By Dr DF Duvenhage

Abstract

As the European Union (EU) seeks to decarbonize its economy in line with the European Green Deal and REPowerEU strategy, attention has turned to global partners that can supply green hydrogen at scale. Namibia, a sparsely populated Southern African nation, has emerged as a focal point for green hydrogen development. This article critically examines Namibia’s potential as a hydrogen-exporting nation, focusing on technical enablers, policy frameworks, infrastructure challenges, and market alignment with European demand. Both the opportunities and constraints of Namibia’s green hydrogen ambitions are explored to provide a balanced perspective.

Introduction

The global pivot toward renewable fuels has placed green hydrogen (GH₂) at the forefront of energy transition discussions. As a clean energy carrier with the potential to decarbonize hard-to-abate sectors, hydrogen has garnered significant interest from industrialized economies. Its versatility—as a fuel, energy storage vector, and chemical feedstock—makes it central to long-term decarbonization strategies, particularly where electrification is technologically or economically infeasible.

Among the regions most aggressively pursuing green hydrogen integration is the European Union (EU), which aims to import 10 million tonnes of renewable hydrogen annually by 2030 as part of its REPowerEU strategy [1]. With domestic production capacity unlikely to meet this target, the EU is increasingly seeking to establish diversified, reliable supply chains with partner countries that possess abundant renewable energy potential, political stability, and a strategic orientation toward green exports. This evolving geopolitical and economic context has thrust Namibia—a sparsely populated but renewables-rich nation in Southern Africa—into the global hydrogen spotlight.

Namibia’s emergence as a potential green hydrogen hub is not coincidental. It reflects a strategic confluence of enabling factors: exceptional solar and wind resources, vast expanses of available land, a progressive policy environment, and strong bilateral relations with key European states, particularly Germany. The country has proactively positioned itself as a future exporter of green derivatives—such as ammonia and synthetic fuels—rather than focusing on domestic fuel substitution, thus directly aligning its ambitions with external market demand.

However, transitioning from theoretical potential to operational capacity involves navigating a complex array of technical, infrastructural, regulatory, and financial challenges. From the deployment of gigawatt-scale renewable power and industrial-scale electrolysis, to seawater desalination and ammonia synthesis, Namibia must build nearly all elements of a green hydrogen value chain from the ground up. Furthermore, the country faces structural constraints in workforce readiness, permitting systems, and long-term revenue stability that could hinder project bankability and sustainability if not addressed in parallel.

This article critically assesses Namibia’s green hydrogen ambitions through a comprehensive technical and strategic lens. It examines why hydrogen—particularly green hydrogen—is central to the decarbonization roadmap, and why Namibia holds a unique value proposition for international hydrogen markets. The analysis spans the full project lifecycle and value chain, from resource endowment and technology choices to export logistics, policy alignment, and institutional capacity. Particular attention is paid to the EU-Namibia hydrogen partnership, flagship projects such as Hyphen Hydrogen Energy, and the systemic barriers that must be overcome for Namibia to fulfill its role as a credible hydrogen exporter.

Ultimately, Namibia’s trajectory in the hydrogen economy will be shaped not only by its natural assets and strategic vision, but also by its ability to coordinate infrastructure development, secure long-term offtake agreements, and ensure social and environmental co-benefits. As this paper will demonstrate, the country stands at a critical inflection point—one that offers lessons for other emerging economies seeking to participate in global green hydrogen supply chains.

The global pivot toward renewable fuels has placed green hydrogen (GH₂) at the forefront of energy transition discussions. As a clean energy carrier with the potential to decarbonize hard-to-abate sectors, hydrogen has garnered significant interest from industrialized economies. The European Union, aiming to import 10 million tonnes of renewable hydrogen annually by 2030 [1], is actively forging partnerships with countries possessing rich renewable energy resources. Namibia has emerged as a prominent candidate due to its unique confluence of geographic, climatic, and political factors. However, realization of this potential requires critical examination of technical, commercial, and institutional variables.

Why Hydrogen, and Why Namibia?

Strategic Role of Hydrogen

Hydrogen has emerged as a key enabler of global decarbonization strategies, particularly in sectors such as petrochemicals, steel, shipping, and aviation, where direct electrification is not feasible. Its appeal lies in its versatility: it can serve as a chemical feedstock, a transportation fuel, or an energy storage medium. Green hydrogen—produced using electrolysis powered by renewable energy—offers a zero-carbon pathway but is constrained by current production costs, infrastructure immaturity, and demand uncertainty. Nevertheless, projections suggest the levelized cost of hydrogen (LCOH) could fall to competitive levels (~USD 1–2/kg) with technology maturation, scaling, and policy support [2].

Namibia’s Renewable Endowment and Export Orientation

Namibia possesses an exceptional combination of geographic, climatic, and policy attributes that position it uniquely for large-scale green hydrogen (GH₂) production. Among the most compelling technical advantages is the country’s vast renewable energy potential. With average solar irradiance levels exceeding 2,200 kWh/m²/year and consistent coastal wind speeds ranging from 8 to 10 meters per second, Namibia is ideally suited for the development of high-capacity factor hybrid solar-wind systems [3]. This dual-resource profile allows for complementary generation patterns—solar peaking during the day and wind contributing more significantly during the night—thus enabling more stable, round-the-clock power supply to energy-intensive electrolysis processes. Such a profile not only enhances the overall efficiency and utilization rate of electrolyzers but also reduces the levelized cost of hydrogen (LCOH) over time by minimizing curtailment and improving asset productivity.

Equally important is Namibia’s abundant land availability. With one of the lowest population densities in the world and large swaths of uninhabited desert and semi-arid terrain, the country can accommodate sprawling renewable energy and hydrogen infrastructure with minimal risk of land-use conflict. Unlike many industrialized countries where infrastructure expansion often encounters regulatory, environmental, or social opposition, Namibia offers a relatively open and permissive physical landscape. This spatial flexibility simplifies siting decisions for solar and wind farms, transmission corridors, desalination units, and hydrogen conversion facilities—critical factors in achieving economies of scale and attracting foreign direct investment.

Strategically, Namibia has deliberately oriented its hydrogen development agenda toward the export market rather than focusing on domestic energy substitution. Recognizing the limited size of its internal energy demand and industrial base, the Namibian government has crafted its national green hydrogen strategy to align with international market opportunities—particularly in Europe, where demand for hydrogen-derived fuels is expected to surge in response to climate policy and decarbonization mandates. The strategy emphasizes the production of export-ready derivatives such as green ammonia and synthetic fuels, which can be more readily transported across long distances and integrated into existing global fuel logistics networks. This export-centric model not only leverages Namibia’s comparative advantages but also positions it as a key player in meeting European Union import targets, thereby enhancing its geopolitical relevance in the emerging global hydrogen economy [4].

Renewable Resources: With high solar irradiance (>2,200 kWh/m²/year) and coastal wind speeds averaging 8–10 m/s, Namibia has the technical potential for high-capacity factor hybrid solar-wind systems [3].

Land Availability: Namibia’s low population density and extensive uninhabited land enable development of large-scale infrastructure with minimal land-use conflict.

Export Focus: National GH₂ strategy prioritizes ammonia and synthetic fuels for export, rather than domestic fuel switching, aligning with EU demand projections [4].

Technologies Required for a Robust Hydrogen Value Chain

A functioning green hydrogen export industry in Namibia must encompass the entire value chain—from renewable energy generation to shipping derivatives like ammonia or methanol. Critical technologies required include:

- Renewable Power Generation

Hybrid solar and wind installations are the foundation. These must be coupled with advanced energy management systems and, potentially, utility-scale battery storage to ensure stable and continuous operation of electrolyzers despite diurnal and seasonal fluctuations.

- Electrolysis Technologies

Large-scale deployment of electrolyzers is central to GH₂ production. While alkaline electrolyzers are more mature and cost-effective, PEM (proton exchange membrane) electrolyzers offer operational flexibility and higher current density—important in Namibia’s variable renewable environment. Solid oxide electrolysis (SOEC) technologies, although less mature, offer higher efficiency and thermal integration potential for future scaling.

- Water Sourcing and Desalination

Electrolysis consumes approximately 9 liters of water per kilogram of hydrogen produced. Namibia’s aridity necessitates seawater desalination. Planned RO (reverse osmosis) desalination plants will be powered by solar and wind energy, yet they introduce added CAPEX, OPEX, and operational complexity. Brine disposal, intake design, and energy efficiency of desalination units are critical design challenges.

- Hydrogen Conversion (Power-to-X)

To facilitate storage and transport, GH₂ must be converted into derivatives:

- Ammonia (NH₃), produced via the Haber-Bosch process, is the most viable vector due to its energy density and compatibility with existing maritime transport systems.

- Methanol and e-fuels require CO₂ feedstock, necessitating integration with carbon capture infrastructure—either from biogenic sources or direct air capture (DAC).

- Storage and Transport

Hydrogen’s low volumetric energy density necessitates high-pressure or cryogenic storage, or chemical carriers such as ammonia or LOHCs (liquid organic hydrogen carriers). For exports, deepwater ports, ammonia tanks, pipeline networks, and hydrogen-ready shipping facilities will be required.

- Export Infrastructure

Namibia’s future as a GH₂ exporter hinges on:

- Port development (e.g., Lüderitz) to accommodate deep-draft ammonia vessels.

- Dedicated transmission lines and storage infrastructure.

- Cryogenic or ammonia-based terminal facilities equipped with safety and environmental monitoring systems.

Without simultaneous investment across the full value chain, Namibia risks asset underutilization or stranded investments. Integrated system planning is essential.

Project Landscape and European Partnerships

Hyphen Hydrogen Energy and Namibia’s GH₂ Strategy

The Hyphen Hydrogen Energy project represents the largest and most advanced GH₂ initiative in sub-Saharan Africa. Located in the Tsau Khaeb National Park, the $10 billion project will aim to deliver:

- Renewable generation capacity: 5–6 GW (wind and solar hybrid)

- Electrolyzer capacity: 3 GW

- Target production: ~300,000 tonnes/year of green hydrogen, primarily as green ammonia

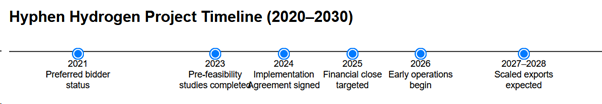

The project is structured as a vertically integrated GH₂ complex, including desalination infrastructure, ammonia synthesis plants, transmission lines, and export terminal upgrades. The projected Hyphen project timeline is ambitious and aims to see H₂ exports from Namibia as early as 2028.

Hyphen’s role goes beyond infrastructure—it is helping shape Namibia’s broader hydrogen industrialization roadmap, including skills development, job creation, and regulatory framework alignment.

European and Bilateral Engagements

European involvement is central to Namibia’s hydrogen strategy.

Germany is Namibia’s primary partner. Through the H₂Global Foundation and GIZ, it has:

- Committed over €40 million for feasibility and pilot activities

- Supported Namibia’s hydrogen diplomacy infrastructure

- Prioritized Namibia in its National Hydrogen Strategy, which mandates 50% of hydrogen imports by 2030 [7]

The EU has allocated €1 billion for green hydrogen projects in Africa, including:

- Co-funding of port and desalination infrastructure

- Capacity-building programs for regulation, safety, and certification

- Support for pilot projects compatible with RED II certification criteria

The European Investment Bank (EIB) is evaluating risk-sharing mechanisms and concessional financing instruments. The 2022 EU–Namibia Green Hydrogen Partnership Agreement outlines collaboration on policy, technology, and trade integration.

In addition, several pilot studies are underway to assess maritime ammonia transport, green methanol production, and digital certification platforms for emissions tracking.

Technical and Logistical Challenges

Infrastructure and Supply Chain Readiness

One of the defining characteristics of Namibia’s green hydrogen journey is that the country must develop almost the entirety of the necessary infrastructure from the ground up. Unlike regions with legacy oil and gas systems that can be retrofitted for hydrogen, Namibia presents a blank slate—an asset in terms of flexibility, but also a significant barrier to timely implementation due to the scale and capital intensity required.

At the center of the logistical puzzle is the Port of Lüderitz, the designated hub for hydrogen and derivative exports. While ideally located relative to planned production zones, the port currently lacks the capacity to handle ammonia carriers or hydrogen-related bulk shipments. Comprehensive upgrades are required, including channel dredging to accommodate deep-draft vessels, expansion of berth facilities, installation of ammonia storage tanks, and integration of safety and environmental monitoring systems tailored to hydrogen and its derivatives. As of early 2025, NamPort has confirmed that preliminary design work is underway, with funding proposals being developed in coordination with Hyphen and European financiers [8]. However, local stakeholders—including Lüderitz Town Council and the //Kharas Regional Council—have raised concerns about the pace of community engagement and environmental planning, with coverage in The Windhoek Observer noting a “growing expectation gap” between local residents and national planners regarding port-linked employment opportunities and housing needs [9].

Connectivity from production zones inland to coastal export infrastructure also remains a major gap. No high-voltage transmission lines currently exist to connect renewable energy generation hubs in the Tsau Khaeb National Park with Lüderitz. Similarly, Namibia lacks a dedicated hydrogen pipeline network or intermodal transport links capable of handling GH₂ derivatives at industrial scale. According to the Ministry of Mines and Energy, efforts are underway to design multi-use transmission corridors capable of accommodating power lines, fiber optics, and future hydrogen pipelines, but these projects are still in the early feasibility stages.

Water sourcing adds further technical complexity. Given Namibia’s arid climate and minimal surface freshwater resources, all water required for electrolysis will have to be sourced through seawater desalination. Hyphen’s proposed desalination plant near Lüderitz will rely on reverse osmosis powered by dedicated renewable installations. However, engineering challenges remain: high energy requirements for desalination could reduce overall system efficiency; brine discharge must be carefully managed to avoid marine ecosystem degradation; and intake design must prevent entrainment of aquatic life. Republikein has reported that local environmental NGOs have urged the government to publish full environmental and social impact assessments (ESIAs) before construction begins, citing long-term risks to fisheries and biodiversity in the Lüderitz lagoon [10].

While the absence of legacy fossil infrastructure may allow Namibia to “leapfrog” directly into a modern, green energy system, doing so will require synchronized investments across power, water, port, storage, and transport domains. Without systemic coordination—led by national planners in concert with private developers and international partners—there is a real risk of asset underutilization or stranded capital.

Workforce and Institutional Capacity

The success of Namibia’s green hydrogen sector will depend not only on physical infrastructure, but also on the country’s ability to cultivate the human and institutional capacity required to support and sustain such a technologically advanced industry. According to modeling by the Millennium Institute, construction-related employment is expected to peak at approximately 32,000 jobs by 2030, driven by large-scale deployment of renewable energy assets, hydrogen production facilities, and export terminals [5]. However, this boom is followed by a projected sharp decline unless subsequent project phases or industrial diversification efforts are introduced.

One of the primary challenges is the limited domestic expertise in disciplines central to the hydrogen economy, including electrochemistry, instrumentation, control systems, process safety, and renewable systems engineering. Namibia’s tertiary education system, while improving, does not yet produce graduates at sufficient volume or specialization to meet these emerging needs. In response, the Namibian Government has signed Memoranda of Understanding (MoUs) with German vocational training institutions, such as the Berufsbildungswerk (BBW), and is working with institutions like the Namibia University of Science and Technology (NUST) to introduce hydrogen-related modules into existing engineering programs.

However, rollout has been uneven. Interviews conducted by The Namibian with lecturers and students at NUST indicate that while interest in hydrogen technologies is growing, the availability of practical training equipment and industry-aligned curriculum remains limited [11]. Furthermore, concerns persist over the alignment between training programs and actual labor market needs. Without close coordination between industry, government, and educational institutions, there is a risk that Namibia may default to importing foreign technical labor, thereby limiting the long-term economic benefits and local job creation potential of hydrogen projects.

Institutional capacity is another critical constraint. Regulatory authorities in Namibia currently face limitations in processing complex Environmental Impact Assessments (EIAs), particularly those involving integrated energy, water, and chemical systems. Likewise, there is a lack of well-developed hydrogen safety codes, standards, and emergency response protocols. As of 2024, the Namibia Standards Institution (NSI) had begun consultations on hydrogen-specific safety frameworks, but full standardization is likely to take years. The Ministry of Industrialization and Trade is also working with legal advisers from the European Union to strengthen Namibia’s capabilities in cross-border trade negotiations, emissions accounting, and compliance with European import certification schemes under RED II and upcoming CBAM (Carbon Border Adjustment Mechanism) provisions.

Encouragingly, several capacity-building initiatives are underway. The Namibian Green Hydrogen Council has launched a scholarship fund for technical studies, while GIZ and the H₂Global Foundation have provided funding for short-term training in hydrogen safety and operations. Nonetheless, reports from The Windhoek Observer suggest that the current pace of skills development is not aligned with the aggressive project timelines being pursued by developers like Hyphen, creating a widening implementation gap [12].

Market and Policy Risks

Export Market Uncertainty

Namibia’s green hydrogen ambitions hinge almost entirely on access to international markets, particularly in the European Union. The country’s domestic demand for hydrogen is negligible due to its limited industrial base and small population. As such, large-scale GH₂ production projects are economically viable only if export pathways to high-demand regions materialize—and do so under favorable market conditions. However, this pathway is fraught with uncertainties.

A key issue is the lack of final regulatory clarity within the EU regarding green hydrogen certification. While the Renewable Energy Directive II (RED II) sets the baseline framework, detailed rules on lifecycle emissions, additionality of renewable power, and temporal correlation between renewable generation and electrolysis are still evolving. For Namibian exporters, this creates a moving target: failure to comply with yet-to-be-finalized certification schemes could disqualify exports from subsidy schemes or blending mandates in destination markets. The Namibian Ministry of Mines and Energy has been collaborating with EU agencies and German institutions to align national regulations with EU criteria, but full equivalence has not yet been achieved.

Carbon pricing presents another pivotal factor. Green ammonia—Namibia’s primary hydrogen derivative—is currently costlier than conventional (grey) ammonia produced from fossil fuels. Without a sufficiently high carbon price in importing markets, or dedicated offtake subsidies, Namibian products will struggle to compete on price. The integrated Sustainable Development Goals (iSDG) model commissioned by the Millennium Institute found that only in scenarios where carbon pricing exceeds ~USD 200/tonne, combined with maritime shipping subsidies, do Namibian GH₂ exports achieve price parity with fossil-based alternatives [5]. This highlights the sector’s dependency not just on domestic policy, but on the climate and energy decisions of foreign governments.

Additionally, Europe’s own industrial policy could shift the balance. The introduction of domestic hydrogen subsidies—such as those under the EU’s Important Projects of Common European Interest (IPCEI) framework—could favor local production over imports. The 2024 Hydrogen Import Outlook published by the German Energy Agency noted that while Africa is a priority source of future imports, geopolitical tensions, supply chain fragility, and sustainability concerns could tilt the balance toward regional European production hubs, at least in the short to medium term.

Local media in Namibia has also expressed concern about the lack of binding offtake agreements. A January 2025 article in Republikein reported that despite advanced negotiations, no firm purchase agreements had been signed between Hyphen and European buyers, raising questions about project bankability [13]. Government officials have reiterated their confidence in ongoing discussions, but acknowledged that early production in 2026 may depend on interim domestic or pilot exports until larger-scale demand stabilizes.

Without clear and enforceable international demand, Namibia risks developing stranded assets—large-scale GH₂ infrastructure without a commercially viable export route. For hydrogen exports to become sustainable, a triangulated framework of regulatory compatibility, price competitiveness, and policy-driven demand signals must be in place between Namibia and its primary trading partners.

Revenue Stability and Industry Sustainability

Even under optimistic export scenarios, Namibia’s green hydrogen industry will remain exposed to market volatility, particularly during the early years of production ramp-up. The capital intensity of GH₂ development—with project costs running into tens of billions of dollars—means that revenue shortfalls or price collapses could quickly undermine investor confidence, delay project phases, or lead to financial distress among key operators.

Simulations run under the iSDG framework have already flagged the possibility of a “boom-and-bust” cycle: a rapid employment and GDP increase during the construction phase, followed by potential oversupply and economic contraction if offtake agreements and infrastructure fail to scale in parallel. While green hydrogen can be a potent catalyst for short-term economic growth—boosting indicators such as energy access, industrial output, and health spending—it does not inherently guarantee equitable development outcomes. In fact, the same model found that SDG 10 (Reduced Inequality) performed better under a scenario without hydrogen investment, due to assumptions about the distribution of economic gains [5].

This divergence arises from Namibia’s structural economic characteristics: high levels of income inequality, a dual economy with limited manufacturing capacity, and low labor absorption in capital-intensive sectors. If the majority of hydrogen-related income accrues to foreign developers, skilled expatriate workers, or centralized state institutions, the broader population may not experience proportional benefits.

Recognizing this risk, national planners have begun drafting policies aimed at embedding social inclusivity within the hydrogen transition. These include hydrogen revenue-sharing frameworks with regional councils, community equity models in infrastructure projects, and expanded access to vocational training. According to The Windhoek Observer, the Ministry of Finance is also assessing sovereign wealth fund models to channel hydrogen revenues into long-term investments in education, health, and rural development [14].

Still, much depends on implementation fidelity and institutional transparency. Civil society organizations, including the Economic and Social Justice Trust, have called for parliamentary oversight and public consultation in determining how hydrogen revenues are allocated and how jobs are distributed. Without such safeguards, the risk of reinforcing existing inequalities—rather than alleviating them—remains high.

Ultimately, Namibia’s hydrogen strategy must go beyond GDP growth and headline investment figures. If it is to be politically sustainable and socially legitimate, it must deliver stable, inclusive, and equitably distributed benefits across regions and demographics. This will require a blend of macroeconomic foresight, regulatory agility, and civic accountability.

Final Reflections – What Will Make or Break Namibia’s Hydrogen Future?

Namibia’s green hydrogen vision is ambitious, plausible, and globally significant—but success depends on more than resources and ambition. Based on system modeling and industry developments, the following factors are ranked by criticality:

- Export Market Access

Hydrogen cannot succeed without confirmed offtakers. Binding offtake agreements, EU market access, and aligned certification schemes are foundational. - Coordinated Policy Interventions

Carbon pricing, shipping subsidies, and investment guarantees on both ends of the value chain are vital for investor confidence. - Infrastructure Build-Out

Desalination, transmission, conversion, and port facilities must be developed in a synchronized, integrated manner. - Climate Policy in Import Markets

The speed of decarbonization in Europe will directly affect Namibia’s export viability. Delays or dilution of EU climate policy may create long-term demand risk. - Skills Development and Local Capacity

Namibia must build domestic technical and regulatory expertise. Without it, project ownership and long-term job creation will be limited. - Social and Environmental Equity

Ensuring the hydrogen sector reduces poverty, benefits communities, and aligns with SDGs requires intentional planning. Without it, social license and long-term sustainability could be compromised.

Namibia’s green hydrogen journey could set a precedent for other emerging economies. Whether it becomes a pillar of clean energy exports or a cautionary tale will depend on the coherence of its strategy, the strength of its partnerships, and its ability to align energy ambitions with sustainable development goals.

As the global hydrogen race accelerates, Namibia is not the only African country positioning itself as a future GH₂ powerhouse. From Morocco’s electrolysis hubs in the Sahara to South Africa’s platinum-fueled hydrogen valley, the continent is awakening to the green hydrogen opportunity. In upcoming articles, we will explore how these regional players compare—technically, geopolitically, and economically—as Africa charts its role in the emerging hydrogen economy.

References

[1] European Commission, “REPowerEU Plan,” Brussels, 2022.

[2] IEA, “Global Hydrogen Review 2023,” Paris, Oct. 2023.

[3] Fraunhofer ISE, “Atlas of Solar Irradiation in Africa,” Freiburg, 2021.

[4] Hyphen Hydrogen Energy, “Project Overview,” 2024. [Online]. Available: https://www.hyphenafrica.com/

[5] Millennium Institute, The Green Hydrogen Economy: Challenges and Opportunities for National Development – Namibia Case Study, Green Hydrogen Business Alliance, May 2023.

[6] Hydrogen Insight, “Namibia eyes early green hydrogen production in 2026,” Feb. 2024. [Online]. Available: https://www.hydrogeninsight.com/

[7] Federal Ministry for Economic Affairs and Climate Action (BMWK), “Hydrogen Partnerships: Namibia,” 2023. [Online]. Available: https://www.bmwk.de/

[8] Namibian Ports Authority (NamPort), “Lüderitz Port Development Plans,” Windhoek, 2024.

[9] The Windhoek Observer, “Lüderitz Residents Demand Greater Role in Hydrogen Export Plans,” March 2024.

[10] Republikein, “Vrae oor ontwateringsaanleg en seelewe-impak,” February 2024.

[11] The Namibian, “NUST Faces Hydrogen Curriculum Gap,” January 2025.

[12] The Windhoek Observer, “Skills Development Lags Behind Hydrogen Timeline,” February 2025.

[13] Republikein, “Geen vaste ooreenkomste vir groen waterstof uitvoer nie,” January 2025.

[14] The Windhoek Observer, “Hydrogen Revenues Could Fund Namibia’s Social Development – Finance Ministry,” February 2025

To all knowledge

To all knowledge