Introduction

The world is at a point in history where decarbonization of energy sources has become imperative. There are two important reasons why decarbonization and sustainability have become the focus of global attention. One reason, which has been widely publicised and debated, is the threat posed by climate change, due to accumulated Greenhouse gases from decades of using polluting fuels. The other reason is linked to the technology “megatrend”, which embeds computer and digital technologies at the core of all economic and social activities. To illustrate, automation and Artificial Intelligence, IoT, digital money, intelligent transportation systems, robotics, online education, entertainment and e-commerce, are affecting all significant domains of human existence. Billions of investment dollars are pouring-in, reflecting the belief that these sectors will propel the world’s economic growth. However, there is a potential showstopper to overcome. Running a dense worldwide-web of computers, cloud servers, communication networks, transportation, industrial facilities and supporting a global population in excess of 8 billion, will consume huge amounts of energy, especially electricity. The energy requirement to realise this vision will be several orders of magnitude higher than what the world currently produces. If all this additional power were to be met through fossil fuels, the resultant Carbon Dioxide burden would be unimaginable. The only way forward is decarbonized energy.

Fossil fuels, which supply the bulk of current global energy requirements, are not a long-term option, as they cannot be replenished. Oil and Gas fields have a limited life-span and it is becoming more difficult to locate new reserves. Mining and extraction activities related to Oil, Gas and Coal have degraded the environment in many areas of the world, including deforestation, subsidence and pollution. The current fossil-fuel based, inefficient and ecologically destructive paradigm that has underpinned industrial growth for over a hundred years is obsolete and simply cannot deliver the quantity and quality of energy required in the future. The energy transition is therefore an existential necessity. In this context, Hydrogen is seen as a key component of the future energy mix.

Hydrogen is found in abundance on our planet, as it is contained in Water, Biomass, Petroleum Hydrocarbons and Coal. It is the only fuel with zero Carbon emissions and has excellent calorific value. The Energy and Chemicals sectors are familiar with Hydrogen and the technologies for producing and handling it at large scale are well established. Rocket engines have used liquid Hydrogen for many decades. Hydrogen Fuel cells, which are more efficient than internal combustion engines, have been commercially deployed in significant quantities, for stationary as well motive power applications.

The industrial production of Hydrogen is currently based on utilization of Natural Gas, liquid Petroleum fuels or Coal as feedstocks. Global demand for Hydrogen in 2019 was 115 million TPA (tonnes per annum), of which 70 million TPA was pure Hydrogen used in Refineries, Ammonia and Chemical industries. The balance 45 million TPA of Hydrogen was produced in combination with other combustible gases, for internal use in Steel and Methanol industries. Historically, demand for Hydrogen, has grown by three times since 1975 [1]. Hydrogen is currently a $122 billion industry and the market size for pure Hydrogen is projected to exceed $200 billion corresponding to demand of 120 million tonnes per annum by 2026. This demand will arise from emerging markets in transportation, fuel cells, heating, steel production, stationary power generation [2].

However, there are major drawbacks that must be overcome before Hydrogen can fulfil its potential as the preferred fuel of the future. At present, almost all the Hydrogen produced is from fossil fuel feedstocks, without Carbon Dioxide capture. As much as six percent of global Natural Gas and two percent of global Coal are consumed for Hydrogen production. Each tonne of Hydrogen manufactured by Steam Reforming of Natural Gas emits nearly nine tonnes of Carbon Dioxide. Coal gasification is much worse, since nearly twenty tonnes of Carbon Dioxide are emitted per tonne of Hydrogen produced [1]. The way Hydrogen is currently produced, therefore, makes it part of the problem, rather than a potential solution for the future.

So, are there better ways of making Hydrogen that mitigate this problem? It turns out that Hydrogen, can be manufactured via numerous pathways, using various feedstocks and energy sources. Some of these pathways are entirely Carbon free, such as Green Hydrogen production by electrolysis. Many Hydrogen production pathways are Carbon neutral, meaning that the process does not add Carbon Dioxide to the atmospheric inventory of Greenhouse gases. The decomposition of biomass to produce Hydrogen from the Carbohydrate matrix is an example of a Carbon neutral process. This is because plants and trees absorb Carbon Dioxide from the atmosphere during their growth phase and this is released during biomass decomposition or combustion. For the same reason, synthetic biofuels such as Bioethanol and Biodiesel are Carbon neutral.

The “Hydrogen economy” vision is based on the premise that sufficient quantities of sustainably produced, low-Carbon Hydrogen can be produced globally, to fulfil the future energy needs of mankind. But how far has the world really progressed on the path to sustainable Hydrogen ?

Sustainable Hydrogen Demand and Supply

While official projections and periodic big-ticket announcements by corporations give an impression of hectic momentum, data on completed sustainable Hydrogen projects indicates that actual achievements do not match the rhetoric.

According to the IEA database, during the two decades from year 2000 to 2021, only 295 sustainable Hydrogen projects had been commissioned or were at the construction stage. As many as 269 of these were based on electrolysis of Water using renewable electricity and 19 projects utilized fossil fuels but with Carbon Capture and Sequestration (CCUS) to minimize Carbon emissions [3].

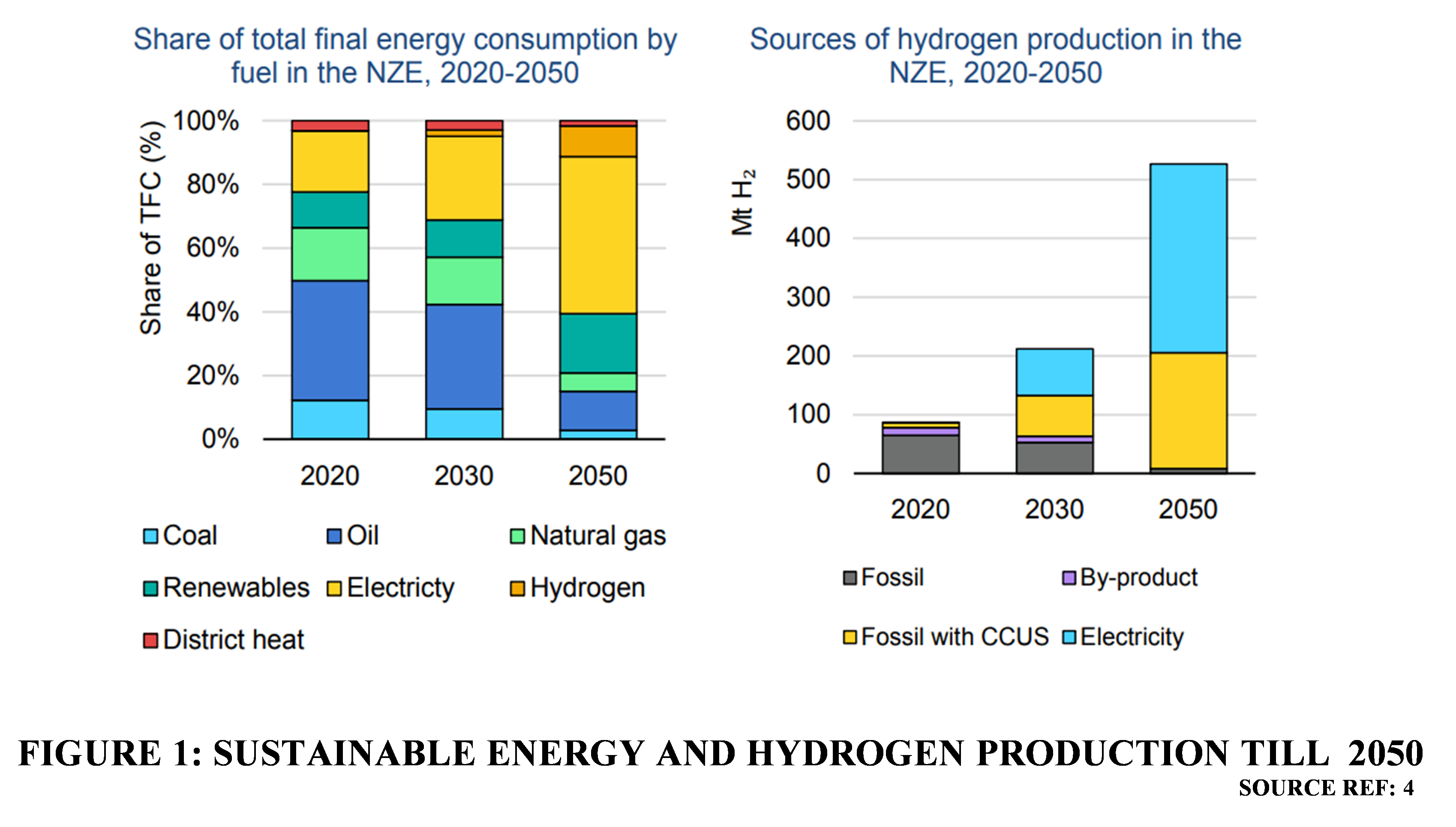

Even optimistic estimates by the IEA indicate that Electrolysis and CCUS projects can deliver only 8 million tonnes of Hydrogen against the targeted production of 80 million tonnes of sustainable Hydrogen by 2030. Eventually, global Hydrogen production is expected to reach 500 million tonnes by 2050 [4].

Figure 1 shows projections by the IEA for energy as well as Hydrogen demand and production till the year 2050. The dependence on Electrolysis and CCUS to meet Hydrogen production goals is obvious.

Figure 1

The major issues currently holding back progress in sustainable Hydrogen production are:

Lack of Investment

From a purely financial perspective, the two main technology options for sustainable Hydrogen, namely Electrolysis and Natural Gas reforming with CCUS, are not competitive when compared to conventional Hydrogen production from fossil fuels. The levelized cost of Hydrogen production from Natural Gas, based on regional gas prices, ranges from USD 0.5 to USD 1.7 per kg. Using CCUS to reduce Carbon Dioxide emissions increases the levelized cost of production to around USD 1 to USD 2 per kg. Using renewable electricity to produce Hydrogen costs USD 3 to USD 8 per kg. The cost of renewable electricity can constitute 50-90% of total Hydrogen production costs. This depends upon on electricity costs and the duration for which renewable supply is available [4].

Several governments are trying to steer investments towards this sector by a mix of incentives, penalties and other regulatory measures. However, ever since the 2008 global economic crisis, market volatility, conflicts, and of course the COVID pandemic have stretched the financial resources of countries and international funding institutions. Large private investors have preferred to fund projects in other commercially attractive sectors. Fund allocations for unviable, futuristic energy projects are therefore limited.

Technology Risks

There are still many technology challenges to be resolved in the production of Hydrogen by Electrolysis and in establishing large-scale Hydrogen supply chains. Sourcing of renewable energy is also a challenge, since it is location dependent. Steam Reforming of Natural Gas is proven technology, but the CCUS aspect is not well established and adds significantly to costs. Carbon Dioxide Sequestration is possible only where geological conditions are suitable. Large scale utilization of captured Carbon Dioxide needs a lot more research.

Absence of a Global Hydrogen Market

Unlike Crude Oil, Natural Gas and Coal, there is no global market for Hydrogen fuel. Almost the entire global production of 70 million TPA of pure Hydrogen today is produced on-purpose to meet the requirements of Refineries, and Ammonia manufacturing units. Similarly, Hydrogen from Coal gasification is usually an integral part of Methanol production units or Steel plants. To expand the Hydrogen market to 500 million TPA by the year 2050, it is essential to establish global markets and global supply chains for Hydrogen, on a scale similar to what exists for fossil fuels.

Notwithstanding the disappointing progress thus far, concerted international efforts are definitely in the right direction and must be supported. We owe it to our future generations, to undo the adverse effects of ecologically destructive growth models of the past. However, there is an obvious need to recast the growth strategy by broadening the portfolio of technologies that can be tapped for sustainable Hydrogen production It is clear that relying only on Electrolysis and CCUS based Hydrogen projects will be insufficient.

In this context, a lot of research has been done on alternative pathways to produce sustainable Hydrogen. The technology landscape is evolving quite rapidly, since there is a race among commercial entities to dominate the Hydrogen energy domain, with proprietary and patented offerings.

A unique feature of Hydrogen is the wide range of feedstocks and pathways from which Hydrogen can be produced on an industrial scale. To facilitate development of the Hydrogen sector on the basis of a consistent theoretical framework, an informal color coding convention has evolved as shown in Figure 2. The informal system assigns a color code to Hydrogen, depending on the method of production and decarbonization aspects [5].

Figure 2

It may be noted that Biogas or any biomass-based pathway to Hydrogen, including biomass gasification does not find place in the color coding convention, at present. It is inevitable however, that the pool of technologies will be expanded to include all forms of biomass-based Hydrogen since current strategies are not delivering on targets.

The Significance of Biogas For Sustainable Hydrogen Production

Biogas is a generic term used to describe a flammable gas produced by anaerobic biological decomposition of organic matter. Its existence has been known to mankind since ancient times. It was originally observed in marshes and hence was called “Marsh gas”. The composition of Biogas varies depending on the source. It is primarily Methane and Carbon Dioxide, with Methane constituting about 45 % to 75% by volume and Carbon Dioxide 25% to 55% by volume. Impurities such as Hydrogen Sulphide and other trace gas compounds may be present.

Biogas is recognized as a significant and affordable renewable energy source. The International Energy Agency (IEA) has published an analysis of its global sustainable energy potential, covering various feedstocks and production costs [6]. The report acknowledges that Biogas and Biomethane have the potential to support the world’s goals to mitigate global warming, improve air quality and provide sustainable energy. It may be noted here that the report includes Biomethane produced by thermal processing of Biomass, in addition to anaerobic decomposition. Interestingly the report observes that in the year 2018, Biogas and Biomethane contributed 35 million tonnes of oil equivalent (Mtoe), to the world’s energy consumption. This is only a small fraction of the existing potential, and the report estimates that full utilisation of existing Biogas and Biomethane potential could cover some 20% of today’s worldwide gas demand [6].

Figure 3 illustrates the worldwide Biogas production, vis-a-vis the potential of Biogas and Biomethane in 2018.

In terms of technology and maturity, commercial Biogas production is well established. The European Union, which is the world leader in Biogas production, had over 17,200 biogas plants with an installed electric generation capacity of 8.293 MW and produced 15.6 Mtoe of primary energy from Biogas in 2015 [7].

The relevance of Biogas for Hydrogen supply chains stems from the following three factors:

- Biogas is a cheap source of Methane. Unlike Natural Gas, which involves huge expenditures on exploration, production and transportation, Biogas can be generated from locally available organic solid and liquid wastes, at negligible cost.

- Since almost all the world’s supply of pure Hydrogen today is by Steam Reforming of Methane, proven Reforming technologies can easily be applied to Biogas.

- The future Hydrogen economy will require a mix of centralized and decentralized solutions for production and supply to various market segments. Commercial scale Biogas plants have traditionally been built at rural or suburban locations where suitable organic feedstock is available in large quantities. Such locations are ideal for establishing decentralized Hydrogen production units utilizing Biogas. Hence Biogas can support Hydrogen production on a decentralized and smaller scale.

It is therefore noteworthy that at least one commercial scale Biogas to Hydrogen facility became operational in the year 2022. This plant has been established by Air Liquide in the USA [3]. There are a few more Biogas to Hydrogen plants which are at various stages of completion or demonstration in the USA, France and Australia [3,10,15], as summarized in Table 1.

TABLE 1: LIST OF HYDROGEN PLANTS USING BIOGAS FEEDSTOCK

| S.NO | PROJECT NAME | CAPACITY | TECHNOLOGY | STATUS |

| 1 | Air Liquide liquid hydrogen production plant, USA | 30t H2/d (only part from biogas, but at least 1/3) | Biogas Reforming | Completed in 2022 |

| 2 | Long Beach Fuel Cell Plant USA | NA | Biogas Reforming | Under Construction |

| 3 | Veolia/Seven, Hyeres-Toulon Sludge Treatment Plant, France | 10 kg/d H2 | Biogas Reforming | Operating pilot plant |

| 4 | Hazer Group Inc., Australia | 100 TPA H2 | Pyrolysis of Methane from Biogas | Demonstration plant under construction |

| 5 | Shikaoi Hydrogen Farm® in Shikaoi, Hokkaido, Japan | NA | Biogas upgradation by Membrane and steam methane reforming | Under Construction |

These projects indicate that the energy industry is seriously looking beyond electrolysis and CCUS technologies, to produce sustainable Hydrogen. In the following sections, this article explores the business case for Biogas to Hydrogen by examining the relevant technologies, prospective markets and project economics.

Technologies for Hydrogen Production From Biogas

Numerous technologies for converting Biogas to Hydrogen are being developed worldwide and are at different levels of maturity. At this point in time, only two processes are at a stage where commercial implementation is feasible. These are:

- Steam Reforming

- Methane pyrolysis

The main features of these two technologies are described in the following paragraphs.

Steam Reforming

Steam Reforming is an established technology for Hydrogen production from Methane or Natural Gas. Since Biogas is primarily Methane, the technology can be quite easily adapted to Biogas. The main aspect to be considered is that Biogas has relatively high levels of Carbon Dioxide. When configuring the Reforming process scheme, there are two choices, depending on whether Carbon Dioxide is removed prior to or after Reforming.

- Removal of Carbon Dioxide before the Steam Reforming step: This scheme allows conventional, proven Steam Methane Reformer designs to be employed. While this reduces the technology risk, it increases costs by introducing an additional Carbon Dioxide removal step.

- Direct Steam Reforming of Biogas containing high levels of Carbon Dioxide: This scheme introduces some uncertainties related to Reformer design and catalyst performance, While there are no serious concerns, it is advisable to implement pilot scale studies before commercialization.

Figure 4 represents the two process schemes [9].

Process Description

The following description is for Steam Methane Reforming after removal of Carbon Dioxide. Carbon Dioxide can be removed from the raw Biogas stream by various methods such as pressure swing adsorption, vacuum swing adsorption, membrane processes or by aqueous alkaline solvent processes.

The steps involved in producing Hydrogen by Steam Methane Reforming are:

- Feedstock purification

- Steam Reforming

- Water-gas Shift Reaction

- Raw Hydrogen Purification

Feedstock purification:

This involves removing impurities that can poison or otherwise reduce the effectiveness of the reforming catalyst. In the case of Biogas, Hydrogen Sulphide is the main impurity to be removed. Biogas reforming without desulphurization will lead to catalyst deactivation due to Sulphur poisoning. Wet processes using aqueous solvents and dry processes using metal oxides or other adsorbents can be used depending on the Hydrogen Sulphide content.

Steam Reforming:

The next step is Steam reforming (SMR). In the Steam Reformer, Methane reacts with Steam in the presence of a catalyst, resulting in Hydrogen liberation from Methane as well as from Water. The reaction is endothermic and needs external energy to maintain temperatures between 800 to 880 degrees Centigrade, at pressures between 20 to 30 barg. The gas stream leaving the reformer is a mixture of Hydrogen (H2), Carbon Monoxide (CO), Carbon Dioxide (CO2), Methane and Water. This mixture is termed Syngas. The main reaction in the reformer is:

CH4 + H2O CO + 3H2

High temperature Syngas is cooled in a heat recovery boiler, which also generates Steam that feeds back into the Reforming process or is exported.

Water-Gas Shift reaction:

After Reforming, the Syngas enters a Water-Gas Shift Reactor, where additional Hydrogen is generated by the reaction between Carbon Monoxide and Water, in the presence of a catalyst. This is an exothermic, equilibrium reaction which can be represented as follows

CO + H2O CO2 + H2

Raw Hydrogen Purification

The gases leaving the Shift Reactor are then cooled down to about 35 to 40 degrees Centigrade via heat recovery systems, before going to a Pressure Swing Adsorption (PSA) unit for Hydrogen and Carbon Dioxide separation. The PSA unit can deliver high purity Hydrogen (99.999%) and Hydrogen recovery varies between 70% to 95 %.

Figure 5

Example Project [10,11]

A consortium of Air Products, Air Water Inc., Kajima Corporation, Nippon Steel & Sumikin Pipeline & Engineering Co. Ltd., are developing the Shikaoi Hydrogen Farm in Hokkaido, Japan. The intent of the project is to demonstrate an integrated Hydrogen energy-based supply chain, leveraging locally available renewable energy sources for Hydrogen production. The project utilises Biogas derived from anaerobic digestion of livestock bio- waste. There are about 20,000 Cows on the farm, resulting in large quantities of livestock excreta causing environmental pollution. Each Cow generates about 23 tonnes of excreta per year, which can produce enough Hydrogen to power a fuel cell car for around 10,000 km[10]. Thus, converting the waste to Biogas and then to Hydrogen solves the pollution problem, decreases the greenhouse gas emissions and produces sustainable Hydrogen fuel using locally available feedstock. This project therefore illustrates the ideal use case for Biogas to Hydrogen technology.

The process scheme involves removal of Carbon Dioxide from Biogas in a series of Membrane separators. The Membrane separators allow smaller Carbon Dioxide and Water molecules to diffuse through a hollow fibre membrane at high pressure, while bigger Methane molecules exit via a separate outlet. Thereafter, Methane is subjected to Steam Methane Reforming to produce Hydrogen. Purified Hydrogen is then compressed into two streams of vehicle fuel: for internal combustion vehicles, like forklifts, at 350 barg and Hydrogen-cell vehicles at 700 barg. The Hydrogen fuel will address the requirements of local livestock farmers, township and neighboring facilities.

The Biogas purification scheme using membranes is illustrated in Figure 6.

Figure 6

Methane Pyrolysis

The production of Hydrogen by Methane Pyrolysis involves splitting Methane (CH4), into Carbon and Hydrogen at high temperatures in the absence of Oxygen. In comparison with Steam Reforming, Carbon Dioxide emissions are negligible. Additionally, Methane pyrolysis is a one-step, dry process unlike SMR. It also does not require high quality Water unlike SMR or Electrolysis. From an energy perspective, SMR is significantly more efficient than Methane Pyrolysis (75% vs 58%), if the sequestration of Carbon Dioxide (CCS) is not considered. However, when the energy requirement of CCS systems is considered, the net energy efficiency of both processes becomes very similar (60% for SMR and 58% for methane pyrolysis) [12]. The Carbon by-product also has commercial value and can be used to improve the overall project economics.

Methane Pyrolysis has been a topic of research interest since the 1960s. The non-catalytic decomposition of Methane needs high temperatures in the range of 1000 degrees to 1200 degrees Centigrade. When using catalysts, Methane decomposition can be achieved at temperatures well below 1000°C. However, Carbon deposits on the catalyst surface are a problem. Different combinations of metals in molten alloys and salts have been used as catalysts as well as heat sources, to mitigate the problem of Carbon deposits. For example, an alloy consisting of 27% Nickel and 73% Bismuth ensures 95% Methane conversion at 1065°C [13].

The reaction mechanism of Methane Pyrolysis is complex but overall, it can be simplified and represented as below :

CH4(gas)→ C(solid) + 2 H2(gas)

There are a few Methane Pyrolysis projects that are close to commercialization. Interestingly, these employ significantly different processes to accomplish Methane Pyrolysis. These processes are :

- Thermal Pyrolysis

- Catalytic Pyrolysis

- Gas Electrolysis (Plasmolysis)

Example Projects

Three Methane pyrolysis technologies are being pursued actively by many reputed companies and research institutions. However, in terms of progress towards commercialization, the market leaders appear to be BASF, Hazer and Graforce. The status of their ongoing projects is as follows:

Thermal Pyrolysis

BASF has conducted extensive pilot scale studies for several years on thermal Methane pyrolysis at a large pilot plant in Ludwigshafen. This plant extends across several floors of their technical centre, indicating a significant scale of investment.

The business case for BASF to invest in this project arises from their corporate commitments to decarbonize operations, as also the fact that they require large quantities of Hydrogen for their ongoing and future manufacturing operations. The Ludwigshafen site of BASF requires 250,000 TPA of Hydrogen for its operations, while the group’s overall global requirement is 1 million TPA [14].

The special feature of the BASF Methane Pyrolysis technology is an innovative reactor design, which employs a moving Carbon bed enabling a high degree of efficiency. According to BASF, about 10 MWh of electricity is needed to produce 1000 kg of pure Hydrogen at temperature above 1000 degrees Centigrade. In comparison the best electrolysis technologies produce only about 182 kgs of Hydrogen with 10 MWh electrolyser energy input. BASF have indicated that their technology will be commercialized by 2030.

Catalytic Decomposition

An Australian company, Hazer Group Inc., has developed a pyrolysis process that converts Methane feedstocks, into Hydrogen and synthetic Graphite, with the help of an Iron Ore catalyst [15].

The company is currently implementing a commercial demonstration plant with a Hydrogen production capacity of 100 TPA and 380 TPA of Graphite. The Hydrogen will be fuel-cell grade, targeted at the transportation sector. The project includes a fuel-cell power generation system, that will use some of the produced Hydrogen to generate renewable power required for operations. The facility is being constructed at Water Corporation’s Woodman Point wastewater treatment plant. The feedstock is Biogas from the treatment plant. The estimated cost of the project is AUD$23-25 million with financing of AUD$9.41 million from the Australian Renewable Energy Agency (ARENA).

Figure 7 shows the plant under construction.

Gas Electrolysis

Graforce of Germany has developed a Methane gas electrolysis technology (also called Plasmalysis) to produce Hydrogen. The principle is that a high-frequency voltage field is generated from solar or wind energy, which generates non-thermal plasma, leading to the ionization of Methane gas. In a non-thermal plasma, the electrons are at a much higher temperatures than the ionized gas atoms and molecules. The electrons reach temperatures of 10,000 to 100,000 K (1-10 eV) causing Methane to decompose, while the gas temperature remains low. Methane is thus split into hydrogen (H2) and Carbon (C). The yield is good, since 4 kg of Methane and 10 kWh of electricity produces 1 kg of Hydrogen and 3 kg of elemental Carbon. The energy consumption is therefore less than one-fifth of commercial Water electrolysers for the same amount of Hydrogen.

The Hydrogen purity can be adjusted between 98 % to 99.999 % by volume and the delivery pressure can vary between 1.4 – 25 bara. Carbon Black has a purity of 98 % by weight. It has commercial applications in the construction industry, where it is added to steel and concrete to improve several properties including corrosion resistance [17].

Figure 8 is a typical layout of a Graforce 0.5 MW (600 Nm³/h H2, 150 kg/h carbon) modular plant.

Example project [18]

Graforce, and Kawasaki Gas Turbine Europe GmbH (Kawasaki), are collaborating for zero-emission heat and power generation, combining the capabilities of Graforce Plasmalyser, with Kawasaki’s Hydrogen Turbine. First projects for this zero Carbon heat and power solution are in the pipeline.

Market Potential of Biogas to Hydrogen projects

The focus of global Hydrogen strategies thus far have been on green Hydrogen and Blue Hydrogen, which are capital intensive and financially unviable. Hence progress has been slow, in spite of favorable policy and regulatory frameworks. In this context, Hydrogen from Biogas offers an excellent strategic option to ramp-up sustainable Hydrogen production and support the growth of Hydrogen markets, albeit on a smaller scale. Biogas to Hydrogen projects are well suited to rural or suburban areas which may not be serviced effectively by large scale energy suppliers. These projects can deliver environmental and social benefits such as mitigating liquid and solid organic waste disposal problems and generating rural employment. This is a way to accelerate the Hydrogen transition at minimum risk.

The immediate market opportunity is in Retrofitting existing Biogas plants, considering scale and proximity to Hydrogen markets. For example, in Germany alone, about 9500 existing Biogas plants could utilize Steam Reforming to produce around 58 terawatt-hours, or 1.7 million tonnes of hydrogen annually [19]. In comparison, Photovoltaic systems in Germany produced 47.5 terawatt-hours in 2019. Similar opportunities are readily available in many other countries. There is, therefore, a market niche which will grow as long as the Hydrogen is competitively priced, capital costs reasonable and economic viability of projects is ensured.

Recognition of business potential in this area is indicated by recent investments in commercial and demonstration projects such as the Shikao Hydrogen farm and the Hazer project, described in the preceding section. In a recent press release, Doosan Fuel Cell announced a ‘business collaboration agreement’ with Kolon Global that will use Biogas to produce Hydrogen for use in their fuel Cells [20].

Economic aspects of Biogas to Hydrogen projects are discussed in the following section.

Biogas to Hydrogen Project Economics

The cost of production of Hydrogen from Biogas depends on various factors such as source of biogas, upgradation requirements, geographical location Hydrogen conversion technology and supporting infrastructure. When the size of projects increases, costs of feedstock transportation and handling, product shipping as well as the offsites and utilities components become significant.

A European Union study commissioned by The Fuel Cells and Hydrogen Joint Undertaking (FCH JU) in the year 2015, looked at various renewable Hydrogen generation other than electrolysis. Biogas to Hydrogen was one of the options studied and found promising. The study estimated the cost of Hydrogen production by Steam Reforming of Raw Biogas. Table 2 summarizes some relevant results [9].

Tabel 2

Please note that 1 MW Hydrogen output corresponds to 25.4 kg/h (or 282 Nm3/h) of Hydrogen, based on the higher heating value of Hydrogen (39.4 kwh/kg). In case of the larger plant (6 MW Hydrogen output) the cost includes compression of Hydrogen from 0.8 MPa (H2-pressure at the outlet of the PSA) to 6.4 MPa for buffer storage (12 hours of full load hydrogen production capacity) within the Hydrogen plant.

Analysis of Cost Estimate

The FCH JU report states that for the 0.6 MW Hydrogen capacity plant, the estimate is based on a small steam reforming plant (2 units, each 100 Nm³ H2 per hour or 0.3 MWH2) plus a Biogas plant which uses Maize whole plant silage as feedstock. The biodigester volume considered is 3000 m3. The investment for the biodigester was considered as 275 € per m³ including feedstock processing. In other words, the biodigester and associated feedstock CAPEX was about 0.825 million €. This excludes utilities required specifically for the biodigester such as heating syst6ems, electrical etc., which may add 10% to the cost. On this basis, one can infer that for the 0.6 MW plant, the biogas system and the SMR system each constitute about half the total CAPEX.

In contrast, the cost of a conventional Natural Gas SMR plant with CCS is approximately 1680 USD/kw Hydrogen [21] or 1 million USD for 0.6 MW Hydrogen capacity, which is only half the cost of a corresponding Biogas based SMR plant. However, Natural gas SMR with CCS is not a realistic option for small decentralized Hydrogen plants. This is because subsurface drilling and Carbon Dioxide sequestration is not possible at all locations and the handful of CCS project that have been implemented worldwide have all been mega-projects costing several hundred million dollars.

Hence the only competitor to Biogas based SMR is Green Hydrogen (electrolysis) which costs about USD 1406/kw Hydrogen [21] or USD 1.41 million for a 0.6 MW Hydrogen output electrolyser plant. However, a decentralized Green Hydrogen plant is unlikely to get 24 hour renewable energy supply from the grid and therefore actual Hydrogen output will be much less than 0.6 MW. The effective cost of a 0.6 MW Hydrogen plant will accordingly be much higher than 1.41 million USD. In contrast, Biogas based SMR plants need not depend on the grid and usually generate their own power requirement. The average cost of Green Hydrogen is around USD 5/kg and ranges between USD 3-8/kg depending on price of renewable electricity and load factor [4]. On the other hand, Hydrogen produced using SMR technology whether from Biogas or Natural Gas, would cost roughly the same, at around USD 1-2 /kg as the operating costs are similar [21].

On this basis a Biogas based SMR plant of 0.6 MW Hydrogen capacity would have a comparable CAPEX to a Green Hydrogen (electrolysis) plant of the same capacity. However, Biogas Hydrogen would cost much less than green Hydrogen, possibly by a factor of four. Assuming the same market price for Hydrogen, the profit margin for Biogas to Hydrogen would be significantly higher.

It appears, therefore that Biogas SMR technology is extremely competitive and probably the ideal option for a production capacity of 0.6 MW Hydrogen. For retrofits to existing Biogas plants, the business case is obviously superior to conventional SMR or Green Hydrogen.

Analysis of Table 2 also indicates that for the larger, 6 MW Hydrogen output case (254 kg/h or 2820 Nm3/h of Hydrogen), feedstock handling as well as Hydrogen compression storage costs lead to disproportionately higher CAPEX. A Biogas to Hydrogen Plant of 6 MW capacity would cost twice as much as a conventional Natural gas SMR with CCS. Further, it is well-known that many large Biogas plants struggle to get regular and adequate supply of feedstock for stable operations. Hence capacity utilization is also poor when the biogas plant size increases. At higher Hydrogen production capacities therefore, Biogas to Hydrogen plants cannot compete with conventional Natural Gas SMR with CCS.

Conclusions

- Decentralized Hydrogen production will be an important part of the hydrogen economy.

- Biogas is an ideal feedstock for decentralized Hydrogen production.

- Technology for Biogas production as well as Steam Methane Reforming are well established

- Due to the projected demand-supply gap in sustainable Hydrogen, Biogas to Hydrogen projects can be readily deployed to supplement other sustainable Hydrogen production pathways.

- Ideally, small Biogas to Hydrogen plants can be established in close proximity to sources of feedstock. These include livestock and dairy farms, sewage treatment plants, landfills and agro-processing industries.

- Biogas to Hydrogen projects will deliver additional benefits such as mitigation of pollution due to organic wastes and creation of rural employment opportunities.

- A promising market niche for Biogas to Hydrogen plants could be in the capacity range of 100 to 500 Nm3/h of Hydrogen, due to advantageous project economics.

- The best case for implementing Biogas to Hydrogen projects would be as retrofits to existing Biogas plants.

References

- The Future of Hydrogen, Report prepared by the IEA for the G20, Japan, June 2019.

- Distributed Hydrogen Production Using Catalytic Methane Pyrolysis, project by Stanford university, Palo Alto Research Center and SoCalGas;

Distributed Hydrogen Production Using Catalytic Methane Pyrolysis – Susteon Inc.

- Hydrogen Projects Database, IEA (2021)

Hydrogen Projects Database – Data product – IEA

- Global Hydrogen Review 2021,IEA;iea.org

- Hydrogen colours codes,H2 Bulletin,www.h2bulletin.com; Hydrogen colours codes – H2 Bulletin

- Outlook for biogas and biomethane-Prospects for organic growth, World Energy Outlook Special Report; IEA 2020.

- Green Hydrogen Production from Raw Biogas: A Techno-Economic Investigation of Conventional Processes Using Pressure Swing Adsorption Unit, Gioele Di Marcoberardino, Dario Vitali, Francesco Spinelli, Marco Binotti and Giampaolo Manzolini, in Processes 2018, 6, 19; doi:10.3390/pr6030019. Processes | Free Full-Text | Green Hydrogen Production from Raw Biogas: A Techno-Economic Investigation of Conventional Processes Using Pressure Swing Adsorption Unit (mdpi.com)

- The Vabhyogaz Process Transforms Biogas Into Renewable Hydrogen by Ames Biogradlija,H2 Energy News, June 29,2022; The VaBHyoGaz process transforms biogas into renewable hydrogen – Green Hydrogen News (energynews.biz)

- Study on Hydrogen from Renewable Resources in the EU – Final Report, a joint study by Ludwig-Bölkow-Systemtechnik GmbH and Hinicio S.A, July 2015, catalogue number: EG-02-15-004-EN-N; Study on Hydrogen from Renewable Resources in the EU (europa.eu)

- Biogas to Hydrogen Upgrading, Shikaoi Hydrogen Farm® in Shikaoi, Hokkaido Japan, Air Products and Chemicals, Inc., White Paper, 2017;

- A Town Producing Milk and Hydrogen, Public Relations Office, Government of Japan, May 2019; A Town Producing Milk and Hydrogen | May 2019 | Highlighting Japan (gov-online.go.jp)

- Methane Pyrolysis for Zero-Emission Hydrogen Production: A Potential Bridge Technology from Fossil Fuels to a Renewable and Sustainable Hydrogen Economy, by Nuria Sánchez-Bastardo, Robert Schlögl and Holger Ruland, Eng. Chem. Res.2021, 60, 32, 11855–11881,c:August 9, 2021; https://doi.org/10.1021/acs.iecr.1c0167

- Direct Conversion of Methane to Hydrogen by Pyrolysis: Status and Prospects, Advanced Energy Technologies, 02.2022; The preliminary estimates of H2 production costs, energy efficiencies and CO2 footprint consistently demonstrate the high competitiveness of the methane pyrolysis technology (aenert.com)

- Innovative Processes for Climate-Smart Chemistry, BASF Report 2021; Methane Pyrolysis – BASF Report 2021

- CSIRO HyResource article “Hazer Commercial Demonstration Plant”, March 18th, 2023; Hazer Commercial Demonstration Plant – HyResource (csiro.au)

- Hazer Advances Construction Of Commercial Hydrogen Demonstration Plant,By FuelCellsWorks, Nov 12,2021; Hazer Advances Construction Of Commercial Hydrogen Demonstration Plant (fuelcellsworks.com)

- Methane -Plasmalyser Catalog Graforce GmbH, www.graforce.com; Methane Plasmalyzer® (graforce.com)

- Article in Hydrogen Central, February 6,2023; Graforce, provider of zero carbon hydrogen plants, and Kawasaki Gas Turbine Europe Collaborate on Zero Carbon Heat-Power Cogeneration Solutions – Hydrogen Central (hydrogen-central.com)

- Green hydrogen from biogas, H2intrenational,September 15,202; Green hydrogen from biogas – H2-international

- Doosan collaborates with Kolon to develop hydrogen business biogas model;

H2 View, March 22, 2023; Doosan collaborates with Kolon to develop hydrogen business biogas model (h2-view.com)

- IEA G20 Hydrogen Report-Assumptions; Doosan collaborates with Kolon to develop hydrogen business biogas model – Search (bing.com)

To all knowledge

To all knowledge