Introduction

Industrial production has historically been one of the worst emitters, with almost all sectors built on energy derived from fossil fuels. Three types of emissions must be considered: i) Direct energy-related emissions from industrial fuel use, ii) Indirect emissions from sourced energy and heat, and iii) Direct process emissions from chemical transformations in industrial processes.

Three sectors – iron and steel, chemicals and plastics, and cement – rank well above others in GHG emissions. Steel emissions are mainly from direct energy, while chemicals have more indirect energy emissions. Cement emissions are predominantly from CO2 process emissions.

Climate change requires more and more comprehensive domestic and international transformations to lower emissions and reduce socio-economic and ecological impacts. South Africa has to rapidly shift to a lower carbon pathway to maintain access to export markets under stricter environmental regulations.

However, this transition also allows for greener re-industrialization by utilizing the country’s renewable energy potential. The key question is how this transition will unfold: will it strengthen local capabilities in renewables and contribute to a diversified clean industrial base, or will it mainly focus on exporting to European industries?

This article also explores the potential of Green Hydrogen (GH2) in addressing heavy industries and examines how these changes could drive the re-industrialization of South Africa’s economy.

Chemicals

Among the various emission reduction challenges, the chemical sector is a typical difficult-to-abate industry. The chemical industry has high carbon intensity, relies heavily on fossil fuels for its raw materials and energy demand, and has relatively limited low-carbon alternatives. For instance, the production of commodity organic chemicals today is both primarily sourced from and powered by fossil carbon resources.

Demand for chemical commodities has historically grown with the gross domestic project (GDP), a trend that is expected to continue. For example, demand for primary chemicals (e.g., light olefins [ethylene and propylene], aromatics, methanol, and ammonia) is projected to increase by 40%–60% by 2050 from 2017. This growth can increase GHG emissions from the chemical manufacturing sector, even if low-carbon technologies are implemented.

Another challenge for this sector is that existing chemical manufacturing involves processes interconnected through mass and energy flows, complicating production method changes for a single product in isolation. For example, using ethane from natural gas in steam cracking instead of naphtha from petroleum increases ethylene yields at the expense of lower propylene and aromatics yields, which drives the need for new propylene and aromatics units.

Toward mitigating climate change, there is a concerted effort in the global community to identify methods of reducing energy consumption and GHG emissions in the chemical sector, including prior efforts to estimate the energy requirements of manufacturing petrochemicals. Areas of particular interest include sourcing alternative feedstocks, implementing renewable electricity, and replacing or reducing fossil carbon-derived heat inputs.

In this context, hydrogen, the most promising zero-carbon raw material and energy of the twenty-first century, has enormous potential to aid in decarbonizing the chemical industry, drawing significant interest in the green hydrogen chemical industry. The United States, Japan, the European Union, and China have all incorporated plans for decarbonizing the chemical industry based on hydrogen into their national strategies, particularly in sectors such as ammonia, methanol, and refining.

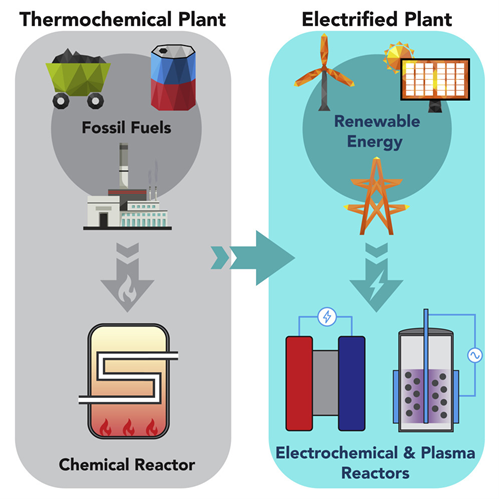

With this heavy reliance on fossil fuels as the primary energy, it is more economical to use heat than electricity because fossil-based electricity generation causes additional efficiency losses. There is growing industry interest in powering chemical processes with cost-competitive, variable renewable electricity to leverage decarbonization efforts in the electric power sector, as exemplified by recent announcements related to the exploration of electrified steam crackers and electricity use for process heat for hydrogen production from steam methane reforming (SMR).

Both approaches focus on directly substituting heat with electricity without changing the process chemistry. Other pathways for electrified chemical processes include electrochemical production of hydrogen for process heat generation, direct use of electricity for manufacturing of chemical products via electrochemistry, and electricity-powered plasma reactors.

The chemicals industry in South Africa is a significant contributor to the country’s economy and is characterized by a high carbon intensity—its production processes are heavily reliant on fossil fuels, particularly coal and natural gas. The chemicals sector in South Africa is dominated by Sasol, which accounts for over 80% of emissions. Sasol is pursuing a green chemicals strategy, but realizing opportunities requires an integrated industrial and energy strategy.

The company is actively aiming to reduce its carbon footprint through various initiatives:

- Investment in Renewable Energy: Sasol is exploring the integration of renewable energy sources, such as solar and wind, to power its production processes.

- Development of Green Hydrogen: The company is investigating the potential of green hydrogen as a feedstock for chemical production, particularly in processes such as ammonia synthesis.

- Circular Economy Initiatives: Sasol also focuses on implementing circular economy principles, which involve recycling and reusing materials to minimize waste and emissions.

South Africa’s chemicals sector is diverse, encompassing various sub-sectors such as fertilizers, polymers, and specialty chemicals. Challenges include the capital intensity of the industry and the need for cross-government commitment.

Steel

Steel production is responsible for the highest GHG of all metals, i.e., 9% of global emissions. As steel is required for buildings, infrastructure, and technologies, it is a key metal for modern societies. Consequently, demand for it is expected to increase due to the future industrialization of developing countries.

Globally, the majority of steel is produced via primary production, around 70%, while secondary production accounts for about 30%. Primary steel is commonly produced via the blast furnace and basic oxygen furnace route (BF-BOF), which mainly uses coke as an energy carrier and has a very high emission intensity of 1.6–2.2 t CO2/t steel.

The commonly used BF-BOF route can barely be decarbonized, requiring very high temperatures of up to 2000 °C. The only other mature process currently being applied is natural gas-based direct reduction (NG-DRI). NG-DRI has a lower emission intensity than the BF, but it is not widely deployed as natural gas is not cost-competitive with coke in most countries.

Thus, in the case of primary steel production, a significant CO2 reduction can only be achieved through switching to different technologies. For a profound emission reduction, the key strategy is electrification. The most promising technologies are hydrogen-based direct reduction (H2-DRI) and electrolysis of iron ore. H2-DRI enables indirect electrification through hydrogen from water electrolysis, and iron electrolysis allows for direct electrification of primary steel production.

Hydrogen-based direct reduction (H2-DRI) can be almost CO2 emission-free if operated with hydrogen from renewable electricity. H2-DRI is often considered the most suitable technology for the near future, as it can be adapted from the already existing technology of natural gas-based DRI (NG-DRI). Direct-reduction furnaces can be operated with a mix of natural gas and hydrogen. Thus, once enough hydrogen is available, DRI enables a transition from natural gas to hydrogen in the same furnaces.

A less mature alternative, yet directly electrified technology, is the electrolysis of iron ore. It applies electricity to reduce iron ore and thus avoids conversion losses during hydrogen production, which occurs in the case of H2-DRI.

The steel sector is a critical component of South Africa’s industrial landscape and is one of the country’s highest contributors to greenhouse gas emissions. The industry is dominated by ArcelorMittal South Africa (AMSA), which accounts for over 90% of emissions. AMSA is pursuing a green steel strategy but faces challenges around the capital intensity of transitioning and the need for aligned policies.

The steel industry is essential for various downstream industries, including construction, automotive, and manufacturing, making its decarbonization vital for the broader economy. As such, steel has strong linkages to other sectors.

Steel production is characterized by significant carbon emissions, primarily due to the reliance on coal as a key energy source. South Africa’s steel sector is responsible for approximately 7.2% of total greenhouse gas emissions. The emissions from steel production have increased significantly, with a rise of around 15% since 2010, driven by growing demand and the carbon-intensive nature of traditional steelmaking processes.

AMSA’s green steel strategy includes several key initiatives:

- Investment in Green Technologies: AMSA is exploring the adoption of electric arc furnaces (EAFs) powered by renewable energy sources. This shift can significantly reduce direct energy-related emissions compared to traditional blast furnace methods.

- Utilization of Green Hydrogen: Integrating green hydrogen as a reducing agent in steelmaking processes is a focal point of AMSA’s strategy.

- Carbon Capture and Storage (CCS): AMSA is also investigating carbon capture technologies to mitigate emissions from existing production processes.

Cement & Mining

Cement is the critical binder material in concrete and accounts for approximately 13% of the weight of concrete and typically 10–15% of a concrete product by volume. Today, cement and concrete are among the world’s largest and most important industrial products. Concrete products are second only to water as the most consumed material in the world by mass, with an estimated yearly consumption approaching 30 billion tonnes, leading to per capita production more significant than any other material.

The production and use of cement and concrete have significant environmental consequences. In 2019, production, transport, use, and demolition of cement and concrete accounted for roughly 9–10% of global energy-related CO2 emissions, including carbonate decomposition, fuel combustion, and electricity use, with cement production accounting for 77% of the total emissions. The remaining emissions are mainly attributed to the transport of aggregates for concrete (approximately 8%), equipment operation for concrete placement on-site (approximately 8%), and other related activities (approximately 7%). As global ambitions for decarbonization strengthen, the cement and concrete industry is under increasing pressure to curtail emissions.

The cement industry is a crucial component of South Africa’s economy. The South African cement is fragmented, with three leading players: AfriSam, Lafarge, and PPC. The emissions from cement production primarily arise from two sources:

- Direct process emissions: These are generated during the chemical transformation of limestone into clinker, a key ingredient in cement. This process releases a substantial amount of CO2, accounting for approximately 60-70% of total emissions from cement production.

- Energy-related emissions: These emissions result from the combustion of fossil fuels used to heat kilns during production. The cement industry heavily relies on coal and natural gas for energy, contributing to its overall carbon footprint.

In South Africa, the cement sector is responsible for about 3% of total greenhouse gas emissions, making it one of the highest-emitting industries in the country. The demand for cement is expected to rise due to ongoing infrastructure development and urbanization, which further exacerbates the need for emissions reduction strategies.

Leading South African cement sector companies are actively pursuing strategies to reduce their carbon emissions and transition towards more sustainable production methods. Key initiatives include:

- Alternative Fuels: Companies are exploring alternative fuels, such as biomass and waste-derived fuels, to replace traditional fossil fuels in cement production.

- Clinker Substitutes: Using supplementary cementitious materials (SCMs), such as fly ash or slag, can reduce the clinker needed in cement production.

- Energy Efficiency Improvements: Implementing energy efficiency measures in production processes can significantly reduce energy consumption. This includes upgrading equipment, optimizing kiln operations, and improving heat recovery systems.

- Carbon Capture and Storage (CCS): Some companies are investigating the feasibility of carbon capture technologies to capture CO2 emissions from the production process before they are released into the atmosphere. This technology has the potential to mitigate emissions significantly.

Several diesel-powered equipment are present in open-pit iron ore extraction. Fuel consumption is the main contributor to transportation costs in open pit and underground mining operations. According to the International Council on Mining and Metals (ICMM), fuel costs can represent up to 32% of the total energy input in the mines. This means that for a large mining operation, the cost of diesel fuel can be a significant factor in the company’s overall profitability.

Hydrogen is considered the best candidate as an additive to be added to diesel because it is a renewable source that meets the required engine characteristics, improves performance, as well as reduces carbon emissions. Similarly, studies have examined the performance of compression ignition engines using dual-fuel fuel hydrogen-diesel. They found that adding hydrogen to diesel in compression-ignition engines increased the fuel efficiency of the engine and significantly reduced emissions of carbon dioxide (CO2), oxides of nitrogen (NOX), and particulate matter.

Further, adding hydrogen has also improved engine performance by increasing power and torque. This is because it increases brake thermal efficiency (BTE) and decreases combustion duration due to the high flame spread speed of hydrogen compared to diesel.

The mining sector is another cornerstone of the South African economy, providing essential raw materials for various industries, including construction and manufacturing. However, mining operations are energy-intensive and contribute significantly to greenhouse gas emissions.

South Africa is rich in mineral resources, including gold, platinum, coal, and iron ore. The mining sector is characterized by several large companies, such as Anglo American, BHP Billiton, and Impala Platinum, which dominate production and emissions.

An Industry Perspective of the SA Green H2 Policy

Here, we analyze essential industrial policy challenges South Africa faces in reducing carbon emissions and restructuring its major industrial polluters, including steel, cement, and chemicals, which are crucial to the country’s economy.

The analysis emphasizes specific opportunities within different sectoral value chains, particularly advocating for rapid changes in steel and fertilizer production. Achieving these opportunities will require a coherent industrial and energy strategy and a commitment from various government sectors to implement it.

South Africa’s transition to GH2 is underpinned by a set of risks and opportunities, external

and internal. The existing disconnection between energy and industry suggests that isolated initiatives may occur, failing to integrate with the broader economy. Realising the structural transformative potential of GH2 across South Africa’s hard-to-abate sectors (steel, chemicals, and cement), which form the backbone of the country’s industrial structure will require targeted industrial strategies.

South Africa has a structural transformation role for GH2, with opportunities in the chemicals, steel, and cement sectors. The Industrial Development Corporation (IDC) is leading South Africa’s commercialization of GH2, with a focus on developing the domestic GH2 industry and infrastructure. Key challenges include the high costs, the need for aligned policies, and the risk of enclave development. Despite the impressive breadth of the IDC-championed GH2 commercialization strategy, critical gaps are likely between the aspiration and implementation.

An effective industrial strategy must encompass a cohesive policy framework that aligns energy and industrial policies. This includes regulations that incentivize the adoption of green technologies and support the development of local supply chains for renewable energy inputs.

Significant investments are needed to develop the infrastructure necessary for GH2 production and distribution. This includes enhancing the electricity grid to accommodate renewable energy sources and establishing hydrogen production facilities. The failure to address grid infrastructure means higher costs – as projects cannot benefit from network infrastructure, which should be shared. Instead of South Africa being a low-cost renewable energy producer (given solar and wind yields) it will be high-cost.

Several factors influence the political economy’s feasibility in implementing these strategies. Strong political commitment is essential for driving the transition. This includes cross-government coordination and a clear mandate to prioritize sustainable industrialization. The transition will require substantial financial resources, and the South African government must explore various funding mechanisms, including public-private partnerships and international climate finance.

Collaborating with diverse stakeholders such as labor unions, business executives, and civil society is essential to establishing agreement over the transformation. Given South Africa’s position within the Southern African region, it is necessary to adopt a regional perspective that considers the interconnectedness of economies and the potential for collaborative initiatives in renewable energy and industrial development.

Industrial symbiosis is where companies and sectors cooperate to optimize their feedstock supply and energy and waste flows, as well as collaborate with other sectors such as agriculture, food, energy, and building utilities. Hence, the synergies of industries play an essential role in GHG emission reduction. For instance, waste gas from steel manufacturers can be captured and utilized to produce high-value-added chemicals.

Sources

- Department of Science and Innovation. (2021). Hydrogen society roadmap for South Africa. https://www.dst.gov.za/images/South_African_Hydrogen_Society_RoadmapV1.pdf

- Andreoni, A., Bell, J. F., & Roberts, S. (2023). Green hydrogen for sustainable (re)industrialisation in South Africa: Industrial policy for hard-to-abate industries and linkages development (CCRED Working Paper 2023/08). Centre for Competition, Regulation and Economic Development, University of Johannesburg. Retrieved from https://www.researchgate.net/publication/370923792

- Zhen, Z., Li, B., Ou, X., & Zhou, S. (2024). How hydrogen can decarbonize the chemical industry in China: A review based on the EIC–TER industrial assessment framework. International Journal of Hydrogen Energy, 60, 1345-1358.

- Rajabloo, T., De Ceuninck, W., Van Wortswinkel, L., Rezakazemi, M., & Aminabhavi, T. (2022). Environmental management of industrial decarbonization with focus on chemical sectors: A review. Journal of Environmental Management, 302, 114055.

- Nicholson, S. R., Rorrer, N. A., Uekert, T., Avery, G., Carpenter, A. C., & Beckham, G. T. (2023). Manufacturing energy and greenhouse gas emissions associated with United States consumption of organic petrochemicals. ACS Sustainable Chemistry & Engineering, 11(6), 2198-2208.

- Mallapragada, D. S., Dvorkin, Y., Modestino, M. A., Esposito, D. V., Smith, W. A., Hodge, B. M., … & Taylor, A. D. (2023). Decarbonization of the chemical industry through electrification: Barriers and opportunities. Joule, 7(1), 23-41.

- Griffiths, S., Sovacool, B. K., Del Rio, D. D. F., Foley, A. M., Bazilian, M. D., Kim, J., & Uratani, J. M. (2023). Decarbonizing the cement and concrete industry: A systematic review of socio-technical systems, technological innovations, and policy options. Renewable and Sustainable Energy Reviews, 180, 113291.

Figueiredo, R. L., da Silva, J. M., & Ortiz, C. E. A. (2023). Green hydrogen: Decarbonization in mining-Review. Cleaner Energy Systems, 5, 100075

To all knowledge

To all knowledge