Brazilian petroleum is poised to be one of the key sources of growth over the medium term.

Brazil – Oil & Gas

Overview

Oil and gas continue to be important sources of energy all over the world. Although many investments have been made in new technologies to aid in developing new energy sources, including renewable ones, the world will still depend on oil and gas for many years.

The pre-salt region —a large-scale oil and gas discovery in Campos Basin—put Brazil among the top ten oil producers in the world. Brazil has surpassed Mexico and Venezuela to become Latin America’s biggest oil producer. According to data from Brazil’s National Oil and Gas (ANP), 2.94 million barrels of oil were produced on average each day in 2020. Brazil produced 127 million cubic metres of natural gas per day in 2020, an increase of 4.1% from 2019.

The pre-salt Santos Basin’s high productivity, which depended on oil outputs well above the average for the world oil sector, was largely responsible for the domestic oil production boom, particularly after 2013. Because of the high reservoir productivity, fewer wells are needed for each production system, which lowers costs.

Figure 1. Inauguration of Plataforma P-52 at Angra do Reis, Rio de Janeiro. Source: https://upload.wikimedia.org/wikipedia/commons/a/a9/Plataforma_P-52.jpg

Estimates of Brazilian pre-salt reserves indicate a potential for 70 to 100 billion barrels of oil equivalent – boe (sum of oil and natural gas). However, the exploration process for this wealth of resources is still in its early stages.

Another noteworthy industry is that of fuel. Despite the pandemic’s significant adverse effects on the industry, these were swiftly reversed as diesel oil demand rose above pre-pandemic levels. The local refineries and import infrastructure, which has become more diversified, were able to manage the intense demand volatility, and refineries are currently working at levels greater than in 2019. Additionally, the refining industry is becoming less concentrated. These elements ought to encourage more investment in Brazilian refining [1].

O&G production by independent companies in Brazil is expected to grow significantly in the coming years as small and medium-sized players develop mature off and onshore assets.

A Brief History

Petrobras — Petróleo Brasileiro S.A. (Brazilian Petroleum Co.) — was established by Law 2,004/1953 as a state-controlled oil and gas company. Under this Law, Petrobras was given a monopoly on oil and gas exploration and production activities. But in the 1970s, Petrobras was allowed to enter into risk services contracts with private international oil companies – IOCs, showing a small market opening [2]. After the oil crisis in 1973, Brazilian President Mr Geisel authorised Petrobras to enter into risk contracts with International Oil Companies—IOCs. At the same time, the President noted that such permission did not mean that the monopoly was no longer enforceable, nor did it mean that it no longer existed.

Two years after the 1995 Constitutional Amendment, the government published Law 9,478/1997, known as the Petroleum Law. This Law created the ANP –Agência Nacional de Petróleo, Gás Natural e Biocombustíveis (National Regulatory Agency of Petroleum) — and established the concession system for the research and production of Brazilian oil, gas and other fluid hydrocarbons. As with every regulatory agency in Brazil, the ANP is an independent agency and was inspired by the United States model.

When the Pre-salt area was discovered, it ignited many debates in Congress and among Brazilian society [3]. After more than a year of debates, in 2010, a new petroleum regulatory framework arose in Brazil. Three new laws were published, creating a mixed regulatory regime. Oil and gas production in the geographical area defined under the Law will be controlled through Production Sharing Agreements.

However, production sharing agreements in Brazil will be unique in one aspect: Besides the regulatory agency, ANP, and Petrobras, another state company will sign this contract: Pré-sal Petróleo S.A. –PPSA. The PPSA, accordingly, will be mainly responsible for: a) conducting the management, audit, and inspecting and supervising of petroleum activities performed under PSCs; b) authorising the bidding processes related to the exploration and production of pre-salt areas; c) representing the government, through the operational committees, in consortiums incorporated for the execution of PSCs; and d) representing the government in case of unitisation in the pre-salt and strategic areas.

The Brazilian natural gas regulatory framework had essential changes after the New Gas Law (Law No. 14,134 of April 8th 2021) promulgated guidelines for natural gas transport, import and export activities. The Law also included natural gas outflow, treatment, processing, underground storage, conditioning, liquefaction, regasification and commercialisation. This led to new companies operating and others diversifying their activities, which boosted the development of natural gas infrastructure projects in Brazil.

An important debate in progress is third-party access to essential facilities, with some interested companies suggesting creating a new midstream company responsible for managing gas flows and processing activities. New LNG terminal projects in the states of Pará (North), Pernambuco (Northeast), São Paulo (Southeast) and Santa Catarina (South) also advanced on their schedules.

Market Trends

An unprecedented transformation

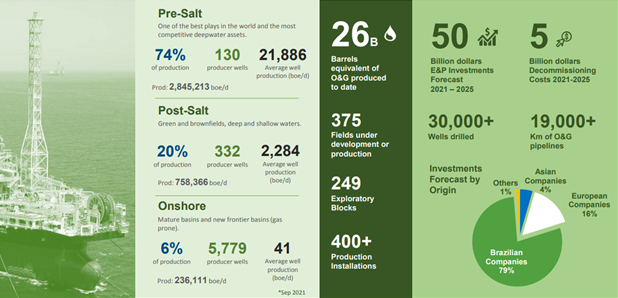

Brazil is taking a leading role in the E&P sector. It is the 8th crude oil and condensate producer (according to the 2021 BP Statistical Review), reaching 3 million barrels per day (BPD) of oil production in September 2021; it has 12 billion barrels in proven oil reserves (as of December 2020). Its gas production reached 133M M³ in September 2021, with 337B M³ in proved gas reserves as of December 2020. According to Empresa de Pesquisa Energética [4], the country can reach more than 5 million BPD and be the 5th Largest crude oil exporter in 2030.

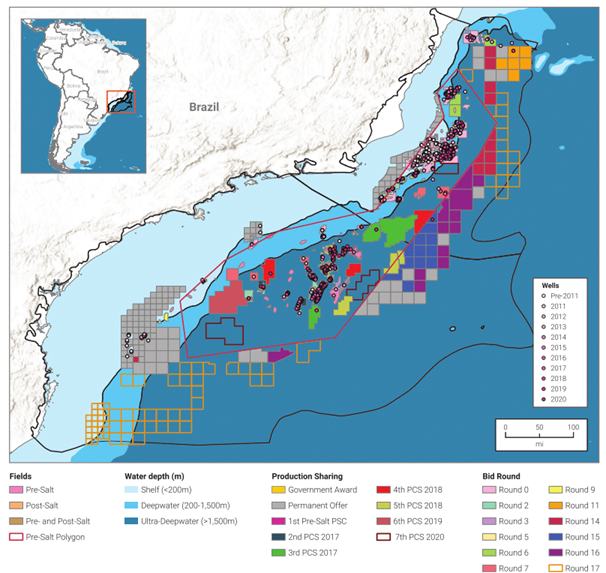

Brazil is home to most of the offshore projects under development in the world; the country has 17 offshore production units scheduled to start operation in 2025. The long-term production scenario depends on the exploration results of the contracted blocks and the fiscal attractiveness of these discoveries. Also, it is very relayed on new investments in exploration. Considering the energy transition, the country has the last opportunity to contribute to this scenario by increasing upstream competitiveness. The pre-salt will be essential to the long-term production and the new frontier basins, like the equatorial margin basins, SEAL basin, etc.

Figure 2. E&P at a glance. Source: https://www.gov.br/anp/pt-br

An utterly diverse sector will emerge from Petrobras Divestment Plan. All onshore and shallow water fields and some great offshore post-salt concessions are being sold. With new investments in mature fields, pre-salt fields and offshore blocks in the exploratory phase, Brazil is ready to escalate production and take a leading position in the sector.

In the upstream business, half of the Brazilian refining capacity (RNEST, REFAP, REPAR, LUBNOR, SIX, REGAP, RLAM, REMAN) is being sold by Petrobras, paving the way for an open and competitive refining and fuel market for the first time. Brazilian National Agency of Petroleum, Natural Gas and Biofuels (ANP) is taking action to deal with the adjustment to this new environment and to make the distribution industry more competitive.

Petrobras’ withdrawal from the transportation and distribution industries resulted in the natural gas market’s first-ever effective openness. A new legal framework has just been set up for the gas market (Law 14,134/2021 and Decree 10,712/2021), and a robust regulatory agenda is underway to create opportunities for suppliers, distributors, and consumers.

Offshore Highlights

The “pre-salt layer” is a diachronous series of geological formations on the continental shelves of basins formed after the break-up of Gondwana, characterised by the deposition of thick layers of evaporites. These basins are extensional since the rock is being stretched or pulled apart in one direction, resulting in faults, fractures, or ductile deformation.

The pre-salt is an oil-rich offshore reserve trapped below a 2,000m-thick layer of salt, which itself is located below 2,000m-thick post-salt sediments. Post-salt refers to reservoirs that overlie the salt and contain younger hydrocarbon reservoirs with oil that has migrated upward from the pre-salt.

Petrobras first extracted oil from the Jubarte field in the Campos Basin in 2008, two years after the company first identified pre-salt oil reserves in the Santos Basin. In a succession of repeated discoveries, the pre-salt layer has now been shown to be concealing more outstanding oil deposits. The results were good, and oil fields like the Badejo, Linguado and Trilha helped the basin increase its output. The pre-salt petroleum system was then relegated to a low priority following the discovery of the super-giant post-salt Tertiary and Upper Cretaceous turbidite systems at shallower burial depths.

But as post-salt oil supplies began to run low, the Brazilian oil giant resumed pre-salt activities. Petrobras began drilling more deeply in recent years, more than 6,000 metres, in search of massive oil and gas accumulations in the pre-salt region offshore, including the Santos, Campos, and Espirito Santo basins, due to the absence of remaining huge possibilities in the post-salt. Among the major hurdles to success in this new exploration frontier was the difficulty of accurately imaging the pre-salt targets, drilling through deep salt layers, and assessing high pressure and temperatures.

Today, the formation holds giant oil reserves with lower costs and emission rates — one well can produce more than 50,000 bpd of oil.

All shallow water fields and some deepwater assets are being divested in the post-salt. Independents, specialised in mature fields, are jumping into these opportunities. New operators are working on reducing OPEX and decommissioning costs, revitalising production facilities and implementing IOR opportunities to leverage existing underutilised facilities. Investment commitment of more than 1.5 billion dollars in the new Development Plans presented for Trident, Perenco and BW shallow water assets [5].

In Brazilian offshore oil and gas drilling, “ultra-deep” is assumed to be anything in waters deeper than 1,520 meters. But producers must go much more profound to attain the rich crude oil and raw gas reserves of the country’s pre-salt. Within the Libra field of the Santos Basin, drillers punch a hole through more than 1.6 kilometres of post-salt rock only after reaching the ocean bed under 2,100 meters of the South Atlantic Ocean [6]. And then drill 2,010 meters through a gigantic salt dome and overlying sediments to get the hydrocarbon prize of the Cretaceous Period beneath.

The past few years have seen Brazil’s oil production overcome its ultra-deepwater reserves and rank among the world’s top 10 largest oil producers, despite the challenges in accessing and extracting pre-salt hydrocarbons.

Regulations

The Brazilian government has authorised several programmes over the past few years that aim to increase predictability and investor confidence. One of them was the extension of Repetro Sped, a unique customs programme exempting the export and import of commodities for the industry from certain taxes until 2040. It was governed by Law No. 13,586/2017 and Normative Instruction RFB No. 1,781/2017.

Additionally, the government has set up a specific tax structure permitting some investments tax deductions. The objective was to encourage additional investments in current and new oil resources. Additionally, discounts for older mature have had their terms extended in an effort to boost investment growth and recovery rates.

A government initiative run by the MME to promote onshore oil and gas exploration and production (the “Reate” Program) is considering an even more advantageous tax system and incentives. Once in place, the Reate initiative will lower royalties for reviving onshore oil resources.

Another significant adjustment was removing local content as an auction parameter and specifying predetermined and lower percentages for future contracts by the National Council on Energy Policy (CNPE). The rates decreased from average percentages of 79.5% in the 2015 bidding round to values between 18% and 40% for future rounds.

As previously mentioned, CNPE has also granted ANP permission to permanently make fields and blocks up for bid. They represent nearly 1,000 blocks in several different basins [7].

Another regulatory landmark took place in late 2016, with the approval of the “new pre-salt law” – Law nº 13,365/2016. It entitled Petrobras to choose to participate as an operator, with a minimal 30% share, in consortia constituted to explore blocks licensed under the production sharing contracts (PSC). No longer must Petrobras be the only operator of PSC projects. If it loses the bid, the state-controlled corporation has the opportunity to demand a 30% share of the winning offer.

Brazil O&G Outlook

Current Trends and Prospects

Due to its control of the abundant pre-salt region, which has high-quality oil and productive fields, Brazil is in a leadership position for offshore oil exploration and production. The International Energy Agency (IEA) highlights the potential of Brazil, which, by 2040, will produce roughly 50% of the offshore oil used in the world, about 5.2 million bpd.

International Oil Companies (IOCs) are competing on possibilities in Brazil due to the country’s significant energy reforms, regular oil discoveries, and current and upcoming oil bidding rounds. Additionally, a few foreign businesses have begun to express interest in and make investments in the Brazilian downstream industry by purchasing gas pipeline networks and developing liquefied natural gas facilities.

Aside from Petrobras, which accounts for almost three-quarters of Brazil’s O&G production and will invest at least $65 billion from 2022 to 2026, another 47 local and 50 foreign enterprises hold oil rights to exploration and appraisal spots in Brazil. Worldwide players like Total, Chevron, Shell, Equinor, Exxon, Murphy Oil, and Repsol-Sinopec are among the foreign oil companies with assets in Brazil.

Petrobras’main investments (more than 80%) will be directed to exploration and production (E&P) activities. About $ 16 billion will be heading for the revitalisation of the Campos Basin fields with three new Floating Production Storage and Offloading (FPSOs) and over a hundred wells to be drilled during this period.

Brazil’s 2021-2030 Energy Expansion Plan [8] forecasts that oil and gas E&P expenditures will range from US$ 416 billion to US$ 455 billion during this period. These figures estimate the investments made by all E&P firms operating in Brazil, including Petrobras.

The Pre-Salt Future

Brazil currently ranks among the top 10 oil producers in the world, with the largest rise outside of the Permian Basin and OPEC+, as production keeps rising. Breakeven pricing and midstream takeaway capacity are crucial factors expected to speed up pre-salt development even more.

For pre-salt Brazil oil production, the breakeven price was as high as $70 per barrel of oil equivalent (BOE) less than ten years ago, illustrating the detrimental effects of ramp-up and lifting costs despite high production quantities. However, cost savings of up to 40% from initial project estimates have been achieved in the Tupi field alone thanks to favourable regulatory and tax reforms, the expertise of Petrobras and joint venture partners pooled to standardise Brazil’s oil and gas drilling procedures, and technological advancements in subsea and topsides infrastructure.

Figure 3. Map with Brazilian offshore resources and activities. Source: https://www.enverus.com/solutions/energy-analytics/ep/prism/global/pre-salt-brazil/

Petrobras is to spend close to $40 billion over the following five years on pre-salt infrastructure projects, including the building and installation of 12 FPSOs. These FPSOs, including the largest FPSO to date (P-80), will be put into service in the Buzios, Mero, Itaipu, and Jubarte pre-salt areas, boosting the region’s total FPSO processing capacity to 2 million barrels per day by 2025.

The pre-salt Brazil oil and gas development rate is speeding up since breakeven prices are predicted to drop below $40 over the next ten years. Petrobras and Brazil’s energy regulators clearly focus on growing pre-salt production. ABESPETRO —the Brazilian Association of Oil Service Companies — believes that because they are essential to Petrobras’ (and its partners’) ability to generate revenue in the upcoming years, “projects of large magnitude in the pre-salt layer will prevail.” [9].

References

[1] BRAZILIAN OIL & GAS REPORT. TRENDS AND RECENT DEVELOPMENTS. Empresa de Pesquisa Energética. December 2022.

[2] Braga, L. P., & Campos, T. N. (2012). A comparative study of bidding models adopted by Brazil, Peru, Colombia and Uruguay for granting petroleum exploration and production rights. Journal of World Energy Law and Business, 5(2), 94-112.

[3] Almada, L. P., & Parente, V. (2013). Oil & Gas industry in Brazil: A brief history and legal framework. Panorama of Brazilian Law, 1(1), 223-252.

[4] https://www.epe.gov.br/en

[6] BRAZIL OIL PRODUCTION DATA ANALYSIS AND MARKET INTELLIGENCE. Enverus

[7] Consultas e Audiências Públicas. Agência Nacional do Petróleo, Gás Natural e Biocombustíveis.

[8] Plano Decenal de Expansão de Energia 2030 / Ministério de Minas e Energia. Empresa de Pesquisa

[9] Energy Resource Guide – Brazil – Oil and Gas. US International Trade Administration.

To all knowledge

To all knowledge