier.

The Panama Canal Authority has made changes in an effort to ease the congestion; the modifications in the transit reservation system and the green light for LNG vessels to reserve two slots rather than one ahead of transit. It has also introduced auctions to sell off any slots that become available within two to three days before transit due to last-minute cancellations.

5 Conclusion

This article includes analyses of natural gas demand, outcomes from cost comparison studies for liquid natural gas, compressed natural gas, oil and pipelines, the possible competitive market opportunities for the development of natural gas import facilities in the region, an assessment of the risks faced by investors seeking to develop these types of projects in a small country context.

For the Caribbean island nations, the expanded use of natural gas could reduce dependence on oil derivatives in the short and medium-term. The electricity sector is expected to be the anchor client for natural gas imports in each of the selected countries. As such, the electricity sector’s potential demand for natural gas will define the size of the infrastructure required for importing and using natural gas.

The introduction of natural gas would bring high economic benefit to the Caribbean. Financial savings may favour public services or the governments’ balance of payments. The benefits analysis indicates that each system’s average cost will decrease by replacing fuel oil power plants with natural gas plants. If the selected countries switch to using natural gas instead of fuel oil, they could reduce their average cost of generation. Also, introducing LNG competitive markets in the Caribbean islands would increase energy affordability for end-users, contributing to increased access to public services and reducing poverty.

The Caribbean countries have important differences in population, GDP, and energy consumption, among others. Recognising these differences is necessary for highlighting market constraints and regulations pertinent for attracting investors and generating confidence in finance mechanisms that would enable the construction of natural gas infrastructure in the region.

6 References

[1] https://www.worldbank.org/en/country/caribbean/overview

[2] Mitigating Vulnerability to High and Volatile Oil Prices: Power Sector Experience in Latin America and the Caribbean. World Bank, 2012. Available at: https://openknowledge.worldbank.org/handle/10986/9341

[3] https://population.un.org/wpp/

[4] https://data.worldbank.org/indicator/NY.GDP.PCAP.CD

[5] https://data.worldbank.org/indicator/EG.USE.COMM.FO.ZS?locations=ZJ

[6] Yépez-García, R. A., & Amenábar, F. A. (2019). Unveiling the Natural Gas Opportunity in the Caribbean. Available at: https://publications.iadb.org/en/unveiling-natural-gas-opportunity-caribbean

[7] https://www.geoexpro.com/articles/2010/06/buried-treasure-in-jamaica

[8] https://www.geoexpro.com/articles/2019/09/promising-oil-and-gas-opportunities-in-the-caribbean

[9] https://www.energy.gov.tt/2020-deep-water-competitive-bid-round/

[10] https://www.eia.gov/outlooks/ieo/

[11] Castalia Advisors, “Natural Gas in the Caribbean – Feasibility Studies” 2015.

[12] http://www.npc.bb/residential-customers/

[14] IRENA (2016). Renewable Energy Prospects Dominican Republic. REmap 2030. International Renewable Energy Agency (IRENA). Abu Dhabi. Available at: www.irena.org/remap

[15] Tractebel Engineering. 2015. CNG for Commercialization of Small Volumes of Associated Gas. World Bank, Washington, DC. © World Bank.

[16] Tseng, L. Y. (2020). Virtual Pipeline System. ECS Transactions, 96(1), 121.

[17] https://www.offshore-energy.biz/panama-canal-hits-lng-transit-record/

[18] The Inter-American Dialogue’s weekly Latin America Energy Advisor. January 22, 2021. Available at: https://www.thedialogue.org/wp-content/uploads/2021/01/LEA210122.pdf

To all knowledge

To all knowledge