1 Introduction & Background

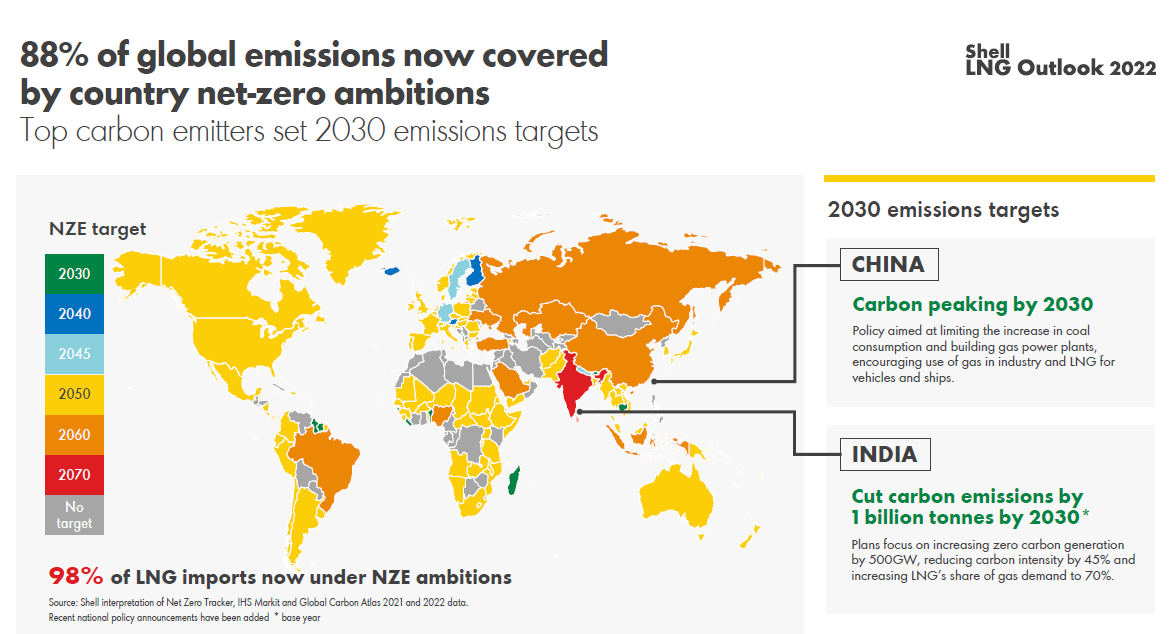

The declared SDGs (Sustainable Development Goals) by United Nations coupled with net-zero emissions targets are continuously exerting pressures to drive the world towards cleaner fuels. Natural gas (LNG with regasification facilities where pipelines cannot transport natural gas) is among the cleaner hydrocarbon fuels and is witnessing increased demand in the world’s transition to clean energy use – being a reliable, available and lower-emissions energy source. On the one side, natural gas / regasified LNG is becoming an immediate option to lower emissions in hard-to-electrify sectors by replacing most polluting fuels (cow dung, coal and wood) in Asia. While on the other side, natural gas / regasified LNG plays an important role in supporting energy transition in the developed world through the provision of hybrid energy supply systems coupled with renewables, providing grid stability during cyclic renewable energy supplies.

Source: Shell LNG Outlook – February 2022

South Asia (mostly India) and China have been among the most affected countries in terms of carbon pollution due to biomass burning and coal for power generation. In India, it has been reported that anthropogenic emissions contribute approximately 80% to surface CO over the megacities of Delhi and Kolkata. Similarly, biomass burning contributes ~23% CO over Northeast India & Myanmar.[1] Large CO concentrations have been identified as a major indicator for determining environmental pollutants, particulate matter and resultant smog creation during winters.

Average Yearly CO levels determined in referred study related to South Asia (2015)

2 LNG Demand in South Asia

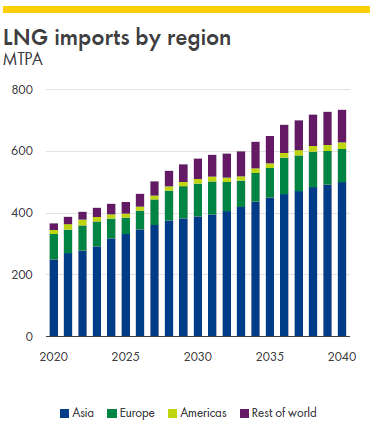

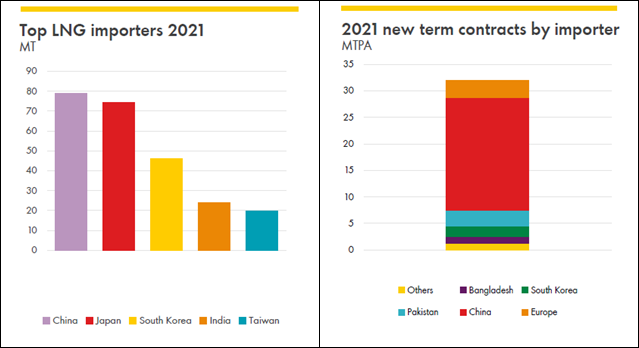

There may be a difference of opinion regarding future outlooks regarding the share of natural gas / LNG in the long-term energy mix. Still, there is no doubt that natural gas and LNG will continue needed. In South Asia, particularly in the Asian subcontinent, natural gas / LNG has a definite role to play in terms of replacing the declining domestic gas production to support economic growth – almost 2 billion out of 4.6 billion Asian population lives in South Asia (Afghanistan, Pakistan India, Nepal, Bhutan, Bangladesh and Sri Lanka constitute 43% of Asian population). The population of China is 1.4 billion. Thus, China a South Asia together constitute 74% of the Asian population. Thus, South Asian (mostly the Indian subcontinent) gas requirements are one of the biggest contributors for driving LNG demand growth, followed by China and the Asia Pacific (Taiwan, South Korea and Japan). In 2020, total LNG imports that landed in Asian countries were 250 MTPA (Million Tons Per Annum) out of 380 MTPA LNG imported by various countries of the world – Asian LNG imports accounted for 66% of total LNG trades worldwide. (Refer to figure below).

Source: Wood Mackenzie 2021 data

3 LNG / Natural Gas Supply Modes in South Asia

South Asia and China are different among Asia’s Top LNG Importing countries. While the Top LNG Importers Japan, Korea, and Taiwan, depend on LNG supplies, South Asia and China have options between pipeline gas imports and LNG. Thus, various modes or options available to Asian countries to fulfil their gas needs practically affect their ability to manoeuvre in the LNG market. South Asia and China have an edge due to their geographical location to get natural gas from large Russian and Central Asian gas reserves through pipelines. Traditionally, Europe used such options to their advantage for decades. However, with the changing geopolitics based on increased supplies of US Shale gas / LNG, Europe has been gradually shifting from Russian piped gas imports to US LNG imports.

Russian pipeline gas supplies have been continually declining towards Europe as the US LNG supplies to Europe increased tremendously during winter 2021 – 2022. Onwards, this will further reduce speedily due to the recent war in Ukraine. The graph on the left below indicates that in January 2022, Russian gas supplies to Europe were less than 60% (300 MMCMD) compared to what Europe received from Russia in January 2019. Similarly, the graph below indicates more than a doubling of US LNG supplies to Europe in January 2022 compared to December 2021.

Russia, in the meanwhile, is looking to sell more pipeline gas to the Asian subcontinent (South Asia). In a recent visit of Pakistan’s Prime Minister to Russia (February 2022), a new pipeline is announced as Kazakhstan – Afghanistan – Pakistan gas pipeline. This pipeline will carry Russian natural gas to South Asia via Kazakhstan. Kazakhstan’s gas network is connected to the Russian gas supply network (and gas sources) in Ukraine’s West and North. Thus, in the coming days, South Asia will have more control over LNG price options and the reliability of gas supplies. In recent winters, South Asian LNG imports declined due to high LNG prices as the relatively developing nations could not compete with the Asia Pacific and European buyers in an LNG price war.

4 The volatility of LNG Price in 2021

Energy markets got destabilised due to the volatility in energy prices in 2021 – the main reason being a disruption in supplies from traditional pipeline connected sources. Despite high LNG production and export from the US, the European countries were helpless in paying rising LNG prices due to lower-than-expected output from renewable sources. European renewable energy supplies (RES) declined despite increased installed capacity, as indicated in the graphs below. South Asian countries also got affected due to high prices for the Asian sub-continent –proximity with JKF (Japan Korea Marker) and TTF (Title Transfer Facility – a virtual trading hub in the Netherlands for natural gas Spot Trades to Europe). The graph below indicates the stable price of Henry Hub (HH is US-based).

Pakistan, India and Bangladesh (combined) imported around 40 million tons of LNG in 2021 – making it the 4th largest LNG import region. These combined imports of LNG, despite rising LNG prices, by South Asia are expected to cross LNG imports of South Korea (3rd largest LNG importer currently) very soon. The graph below indicates that two South Asia (Pakistan and Bangladesh) were among the list of countries entering into Term Contracts with big LNG suppliers.

5 Current LNG / Natural Gas Business in South Asia

- Afghanistan

Most of Afghanistan does not currently have an established gas supply network, except gas distribution system in a couple of cities like Herat – mostly bottled LPG / LPG tankers are the main gaseous fuel source. Afghan Gas Enterprise (AGE) is a state-owned company that extracts and supplies natural gas. The AGE currently provides 95% of natural gas to industrial projects like Kod-e-Barq enterprise, Bayat and Ghazanfar IPP. The total gas consumption of Afghanistan is around 6 BCF annually. Natural gas currently accounts for less than 1% share in Afghanistan’s energy mix, with no possibilities of LNG imports due to it being a land-locked country.

- Pakistan

Pakistan has had a well-established gas transmission and distribution system operating since the 1950s – 15,000 km high-pressure transmission lines and 150,000 km low-pressure distribution network operated by Sui Northern Gas Pipelines Limited, Sui Southern Gas Pipelines Limited and a few small companies operating single pipeline systems under Third Party Access arrangement. Two LNG regasification terminals (Engro Elengy Terminal and Pakistan GasPort Limited) have been commissioned in 2015 and 2017, supplying 1.2 BCFD gas to make up for declining domestic natural gas supplies – the combined nameplate capacity of two terminals is 9 MTPA. Currently, total natural gas consumption in Pakistan is around 5 BCFD (1,700 BCF gas annually), with more than 20% procured through imported LNG. Term contracts for importing LNG are made by Pakistan State Oil and Pakistan LNG Limited with Qatar Energy and Qatar Gas. Spot LNG is also procured as per requirements. Currently, natural gas (indigenous plus imported regasified LNG) accounts for more than 40% of Pakistan’s energy mix.

- India

India has numerous gas companies supplying 6 BCFD gas to consumers. GAIL (India) Limited, Indraprastha Gas Limited, Gujarat State Petronet, Petronet LNG Limited, Gujarat Gas Limited, Mahanagar Gas Limited, Adani Total Gas Limited and Central UP Gas Limited are among the big names in the LNG / natural gas business. India’s natural gas pipeline network, currently operational and under construction, totals around 34,000 km (including high to low-pressure pipelines). Currently, India’s total natural gas consumption stands at 2,000 BCF annually, with more than 40% procured through imported LNG. Currently, natural gas accounts for only 7% of India’s energy mix, which is far below the global average of 24%.

There are currently five LNG import terminals operational in India with a total nameplate capacity of around 40 MTPA.

- Dahej LNG Regas Terminal

- Hazira LNG Regas Terminal

- Dabhol LNG Regas Terminal

- Kochi LNG Regas Terminal

- Ennore LNG Regas Terminal

- Sri Lanka

Sri Lanka is one of the two countries in South Asia whose share of renewable energy in the grid is over 50%; however, base-load electricity generating facilities are required to avoid capacity shortages when rainfall reduces to below-average values. Currently, Sri Lankan gas consumption is negligible, and the petroleum and gas supply industry has not been brought under regulatory reform. However, there are plans to set up an LNG regasification terminal, operate by Ceylon Petroleum Corporation, and construct a pipeline to supply regasified LNG to the power plant. Sri Lanka is expected to set up a natural gas company[1] as a subsidiary of the state-run Ceylon Petroleum Corporation under a public-private partnership to store, construct pipelines, transport and distribution, develop facilities and monitor local natural gas exploration and production.

- Bangladesh

Bangladesh has 2,000 km[2] of high-pressure transmission pipelines operated by Gas Transmission Company Limited (GTCL) is, a subsidiary of state-owned Petrobangla. Six gas distribution companies support GTCL in supplying 3 BCFD gas to consumers.

- Titas Gas Transmission and Distribution Company Limited (TGTDCL)

- Jalalabad Gas Transmission and Distribution Systems Limited (JGTDSL)

- Bakhrabad Gas Systems Limited (BGSL)

- Karnaphulli Gas Distribution Company Limited

- Pashchimanchal Gas Company Limited

- Sundarban Gas Company Limited

Total natural gas consumption in Bangladesh currently stands at 1,300 BCF annually, out of which around 130 BCF (or 10% of consumption) is met through LNG imports. Currently, natural gas (indigenous plus imported regasified LNG) accounts for around 60% of Bangladesh’s energy mix. Starting from 2018, Bangladesh utilises two 3.75 MTA floating storage regasification units (FSRUs) for importing LNG.

- Myanmar

Myanmar has numerous gas companies supplying 1.5 BCFD gas to local consumers through 4,000 km of the domestic pipeline network. In addition, there are export pipelines to China and Thailand. Myanmar Oil and Gas Enterprise (MOGE) is the company responsible for the operation of these pipelines. Total natural gas consumption in Myanmar currently stands at 550 BCF annually with 100% indigenous production – Myanmar’s total natural gas production stands at 700 BCF annually with 150 BCF exports. Natural gas currently accounts for 39% of Myanmar’s energy mix. Hydropower and natural gas dominate Myanmar’s power sector fuel mix. The share of hydropower in the power generation mix is currently around 59.0%.

Myanmar has been exporting oil and gas[3] through two separate, parallel pipelines running from offshore blocks A-1 and A-3 in Myanmar to China – Shwe gas field located offshore of the Bay of Bengal is owned by a joint venture between Daewoo International, ONGC Videsh, MOGE, GAIL and Korea Gas Corp. The gas and oil pipelines have been operational since 2013 (gas pipeline transport capacity is 13 BCM (455 BCF) per year). The gas pipeline is 2,520km long, including the 793km Myanmar section and 1,727km China section – starting at Ramree Island in Kyaukryu (on the west coast of Myanmar) and ending at Kunming (the capital city of Yunnan province in China). The crude pipeline carries the crude oil that CNPC imports from Africa and the Middle East into China via Myanmar. Myanmar natural gas exports to Thailand currently stand at 0.6 BCFD. Myanmar export natural gas to Thailand from Total/Chevron’s Yadana field and PTTEP’s Zawtika fields.

6 Future of LNG Supplies in South Asia

Afghanistan, Pakistan, India, Bangladesh, and Sri Lanka are the South Asian countries that need more imported gas / LNG to meet their energy requirements and keep pace with Net Zero Emission goals. Pakistan and Bangladesh signed new term contracts in 2021, but India remained on the sidelines – it seems satisfied with its existing supply contracts. Higher LNG prices have reduced the capacity of South Asian nations to pay in the spot market. Indian LNG terminals indicate a decline in operations due to high LNG prices and a lack of downstream transportation capacity. Before the recent price hike, India planned to add 17 more LNG terminals. However, the current situation indicates that new LNG terminals in India will likely only add pressure on the existing terminals – running at low capacity due to lack of downstream takeaway capacity. But India needs to improve its energy mix to avoid further environmental degradation – currently 6% natural gas share in the Indian energy mix. Indian regulator PNGRB recently authorised 232 geographical areas (GAs) through 10 city gas distribution (CGD) bidding rounds that have covered more than 400 districts spread across 27 states and union territories. This covers around 71% of India’s population and 53% of the country. In addition, PNGRB plans to offer another 44 GAs in the upcoming bid round.

Indian government plans to increase the share of natural gas in its energy mix to 15% by 2030. India’s gas demand is expected to rise. To achieve this goal, the government of India is carefully weighing its options to import LNG at a lesser price – looking towards US Shale LNG supplies. Efforts are also underway to increase India’s domestic natural gas production. India’s natural gas production is expected to increase based on the collaboration of local investors like Reliance Industries Ltd and its foreign partner BP. This joint venture has been developing three deep-water gas developments in its KG D6 block off the Andhra Pradesh coast, which together are expected to produce around 1 billion cubic feet a day of natural gas by 2023. Also, state-owned Oil and Natural Gas Corporation Ltd has started gas production from its KG-DWN-98/2 field Situation

The situation is different for Pakistan and Afghanistan are actively looking for pipeline gas imports from Russian and Central Asian Republics – to avoid some of the volatility in LNG price and supply commitments.

7 Technical Conve

To all knowledge

To all knowledge