DNV’s excellent Energy Transition Outlook (ETO) Report Energy Outlook on Oil and Gas provides an outlook and forecast on the world’s energy mix to 2050. The full report can be requested from https://eto.dnvgl.com/2018. This summary focuses on the oil and gas sector report.

EPCM breaks down the Energy Outlook—Oil and Gas (DNV Report Notes): In efforts to make the world’s energy system cleaner and more efficient, the oil and gas value chain is changing. There is a focus on transitioning to a lower-carbon energy mix, which is seeing companies diversify from oil and increasingly include gas in their portfolios.

1. Abbreviations used

In the oil and gas industry, energy is measured in million tonnes of oil equivalent, whilse the power industry uses terawatt hour. The International System of Units uses joules, or exajoules (EJ).

One EJ is

- 24 Mtoe

- 278 Twh of energy

- One day of the world’s current total final energy demand

For regions described, the following abbreviations are used: NAM (North America), LAM (Latin America), EUR (Europe), SSA (Sub-Saharan Africa), MEA (the Middle East and North Africa), NEE (North East Eurasia), CHN (Greater China), IND (Indian Subcontinent), SEA (South East Asia), OPA (OECD Pacific).

2. Oil and gas demand forecast

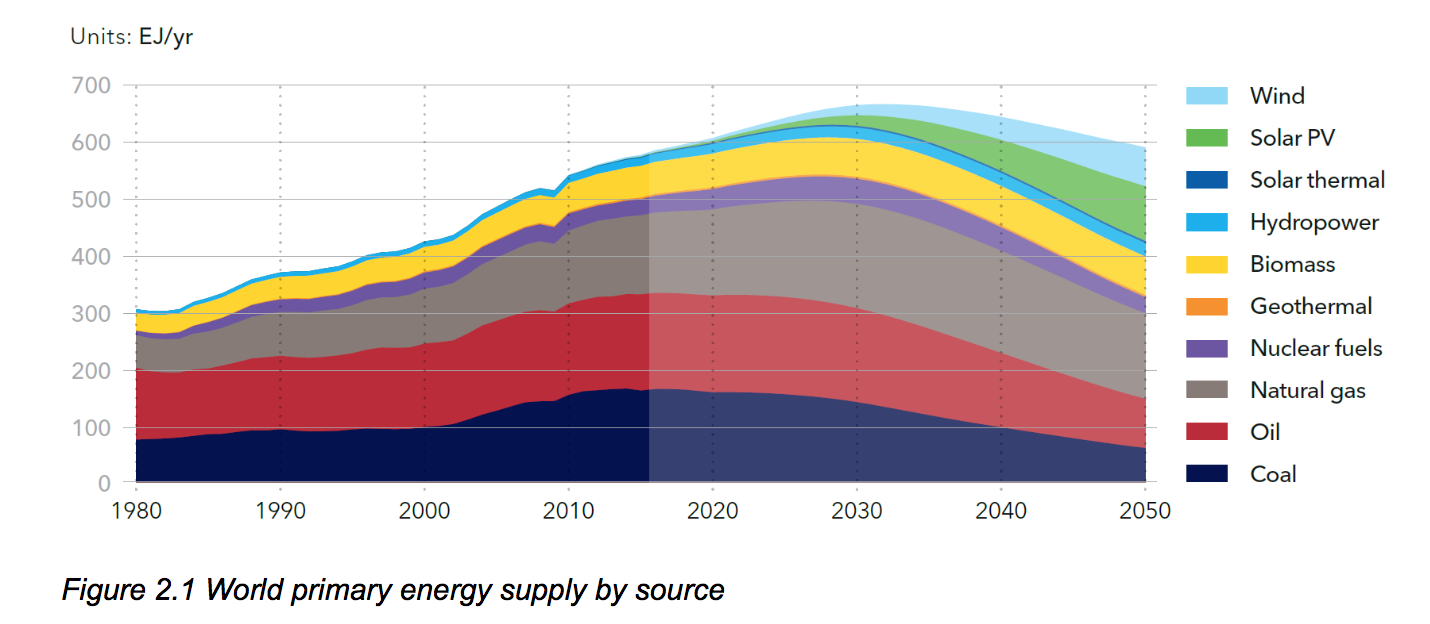

Gas is forecasted to be the primary energy source by the end of 2050, followed by oil.

2.1 Oil demand

It is forecast that there will be a steady increase in oil demand over the coming years, reaching the peak demand in 2023. A steep decline will follow this. Although the oil demand will decrease, new resources must be developed to replace depleted reserves.

Demand growth in emerging economies is expected to continue until 2030, notably in China, India and Southeast Asia. However, the shift to cleaner fuel sources will result in a decline in oil demand in Europe, North America, OECD Pacific and Latin America.

Demand for oil used in transport will reduce by two-thirds between 2022 and 2050, from 106 EJ/year to 34 EJ/year. Non-oil energy sources will account for over 60% of transportation energy use by 2050, compared with 7.3% in 2017. This will result in refineries having to shift their product slates from liquid fuels to petrochemical products, particularly in India and Sub-Saharan Africa.

2.2 Gas demand

Gas demand will continue to increase by 30% for the next 15 years and peak in 2034 at 186 EJ/year. From there, it will decline to 148 EJ/year in 2050.

With the decarbonisation of the gas supply, biogas, hydrogen, and syngas will gain more prominence.

Peak demand for gas has already reached various regions, including Europe (20 EJ/year in 2010), OECD Pacific (9 EJ/year in 2015) and North East Eurasia (24 EJ/year in 2011). Peak gas demands are still to be reached in China (41 EJ/year in 2035), North America (39 EJ/year in 2021) and Southeast Asia (10 EJ/year in 2035). The Indian subcontinent and Sub-Saharan Africa will see a continuation of gas demand through 2050.

The demand for gas will be driven by power generation, which will see the demand for gas rise for the next 15 years, before declining towards 2050 as wind and solar start to dominate power supply.

Gas use in transport will increase in the form of compressed natural gas (CNG) and liquefied natural gas (LNG). By 2050, gas will meet 5% of transportation fuel needs.

3. Trends and Implications

3.1 Oil exploration and production

3.1.1 Onshore

Conventional onshore oil will provide the majority of total oil production but will see a steady decline in production levels. Unconventional onshore oil production (horizontal drilling and hydraulic fracturing) is set to double to 17 million barrels per day (Mb/day) by 2023.

The Middle East and North Africa will yield more than half of conventional oil production by 2050. North East Eurasia production will decline from 2026 but will remain the second-largest producing region. Latin America will move into third place as output from China declines. China will shift its focus to decarbonisation and focus on gas and renewables.

The world’s need for new conventional onshore oil capacity will continue to decrease, and by 2045, only mature fields will be in operation. North America will not see new additions to conventional onshore production due to the rise of unconventional oil production there.

Beyond 2020, oil supply will increasingly come from unconventional sources due to increasing volumes being accessible. It is interesting to note that unconventional oil producers are not bound by OPEC agreements and can be profitable at oil prices of USD 50-55 per barrel, circumventing OPEC’s efforts to raise prices by cutting production.

North America and Latin America dominate unconventional oil production, but other regions, such as China and North East Eurasia, will become more prominent. Peak production of unconventional oil will be 17 Mb/day in 2034, with North America accounting for 50%, Latin America 42% and China 5%. New production capacity will, therefore, double from 1.5 Mb/year in 2015 to 2.1 Mb/day per year in 2031.

3.1.2 Offshore

Offshore production will drop by more than two-thirds from 27 Mb/day in 2017 to 9 Mb/day in 2050 due to cost increases from operating in challenging environments. Most regions will see a large reduction in production, with only the Middle East and North Africa maintaining high production levels due to low development costs. Sub-Saharan countries will see annual additions to capacity, but only until the mid-2020s.

International oil companies are shifting their focus to building broader energy portfolios that include batteries, hydrogen, and renewable energy. This may result in less appetite for developing deepwater sources or resources in harsh environments. However, the cost of deepwater developments did drop from USD 75 per barrel in 2014 to USD 45 in 2017, making them more viable at lower oil prices.

3.2 Gas exploration and production

Onshore

New gas production capacity will increase from 52 Gm3 added annually in 2017 to 64 Gm3 per year in 2022. This surge will mostly come from developments in Northeast Eurasia (including Russia), the Middle East and North Africa. While China’s addition of new capacity will taper off from 2020, the Indian Subcontinent and Sub-Saharan Africa will add new capacity until 2035.

North America, Latin America, the Middle East, North Africa, and China are estimated to have the largest recoverable shale gas resources. Production of unconventional gas in North America will peak in 2035 at 1031 Gm3/year. By 2050, this is expected to account for 91% of the US domestic gas supply.

North America leads the way in developing unconventional gas resources. Other regions are lagging either because they do not need to develop new sources or because of environmental concerns, with some countries banning hydraulic fracturing. Technological advancements are set to reduce the cost and environmental impact of unconventional oil and gas production.

3.2.1 Offshore

Offshore gas production volumes will grow mainly from the Middle East, North Africa, and South-East Asia. Production will increase by 26% by 2031, after which it will slowly decrease. Europe will remain a large source of offshore gas.

The new capacity will be added at a rate of 87 Gm3/year in 2036, up from 68 Gm3/year in 2017. New additions will then reduce to about 26 Gm3/year in 2050. This is half of the reduction expected for offshore oil capacity additions. The Middle East and North Africa will see the newest production capacity by 2050.

New floating LNG (FLNG) production technology offers a solution to unlock offshore gas assets that can be exported by LNG carriers rather than uneconomic pipelines.

Costs for deepwater developments have reduced from USD 75 per barrel of oil equivalent in 2014 to USD 50 in 2017. Overall, development and production costs have reduced by 30-40%. Additionally, demand for gas in domestic appliances has increased in emerging markets, notably in African nations. The demand for natural gas in residential and commercial buildings will grow nine-fold to 1 EJ/year in 2050 in Sub-Saharan Africa.

3.3 Technologies

3.3.1 Transmission

There will be a large increase in gas demand in countries with less established gas infrastructure, such as India and China. Between 2017 and 2035, China’s gas import demand will increase from 160 Gm3/year to 760 Gm3/year in 2035. Gas trade by sea from North America to China will treble to more than 100 Gm3/year. A substantial increase in gas trade from Sub-Saharan Africa to India and South East Asia is expected to reach 25 Gm3/year in 2050.

Overall, there will be a 2.5% annual increase in the global seaborne natural gas trade (LNG and LPG combined). The maritime industry’s demand for LNG as fuel will increase from 16 Mt/year in 2017 to 85 Mt/year in 2050. The increase in demand could drive the construction of cross-border and national transmission pipelines, LNG terminals, LNG bunkering and LNG carriers. Gas transport, such as LNG, is expected to grow faster than pipeline transport. This could underpin a stronger global market for trading gas since consumers aren’t dependent on pipeline routes.

3.3.2 Refineries

Refiners have to adjust to changes in demand for petroleum and diesel products, changes to fuel quality specifications (e.g., sulphur limits for ship fuel) and the switch to electric vehicles. A peak refinery output of 29 000 Mb/year is forecast in 2025, followed by a 50% decline in global production by 2050. Refinery demand growth is the only forecast for Sub-Saharan Africa and the Indian Subcontinent. Improvements in the energy efficiency and technical configuration of refineries will be required.

3.3.3 Petrochemicals

There will be ongoing demand for petrochemical products driven by product innovations in the agricultural, pharmaceutical and industrial chemical markets. There will be significant market growth in the Indian Subcontinent and Sub-Saharan Africa. The industry’s feedstock mix is forecast to change from 56% oil/36% gas in 2016 to 48% oil/42% gas in 2050, also showing the prominence of gas over oil in the global energy mix in the future. There will be a focus on optimising lifecycle performance and efficiency for existing and new facilities.

3.3.4 Gas terminals

The increasing demand for natural gas will require investment in production, processing and transportation services. Trade in LNG hit a global record of 258 Mt in 2017, caused by additional supply from the Pacific Basin, exports from the Gulf of Mexico and increased demand in Asia (notably China, India and Pakistan). This led to the development of new processing capacity; now, over 1,800 processing plants are operating globally. Europe is unlikely to see growth in processing capacity due to declining gas production.

3.4 Technologies for Decarbonisation

3.4.1 Carbon capture

Carbon capture, utilisation and storage reduce emissions from large industrial sources of CO2. Carbon can be captured and stored permanently or be utilised in manufacturing processes or other industrial applications. Currently, 22 carbon capture and storage facilities are in operation worldwide, with 12 of those located in North America, where the carbon is used in enhanced oil recovery (EOR). EOR projects largely have viable business cases, but other forms of CCUS generally require government subsidies. The uptake of these technologies is heavily reliant on the carbon price, which is driven by policy. It is estimated that an increase of 33% in the carbon cost will increase the uptake of CCUS technologies by sevenfold.

3.4.2 Biogas

Biogas largely consists of methane (50-60%) and CO2 (35-50%) and can be used to generate electricity and heat. If the CO2 is removed, the resulting pure biomethane can substitute natural gas in power plants and residential gas appliances. It can also be used in the transportation sector as fuel.

Biomass transportation is costly, so the generation of biogas is most feasible when it is located close to the source.

3.4.3 Biomethane

Europe is the main location for biomethane production due to its well-developed natural gas infrastructure. This infrastructure lends itself to utilising biomethane to supply industry and provide fuel to existing gas-fired power plants. The industry there also benefits from a public policy that encourages the use of biogas.

3.4.4 Gas in Transport

The global cap on sulphur emissions in the marine industry is driving the uptake of LNG as a marine fuel. The use of gas as fuel in vehicles is also seeing a large uptake, most notably in heavy goods vehicles, where battery solutions are unsuitable. Vehicles that can use biogas, CNG, hydrogen or LNG as fuel are being produced. Aviation is the most difficult sector to decarbonise in this way, but progress is being made, with hybrid diesel/hydrogen fuel cell engines in development.

3.4.5 Hydrogen

Hydrogen has a high energy storage capacity and does not emit greenhouse gases when burned. Hydrogen is expected to have a growing share of the energy demand in some regions, with a 0.5% share of the global energy mix expected in 2050.

It will mostly be used in the transport and building sectors. The drive for decarbonisation is expected to boost the market for multi-fuel burners and engines suited for hydrogen. Small fuel cells and domestic appliances can also be modified to run on hydrogen.

To all knowledge

To all knowledge