1 Introduction

1.1 Shale reservoirs

The term oil shale ordinarily applies to any sedimentary rock containing solid bituminous elements (called kerogen) that are liberated as petroleum-like fluids when heated in the chemical process of pyrolysis. Millions of years ago, oil shale was formed by depositing silt and organic debris on lake beds and sea bottoms. Over long periods, heat and pressure converted the materials into shale in a process similar to the process that forms conventional oil; however, the heat and pressure were less intense.

Whereas oil shale is found in many places around the globe, the largest deposits by far are located in North America. Not all resources are recoverable; however, even a moderate estimate in some of the most studied and extended formations is several times greater than the proven oil reserves of countries like Saudi Arabia.

Oil shale generally contains enough petroleum that it will burn without any additional processing. This unconventional resource can be mined and processed to generate oil similar to the one pumped from standard wells; however, extracting oil from shale is more complex than conventional oil recovery and currently is more expensive. The petroleum substances here are solid and cannot be pumped directly out of the ground; oil shale must first be mined and then heated to a high temperature — the resultant liquid must then be collected.

An alternative experimental process referred to as in situ recovery involves heating the oil shale while still underground and then pumping the resulting liquid to the surface.

1.2 Why EOR?

Oil and gas resources remain the planet’s major contributor to energy supply even with the recent rise in energy generation from renewable sources. As global energy demand increases in contrast to diminishing energy resources, maximising oil recovery from previously under-exploited reserves becomes decisive to meet the ever-increasing energy demand.

The current technique to produce shale oil is to use horizontal wells with multi-stage stimulation. However, the primary oil recovery factor is only a few per cent. The oil recovery from shale reservoirs is less than 10% on average [1]. The oil recovery factor for each of 28 U.S. tight oil plays is below 10%.[2]. Therefore, there is immense potential to enhance oil recovery (EOR) in shale and tight reservoirs. In terms of EOR methods, gas injection, especially huff‐n‐puff gas injection, has been extensively studied. Although water injection may not be as effective as gas injection, many efforts have also been made to add surfactants in water and fracturing fluid for the EOR purpose.

Well productivity in shale oil and gas reservoirs primarily depends on the fracture network’s size and the stimulated reservoir volume, which provides highly conductive conduits to communicate the matrix with the wellbore. The natural fracture complexity is critical to the well production performance, and it also provides an avenue for injected fluids to displace the oil. However, the disadvantage of gas flooding in fractured reservoirs is that injected fluids may break through to production wells via the fracture network. Therefore, a preferred method is to use cyclic gas injection to overcome this problem.

2 EOR Fundamentals

2.1 Shale mineralogy

The uniqueness of shale can be mainly attributed to the fact that the direct correlation of porosity and permeability in sandstone reservoirs does not hold shale. Like sandstones, shale is also sedimentary rock and has good porosity, but it has a very low permeability. To understand this unique behaviour of shale, one must understand the mineralogy of shale.

Shale is a very fine‐grained sedimentary rock composed of tiny mud particles, clay minerals, and an associated organic material called kerogen. The main clay-sized mineral grains in a shale sample are montmorillonite, illite, kaolinite, and chlorite, along with other mineral particles such as quartz, chert, and feldspar. Along with these particles, a few other constituents of shale may include organic particles, minerals of carbonates, iron oxide and sulfide minerals, and heavy mineral grains.

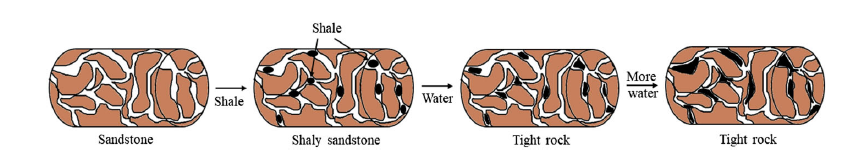

The interstitial spaces in shale are tiny, which makes shale mineralogy to be dominated by nano‐pores. In sandstone reservoirs, shale is also found in small to significant quantities. Shale in sandstone reservoirs can be found in the form of a structural layer, lumps of shale rock, and tiny pieces of shale just dispersed all over the reservoir or in the form of bands and divisions. Thus, the increasing amount of shale in sandstone will progressively create the network of nano‐pores as shown by the schematic in Figure 1, and after a specific limit, the flow from the sandstone will be governed by these nano‐pores.

Figure 1. Schematic showing the effect of shale swelling on available free pore space in conventional sandstone. Source: https://doi.org/10.1002/apj.2352

Therefore, it becomes pertinent to know when oil recovery methods such as gas-injection or water flooding may fail to work in reservoir enriched with heterogeneous shale components.

2.2 Cyclic gas injection

Cyclic gas injection is an effective and quick responding enhanced-oil-recovery method in intensely naturally fractured or hydraulically fractured reservoirs. The fast payout is an excellent characteristic to attract the industry’s interest in investing in these projects. One of the limitations of water or gas introduction in tight shale oil reservoirs is that the fluid injectivity is modest due to the very low permeability of shale.

The U.S. Energy Information Administration published a report [3] about the world shale gas and shale oil resource assessment. Cyclic gas injection (CGI) in a single horizontal well is not affected by early gas breakthrough. Compared to gas flooding, cyclic gas injection is a more effective recovery process in tight shale oil reservoirs. Enriched-gas displacements are widely used as a secondary recovery process because it is possible to obtain high local displacement efficiencies for enriched gas with reservoir oil.

Gas injection is considered an effective recovery process that has been widely used worldwide. There are limited pilot field projects conducted on the EOR process by gas injection in shale oil reservoirs. Although many studies have been under

taken on gas injection in tight gas or oil reservoirs, the primary recovery mechanism in shale oil reservoirs is not well understood. Diffusion plays an essential role in the oil recovery process in fractured shale reservoirs.

Experts have been studying for how long to inject and then soak the reservoir with gas. Some findings suggest that achieving high-enough pressures to maximise or spread out the contact area is essential to the process [4]. This also gives reason to assume that all new barrels of oil that reach the surface are likely to have come from just a few inches into the rock at most — the production comes from the near-fracture areas, there is no place to talk about the reservoir as if it contributes.

Some of the top factors determining if a shale reservoir is fitting EOR include natural fractures, gas-to-oil ratios, API gravity, fault locations, external stresses, and negative communication due to frac hits. Where all these points line up tend to be in the lighter hydrocarbon windows.

Figure 2. Oil recovery factors of cyclic gas injections using different gas media. Source: https://doi.org/10.1007/s12517-020-5131-4

2.3 Chemical enhanced oil recovery

For unconventional (shale and tight) reservoirs characterised by poor or extra-low permeability, the addition of surfactants at appropriate concentration into frac fluids was described to improve fracking performance by modifying the matrix wettability, and consequently, the fluid flow behaviour. Accordingly, the aqueous phase penetrates the matrix by overcoming the capillary forces trapping the oil, resulting in greater oil recovery.

The rationale behind this method is to reduce the capillary pressure of the system using surfactants as additives in fracturing fluids. Hence, more oil can be produced due to the further imbibition of brine into these rocks. Reducing the capillary pressure by, for instance, using surfactants with hydraulic fracturing fluid can potentially boost the amount of oil recovery from reservoirs. Surfactant molecules tend to accumulate at fluid-fluid and rock–fluid interfaces [5].

2.4 Microwave heating

To develop oil shale, kerogen is heated at an appropriate temperature for days to months by in situ heating methods. Among them, the microwave heating method has the advantage of heating oil shale layers with high efficiency.

Many researchers have already proposed and investigated microwave heating to overwhelm the difficulties in reservoir development [6]. Some used numerical simulation analysis to show that microwave heating could efficiently remove water and create microfractures in tight gas sand. Others performed numerical simulations to prove the possibility of microwave heating for enhanced shale gas recovery.

Microwave heating has also been analysed experimentally for developing oil shale. It has been shown that microwave heating could rapidly heat oil shale and obtain shale oil with high efficiency. Although oil shale has a low dielectric constant, enhancing its microwave absorption could be accomplished by adding carbon and iron oxide nanoparticles.

The transformation of oil shale during microwave treatment involves complex physical and chemical reactions. Much progress has been made comparing the similarities and differences between microwave heating and conventional heating with different fundamental parameters in recent years. These parameters include heating rate, temperature distribution, shale oil production and quality, gas volume and composition.

The results have shown that microwave heating accelerates the heating rate and improves the production and quality of shale oil compared with conventional heating. In contrast to heat convection and heat conduction, microwave heating induces the fragmentation of large molecules and promotes the decomposition of chemical bonds.

In addition to the above investigations, it is also essential to comprehensively explore the changes in the microstructure of oil shale, including developing the pore network and creating fractures. The microstructure of oil shale directly influences heat transfer and mass transport, particularly in shale oil and gas flow after in situ conversion.

2.5 Fractures and productivity

Natural fractures are critical to the well productivity in shale oil reservoirs. A distinct feature of exploiting shale oil reservoirs by secondary cyclic gas injection is that the fracture-network spacing is more critical than fracture conductivity. The fracture-network spacing is predominant and plays a more crucial role than fracture network conductivity in enhancing oil recovery.

If the infinite conductivity primary hydraulic fractures were connected to a finite conductivity network, the hydraulic fracture or fracture-network conductivity reduction due to the stress effect would not result in significant ultimate oil recovery loss by using the cyclic gas injection technique.

The priority in designing fracture treatments for enhancing oil recovery in shale oil reservoirs should be maximising the fracture network complexity rather than spending money by pumping large proppant volumes to maximise the fracture conductivity. It is recommended that creating dense fracture spacing in shale oil reservoirs will lead to more effective completion designs and bring more productivity to enhanced oil recovery by the cyclic gas injection process.

The paramount well productivity is from the stimulated reservoir volume (SRV). The number of fracking treatment stages is central to improving the stimulated rock volume, which provides the main drainage area and the flow conduits for hydrocarbons.

The role of diffusion in a field-scale displacement on the enhanced-oil-recovery process by cyclic gas injection are central aspects to be considered.

2.6 Numerical simulation

A numerical simulation approach can evaluate the EOR potential in fractured shale oil reservoirs by cyclic gas injection. Simulation results may indicate if the stimulated fracture network contributes significantly to the well productivity via its contact volume with the matrix, which prominently enhances the macroscopic sweep efficiency in the secondary cyclic gas injection process.

In some previous simulation works, the EOR potential was evaluated in hydraulic planar traverse fractures without considering the propagation of natural fracture-network. Researchers have examined the effect of fracture networks on shale oil secondary production performance. The impacts of fracture spacing and stress-dependent fracture conductivity on the ultimate oil recovery are investigated. Their results demonstrate an EOR potential by cyclic gas injection in shale oil reservoirs [6].

The objective of numerical simulation tools focuses on evaluating the effects of fracture spacing, the size of fracture-network, fracture connectivity (uniform and non-uniform) and stress-dependent fracture-network conductivity on production performance of shale oil reservoirs by secondary cyclic gas injection.

2.7 Reservoir imaging techniques

The planning of any recovery scheme requires an accurate characterisation of the formation. Petroleum reservoirs that are always heterogeneous, often fractured, and necessarily anisotropic have been modelled with the assumption of homogeneity, simple geometry and isotropic features. While new techniques for imaging the formation have flourished, few have been fully incorporated in reservoir characterisation.

Borehole imaging tools provide high-resolution borehole images based on (generally) either ultrasonic velocity or resistivity. Borehole imaging tools provide wall coverage between 20% and 95%, depending on the tool specification and borehole diameter.

Kingdon et al. [8] provided one with several stages for ensuring proper management of fracture characterisation. They are:

- Review and correction of metadata to ensure that all are adequately located and orientated.

- The addition of borehole construction metadata includes casing intervals and downhole bit size, allowing for accurate section-by-section review of borehole data.

- Where possible, inclinometer surveys from borehole image logs should be reloaded from original media to maximise availability and auditability.

- Review of all available data to ensure that any previously unidentified image logs are included and processed.

- Loading of the entire available digital archive of both the radioactive waste disposal program (whenever available) and also the oil and gas industry, which includes outputs from a variety of borehole imaging tools.

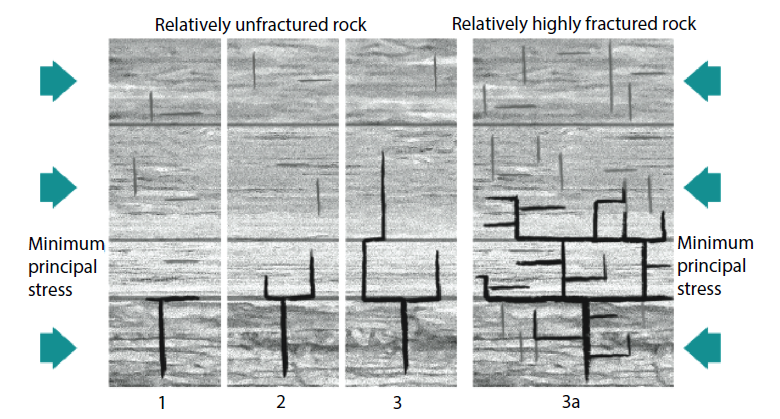

Figure 3. Different scenarios in fractured shale formation. Source: https://doi.org/10.1002/9781119479239.ch5

Some of the considerations of reservoir characterisation must be altered for shale due to the unique features of shale oil. Figure 3 shows how induced fracture would propagate in shale. Scenarios 1, 2, and 3 represent theoretically possible directions of fracture propagation resulting from increasingly higher levels of fracture-inducing force. As force increases in relatively unfractured rock, fractures propagate perpendicular to the direction of maximum principal stress. When they encounter a rock layer boundary (which is naturally weaker), the energy forcing the fracture dissipates laterally, making it harder for a fracture to continue across borders. In more fractured rock (scenario 3a), even with the same pressures as seen in 3, pre-existing fractures can cause energy forcing a fracture to dissipate in other directions. Because of the many boundaries between rock layers and pre-existing fractures in scenario 3a, the fractures propagated are wider and shorter than they would usually be if the same rock were relatively unfractured.

Usually, the sonic log is used as the porosity indicator. In alternative techniques, the transit time curve and the resistivity curves are scaled. The sonic curve lies on top of the resistivity curve over an extended depth range, except for organic-rich intervals where they would show crossover between themselves. An integrated workflow in which well data and seismic data are used to characterise the hydrocarbon-bearing shale can be developed.

3 Study Cases

Table 1. Shale producers working on cyclic gas injection. The list is not exhaustive. Source: Company announcements and public reports.

3.1 Permian Basin of West Texas

The Woodford Shale is considered an essential source of hydrocarbons within the Permian Basin. Based on its geographic location and depositional characteristics, this shale has been discovered in three different basins: the Woodford (Arkoma Basin) and Cana-Woodford (Anadarko Basin) of Oklahoma, and the Barnett Woodford (Delaware Basin) of Texas. The Permian Basin hosts the most extensive CO2-EOR flooding efforts in the United States, and within the basin, CO2-EOR flooding occurs primarily in carbonate reservoirs, specifically dolomite formation.

In the second half of 2016, Houston-based EOG Resources announced that its shale EOR program increased production from vintage horizontal wells in south Texas’s asset. In following quarterly earnings statements, EOG stated it continued to see solid outcomes from almost 150 enhanced oil recovery wells, more than a third of which were converted in 2018. Engineering consultants have noticed about 100 other wells in the asset that several other operators have converted into huff-and-puff injectors. Data analysts found dozens of pad wells that saw a combined 10-fold rise in production above their trough after physically combing through filings at the Texas Railroad Commission. Not so long ago, it was unimaginable to see these data.

Among the standouts, a group of eleven wells reached a combined peak production rate in late 2011 of about 90,000 barrels (bbl) a month. By mid-2017, these wells were pumping out hardly 5,000 bbl. After gas injections began, the group yielded 40,000 bbl a month—an average increase from about 15 barrels per day (B/D) to 117 B/D per well. Another case involved 14 wells that topped at 330,000 bbl a month in 2013, then plummeted to 10,000 bbl. Post injection, output escalated to 170,000 bbl a month.

Figure 4. Areas in red are believed to perform best under cyclic gas injections, or huff-and-puff, in the Eagle Ford Group. Source: https://jpt.spe.org/shale-eor-delivers-so-why-wont-sector-go-big

3.2 Bakken

The Bakken is found in the Williston Basin underlying North Dakota, Montana, South Dakota, and Saskatchewan, Canada. This shale is not a new discovery, having been initially found to contain oil in the 1970s. During the 2000s, thanks to a higher oil price and the introduction of new and effective well completion technologies, production in this area have increased dramatically.

Wells drilled in the Bakken shale come with a high price tag. The target formation is at a depth of approximately 10,000 ft and requires laterals of anywhere from 5,000 to 10,000 ft in length [9]. The formation is exceptionally tight and has a low matrix permeability of approximately 0.05 mD, with limited evidence of natural fractures. Fractures treatments are pretty large, and only with high oil prices can the Bakken formation produce oil economically.

Primary recovery in the Bakken, due to the nature of the reservoir, is low. This necessitates the use of EOR to lower declines, increase oil recovery, and extend the field’s economic life. Different operators have reviewed the technical and financial merits of water, carbon dioxide, and natural gas flooding as secondary and tertiary recovery methods during the project evaluation stage. Typically, processed solution gas was determined to be the most effective injectant because the high compressibility and low viscosity characteristics provide greater access to the formation and replace voidage in a tight-oil reservoir. Core flooding experiments have demonstrated that low salinity waterflood can work as a plausible solution to improve oil recovery from Bakken formation by controlling the rate of osmosis [10].

Most Bakken injection trials have used a huff-and-puff technique. Successful CO2 huff-and-puff approaches in conventional wells typically see full improved oil production shortly after soaking for several weeks. While these Bakken tests would not be deemed successful compared with conventional huff-and-puff tests, it is vital to keep in mind that Bakken is an unconventional tight oil play.

4 Major Challenges

4.1 A financial tug-of-war

The oil is there, the process is proven, the gas is nearby. So why won’t the sector go big? The truth is that unconventional oil producers are still trying to weigh the options from what amounts to a complicated pros-and-cons list. Generating a shale EOR business may mean drawing resources away from new exploration projects with more immediate returns, the same problem that has hindered the U.S. refracturing market. On the other hand, shale EOR enjoys impressive economics for companies willing to reinvest in wells and land already paid for. This economic antagonism has been playing out in the shale sector since 2016. That was when Houston-based EOG Resources announced that its shale EOR program increased production from vintage horizontal wells in south Texas’s asset (see section 3.1).

Watson’s study [11] encompasses more than a dozen other shale EOR developments, but most withheld performance data instead of reporting only project costs. As elusive as the shale EOR project has become so far—at least outside of academic research—operators have shared these eye-openers for one fundamental reason: they have to. That is, if they wish to take advantage of the tax incentives available for all EOR programs. Observers and proponents in the EPC consulting sector are emphasising that the results above are not fortunate. The troublesome point here is that replicating them entails several factors to come together:

- The operator has both the money and time to develop the project

- Management must be willing to pioneer in the uncertain territory and new technology

- Fluid properties and fracture networks must be optimal for injections

- Investors and lenders accept the upfront capital investment

Figure 5. A multimillion-dollar compression system being assembled next to a horizontal well pad site in Texas. Source: https://assets.spe.org/36/36/707376a6ab79930c0843f74adaa5/jpt-2019-05-shaleeorhero.jpg

In such a manner, technical success is not enough. A small number of shale producers are known to be testing injection operations of various scales and moving forward commercially. That is because early results have not proven to be enough to warrant significant investments by most of the sector. From a technical standpoint, one of the big pieces of this process is the lack of long-term data to be confident that one is increasing overall recovery instead of just accelerating production.

Such certainty will be critical in pulling down the perceived risk profile of shale EOR operations, given the sector’s financial limitations. With access to new capital narrowing, the challenge to understand the long-term potential of shale EOR is likely to continue. Further, unless oil prices increase significantly, the operators’ priority will keep firmly set on drilling new wells that deliver thorough returns in their first year. And if the total value of shale EOR can be realised after the first injection period (unlike traditional EOR), the payoff can take up to two years due to the expense of “filling up” the exhausted wells with gas.

4.2 The bottlenecks

Not long ago, the biggest holdup for shale EOR involved access to the high-horsepower compressors that seem to work best; it seemed that the interest in the process had far outpaced the supply of these compressors — if a developer wanted to order a gas compressor to inject, he simply could not find one. Typical field compressors have an upper limit of about 4,000 psi. Here, we are going up to 8,000 or 9,000 psi, which is not easy to find in the market.

The most sought-after compressors are high-horsepower engines that must be paired with a piece of equipment that does the general gas compression, and there are only a few firms around the globe that supply the entire assembly. The long wait was seen as worth it, though, since these massive compressors are essential to minimising the time it takes to see the effects of EOR. That is because early field results strongly indicate that if a project wants to be successful, it better goes big, both in terms of the horsepower and the number of wells being converted to huff-and-puff injectors.

The best returns are seen on projects that involve at least ten wells; such large projects might even crave two of the large compressor units on the same site. Multiple factors dictate performance, but specialised reports showing estimated project economics support the idea that operators using the most capital are foreseeing significant returns.

Once the compressor is on its way to the field, the ramifications of shale EOR are only partially solved. Aside from obtaining the equipment, the next challenge to overcome is providing them with enough gas to satisfy their voracious demands of about 15 million cubic ft a day each. Many locations might have sufficient supply for a single compressor, but the issues begin to appear when meeting more than two input needs.

4.3 Reservoir characteristics

Horizontally, confinement has so far been a concern to practitioners — the worry is over the long, tensile fractures created via early-generation stimulations. While a wide surface area for the gas to interact with is crucial to performance, there may be situations where the tensile fracturing networks are overly extensive, causing the gas to migrate rapidly through neighbouring wellbores.

Operators are in a growing need of pressure, volume, and temperature (PVT) analysis to comprehend how the injections will perform downhole. Consultants now use PVT reports to find key indicators such as the first-contact miscibility (FCM) pressure of the formation — knowing it means knowing the pressures at which the condensate-rich gas will begin affecting oil flow. By doing so, they advise operators that the correlated bottom hole injection pressure should not exceed the rock’s fracture gradient, or else new geomechanical complications arise from refracturing the formation.

Figure 6. Phase envelope of oil mixture using two different Equation of State (EoS) models. Source: https://www.calsep.com/news/10010/219/10-Common-EoS-Model-Development-for-Reservoir-Fluids-with-Gas-injection/d,techtalkdetails.html

4.4 Sequencing

An EOR cornerstone is the order in which gas injections take place between a group of wells. What is more, the shale sector has learned that the pad wells communicate, which is a significant deciding factor in sequencing.

Reservoir models are thus employed to derisk the concatenation options. Based on a history of intense frac hits during the completions phase, scenarios where wells are highly communicative may turn out to be noneconomic for enhanced oil recovery. Contrarily, when converting isolated individual wells to EOR, sequencing will have almost no impact on the project economics.

Another challenge of gas flooding is that the injected gas is subject to early breakthrough in densely fractured shale gas or oil reservoirs, resulting in poor flooding performance. In the worst cases, the main danger is that the wells end up recycling the pumped gas from one to the next, with a slight improvement in production. To sum up, how critical sequencing is, we should acknowledge that if a shale operator does not find the correct order, it can lose money, and incremental recovery will be terrible.

5 Conclusion

Unconventional shale oil reservoirs are becoming increasingly crucial to hydrocarbon supplies across the world. Shale rocks have complex nano- and micro-scale pore networks and sophisticated matrix mineralogy. They mainly consist of clay minerals, carbonate/quartz grains, and organic matter with very low permeabilities. Therefore only a limited portion of the primitive oil in place is recoverable by primary production.

The low recovery and the abundance of shale reservoirs provide the massive potential for enhanced oil recovery. Well completions will be pivotal to the success of any EOR venture. A detailed understanding of offset wells’ production history and completions is also unavoidable for valid test result interpretations. A compliance control strategy also will be essential to influence production positively.

There is an excellent reason to be optimistic about the future of EOR in tight oil formations. Laboratory studies point to significant potential for high rates of oil mobilisation using both produced field gas and carbon dioxide injection under the right conditions.

Achieving success involves understanding the reservoir and if its conditions are agreeable to the EOR process. To adopt the long-term conception of shale EOR, producers will be required to redistribute time and resources to the effort.

6 References

[1] http://www.ndoil.org/?id=78&advancedmode=1&category=Bakken%20Basics

[2] Advanced Resources International, Inc. EIA/ARI world shale gas and shale oil resource assessment, report prepared for U. S. Energy Information Administration/U.S. Department of Energy, June. Arlington, VA, USA; 2013.

[3] U.S. EIA/DOE. 2013. Technically Recoverable Shale Gas and Shale Oil Resources: An Assessment of 137 Shale Formations in 41 Countries Outside the United States.

[4] Gbadamosi, A.O., Junin, R., Manan, M.A. et al. An overview of chemical enhanced oil recovery: recent advances and prospects. Int Nano Lett 9, 171–202 (2019). https://doi.org/10.1007/s40089-019-0272-8

[5] Mirchi, V., Saraji, S., Goual, L., & Piri, M. (2015). Dynamic interfacial tension and wettability of shale in the presence of surfactants at reservoir conditions. Fuel, 148, 127–138. doi:10.1016/j.fuel.2015.01.077

[6] https://onlinelibrary.wiley.com/doi/epdf/10.1002/ese3.311

[7] Wan, T. (2015). Investigation of EOR performance in shale oil reservoirs by cyclic gas injection (Doctoral dissertation).

[8] Kingdon, A., Fellgett, M. W., & Williams, J. D. (2016). Use of borehole imaging to improve understanding of the in-situ stress orientation of Central and Northern England and its implications for unconventional hydrocarbon resources. Marine and Petroleum Geology, 73, 1-20.

[9] Clark, Aaron J. “Determination of Recovery Factor in the Bakken Formation, Mountrail County, ND.” Paper presented at the SPE Annual Technical Conference and Exhibition, New Orleans, Louisiana, October 2009. doi: https://doi.org/10.2118/133719-STU

[10] Fakcharoenphol P, Kurtoglu B, Kazemi H, Charoenwongsa S, Wu Y. The effect of osmotic pressure on improve oil recovery from fractured shale formations. Proceedings of SPE Unconventional Resources Conference; April 1–3, 2014; United States of America.

[11] Jacobs, Trent. “Shale EOR Delivers, So Why Won’t the Sector Go Big?.” J Pet Technol 71 (2019): 37–41. doi: https://doi.org/10.2118/0519-0037-JPT

To all knowledge

To all knowledge